Moab Khotsong, Hidden Valley boost Harmony’s production, cash flows

Harmony CEO Peter Steenkamp discusses the company's underperforming operations, new prospects and its hedging strategy. Video and editing: Nicholas Boyd.

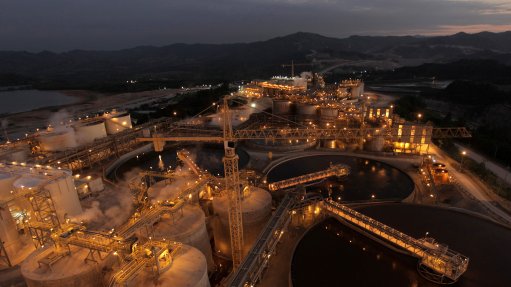

JOHANNESBURG (miningweekly.com) – Harmony Gold on Tuesday reported favourable financial and operating results for the financial year ended June 30, with both output and cash flows having benefited from the inclusion of a full year’s production from the Moab Khotsong mine, in South Africa’s North West province, and Hidden Valley, in Papua New Guinea.

The JSE- and NYSE-listed company achieved a 17% year-on-year increase in gold production to 1.44-million ounces, resulting in a 23% increase in production profit, which, in turn, contributed to a 32% increase in revenue.

Moab Khotsong and Hidden Valley generated R1.3-billion in operating free cash flow, while also improving Harmony’s underground grade by 10% from 5.10 g/t to 5.59 g/t.

All-in sustaining costs (AISC) decreased to $1 207/oz, from $1 231/oz in the prior financial year. In rand terms, AISC increased by 8% year-on-year to R550 005/kg mainly as a result of wage and salary increases and higher Eskom electricity tariffs.

Harmony CEO Peter Steenkamp noted in a conference call with the media that Harmony expects to produce about 1.46-million ounces of gold at an AISC of R579 000/kg in the 2020 financial year.

He noted that Harmony would continue to hedge about 20% of its production, in line with the strategy implemented in 2016. He and FD Frank Abbott noted that the strategy had helped to “lift” earnings in the years since implementation.

Meanwhile, headline earnings a share increased by 19% year-on-year to 204c, while the company’s basic loss a share narrowed by 50% to 498c.

No dividend was declared.

SAFETY

Harmony recorded 11 fatalities in the period under review, with Steenkamp noting that the company had had a particularly bad quarter, when accidents increased owing to “behaviour-related” incidents.

Six of the 11 fatalities occurred during the fourth quarter of the financial year, with two incidents each at Doornkop and Tshepong.

Extending his heartfelt condolences to the families, colleagues and friends of the deceased, he reiterated the company’s commitment to improving safety, adding that despite the regrettable regression in the last quarter, Harmony had achieved its best lost-time injury frequency rate in the 2019 financial year

He noted that there was no “specific pattern” to the injuries and fatalities aside from a disregard for protocol and rules, and that the company and South African mining as a whole needed a change in culture.

Steenkamp stressed that he believed the safety system introduced by Harmony was both proactive and world class, but added that the company was working with government and other stakeholders to continue to improve its overall safety performance.

OPERATIONS

Moab Khotsong produced 254 891 oz of gold and achieved a recovered grade of 8.17 g/t. Harmony expects the operation’s grade performance will improve further in the 2020 financial year.

Hidden Valley produced 200 042 oz of gold and generated operational free cash flow of R573-million. Harmony noted that stripping of the cutbacks would continue for the next two and a half years, to deliver an average life-of-mine AISC below $950/oz.

Kusasalethu’s gold production increased by 13% to 160 400 oz, as a result of an 11% increase in tonnes milled and a 2% increase in recovered grade to 6.72 g/t.

Unisel and Doornkop both saw production decrease by 5%, the former owing to its

restructuring, while the latter experienced a 9% decrease in recovered grade. Bambanani’s gold production decreased by 11%, also as a result of a decline in recovered grade.

The Phoenix tailings retreatment project increased its gold output by 3% to 24 306 oz, as a result of a 3% increase in tonnes processed, while Masimong and Tshepong’s production dropped by 12% and 15% respectively, as a result of a lower recovered grade and tonnes milled.

Kalgold’s production remained flat at 40 156 oz, while at Joel, production decreased by 4% to 50 379 oz, owing to a 6% decline in tonnes milled. Harmony noted that the Joel mine decline project was nearing completion and an increase in both production and grade was expected in the 2020 financial year.

Target 1 production decreased by 7%, owing to a 14% decrease in tonnes milled, which partially offset the 7% increase in recovered grade.

Steenkamp explained that, in terms of improving performance at some of the underperforming assets, steps had been taken to address Tshepong’s performance, while Doornkop’s decreased production had largely been the result of safety stoppages.

Additionally, one of the projects Harmony would be undertaking at Target 1 was a capital efficiency project to transport the crusher, and associated mining activities and services closer to the working areas, thereby improving the overall efficiency and productivity of the mining circuit.

Looking ahead, Steenkamp said Harmony would continue to focus on producing safe, profitable production during the 2020 financial year, while pursuing value-accretive acquisitions and strengthening our cash flows.

In terms of organic growth prospects, Harmony is prioritising permitting of the Wafi-Golpu project, in Papua New Guinea, and is advancing the prefeasibility study into the Zaaiplaats high-grade mine extension, a deposit below the existing Moab Khutsong mine

The miner pointed out that the Zaaiplaats extension would not be highly mechanised.

With regard to acquisitive growth, Steenkamp reiterated that the company was always looking for new merger and acquisitions prospects, stressing that decisions would be made in line with the company’s investment criteria.

“Value – rather than volume – will translate to shareholder returns in the long term”, he stressed.

He noted that current geopolitical developments were supporting a higher gold price and that, “If the gold price stays at these levels, our [future] results going to be significantly better”.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation