Receive our free daily newsletter:

The last time BHP Group took a swing at another major miner, it was Rio Tinto back in 2007. That could have been a blockbuster $150-billion takeover, but with metals prices crashing as the...

Diversified miner Anglo American has firmly rebuffed a $38.8-billion proposal from mining heavyweight BHP, with chairperson Stuart Chambers dismissing the nonbinding offer as “highly...

BHP Group shares fell 4% on Friday a day after revealing a $38.8-billion bid for Anglo American as investors feared a deal could erode BHP's profitability especially if it has to sweeten its...

Anglo American's management does not consider a proposed $39-billion takeover offer from BHP Group as attractive, two sources told Reuters, as some investors and analysts dismissed it as...

When former boss Mark Cutifani left Anglo American in mid-April 2022, things had rarely looked better for the century-old miner. Metals prices soared as the world emerged from lockdowns, the...

Australia-headquartered BHP has made a bold move with its bid to acquire rival Anglo American in an all-share deal valued at $38.8-billion. With this manoeuvre, BHP aims to create the largest...

Brazilian miner Vale sees no impact from BHP Group's bid for Anglo American on the latter's Minas-Rio project, its CEO, Eduardo Bartolomeu, said on Thursday. "We don't see any impact on the...

South African Mines Minister Gwede Mantashe signaled his opposition to BHP Group Ltd.’s proposed takeover of Anglo American. The offer by the world’s largest miner envisages an all-share deal in...

Legal & General Investment Management, one of the 20 largest shareholders in Anglo American said an approach by BHP Group is "highly opportunistic" and "unattractive". "As with many other...

South Africa’s 30 years of democracy has changed the character of this country’s mining industry profoundly, Minerals Council South Africa emphasised in a report that highlights the industry’s...

Mining company Vale expects to reach a final agreement with authorities for reparations for the collapse of the Samarco tailings dam by the end of the first half of this year, the company told...

Diversified mining major BHP on Thursday announced a proposed all-share offer that values Anglo American at £31.1-billion. The deal has the potential to transform the mining industry landscape....

Brazilian miner Vale on Wednesday said lower prices for iron-ore, nickel and copper in the first quarter dragged down earnings compared to the year before, as it posted net profit slightly below...

Aim-listed mining development company Ironveld has entered into a further working capital loan facility agreement with shareholder Tracarta, in which Ironveld chairperson John Wardle has a...

Canadian miner Champion Iron is considering a significant expansion of its production capacity at the Bloom Lake mine, in Quebec. CEO David Cataford says Champion’s technical team is assessing the...

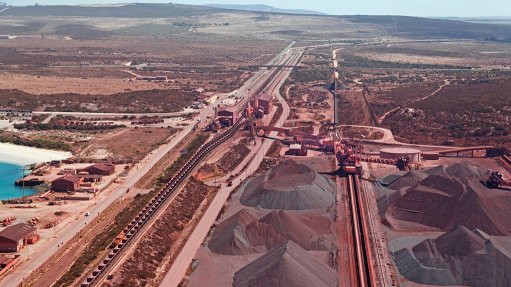

Australian green energy and iron-ore giant Fortescue has revealed a 6% decline in third-quarter iron-ore shipments, attributed to the repercussions of an ore car derailment on December 30, coupled...

Anglo American subsidiary Kumba Iron Ore has reported a 10% year-on-year decrease in sales to 8.5-million tonnes for the quarter ended March 31, on the back of port performance challenges. About...

Copper production increasing by 11% as Quellaveco achieved its highest plant throughput rate in Peru, and Collahuasi and El Soldado in Chile benefitting from higher copper grades were among the...

Diversified mining company Anglo American is taking steps to help to restore an Amazon rainforest equivalent of which less than 10% remains intact. The Mata Atlántica carbon forest is located near...

A new process being pioneered by energy companies such as Israel-based Helios and Netherlands-based Alkalium proposes the use of sodium metal rather than coal or hydrogen to refine iron-ore into...

The Western Australia Department of Mines, Industry Regulation and Safety has granted Aim-listed Alien Metals a mining lease for the Hancock iron-ore project. This represents a key milestone on the...

Diversified mining company BHP is nearing a decision regarding its nickel operations in Western Australia. The company, which has been conducting a review of these assets since February, is...

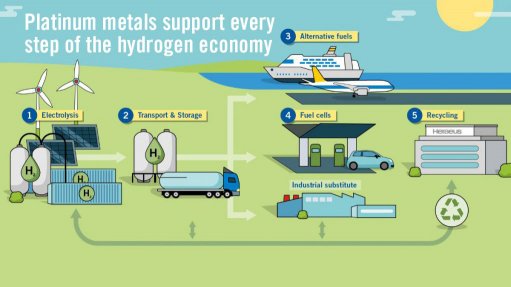

Minerals Council South Africa is focused on increasing the domestic demand for green hydrogen, which it sees as contributing to the kickstarting of the hydrogen economy in South Africa. “The...

Diversified mining group Rio Tinto has reported lower first-quarter iron-ore shipments of 78-million tonnes, amounting to a 5% year-on-year decline. The company attributed the dip to weather...

Brazilian miner Vale on Tuesday reported growth of 6.1% in its first-quarter iron-ore production from a year earlier, driven by improved output from a key project in northern Brazil, while sales in...

State-owned Transnet Port Terminals’ (TPT’s) Saldanha Iron Ore Terminal has embarked on a five-day shutdown for the maintenance and servicing of equipment on two tipplers, starting on April 15. The...

Mining giant Vale has exceeded its target of reaching 100% renewable energy consumption in its Brazilian operations, accomplishing this milestone two years ahead of schedule. The announcement,...

Sweden's LKAB will cut its iron ore output following derailments on a railway linking Sweden and Norway and reduced transport capacity going forward, the state-owned mining company said in a...

South Africa's Department of Science and Innovation (DSI), through the Council for Scientific and Industrial Research (CSIR), has launched the first of three new government-led collaborative...

There's no climate solution without hydrogen. It’s the missing piece of the clean energy puzzle, says a global CEO-led initiative that brings together leading companies with a united vision. This...

Guinea said shareholders involved in Simandou, the biggest untapped iron-ore reserve globally, have signed $15-billion in financing agreements for the project. The accords provide funds for rail...

South Africa’s many underground mines can be used as batteries that store the clean electricity that the water descending for cooling can provide. At the same time, the local community could end up...

Australian iron-ore miner Mount Gibson is on track to meet its 2024 guidance, having shipped 0.7-million wet metric tonnes of high-grade iron-ore fines from Koolan Island in the March quarter. The...

South Africa’s mining industry is investing R46-million in an action plan to eliminate fall-of-ground (FoG) fatalities. The FoG action plan is being implemented through Minerals Council South...

Rio Tinto faced demands from shareholders at its annual meeting on Thursday to come clean on environmental issues, including water and biodiversity, as the company said it was committed to...

Innovative technological and mining solutions provider TAKRAF Group recently concluded the signing of an extensive project with Mauritanian mining and industrial company Societe Nationale...

West Africa’s mining and industrial sectors are characterised by growth and challenges, says multinational banking and financial services provider Absa Corporate and Investment Banking (CIB)...

Iron-ore’s reset to around $100 a ton is indicative of a broader reshaping of China’s commodities markets that favors the new economy over the old. The steelmaking material plunged to $95.40 a ton...

Nigeria will only grant new mining licences to companies that present a plan on how minerals would be processed locally, under new guidelines being developed, a government spokesperson confirmed on...

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

Developed to exceed the latest EN 15964 standards for police breathalysers proving that it will remain accurate and reliable for many years to come.

VISIT SHOWROOMFlameBlock is a proudly South African company that engineers, manufactures and supplies fire intumescent and retardant products to the fire...

VISIT SHOWROOMAt SMS group, we have made it our mission to create a carbon-neutral and sustainable metals industry.

VISIT SHOWROOMBooyco Electronics, South African pioneer of Proximity Detection Systems, offers safety solutions for underground and surface mining, quarrying,...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation