First Quantum said to rebuff informal approach from Barrick

First Quantum Minerals recently rebuffed an informal takeover approach from Barrick Gold, the world’s second-largest producer of the precious metal, as miners scour the globe for deals, people with knowledge of the matter said.

Barrick made overtures to First Quantum in the last few months as part of its search for ways to expand in copper, the people said. First Quantum indicated it wasn’t keen on a combination and declined to enter any substantive talks, according to the people.

Shares of First Quantum jumped as much as 12% in Canadian trading Thursday, the biggest intraday gain since November. They were up 9.5% at 11:09 a.m. in Toronto, valuing the company at $17.7-billion. Barrick shares were down 2.1% in New York trading, giving the company a market value of $28.8 billion.

Barrick and First Quantum aren’t currently in formal discussions, the people said, asking not to be identified because the information is private. It remains unclear whether Barrick will revive its interest, according to the people.

Representatives for Barrick and First Quantum declined to comment.

ZERO PREMIUM

Barrick CEO Mark Bristow got the top job when the mining company he founded, Randgold Resources, was taken over by Barrick in a zero-premium deal completed in 2019. The South African has since expounded the virtue of doing deals to create value, not just to get bigger, and talked down the need for bumper premiums.

Soon after taking the top job at Barrick, he went after Newmont with a hostile all-share no-premium bid that ultimately failed. By contrast, recent takeovers in the copper space have come with big premiums.

BHP Group offered a 49% premium to OZ Minerals' undisturbed share price to seal a A$9.6-billion ($6.6-billion) deal for the Australian miner. Rio Tinto Group last year bought out minority shareholders of Turquoise Hill Resources Ltd., which is developing a massive Mongolian copper project, for 67% above its last close before the bid was unveiled.

A deal with First Quantum would transform Barrick into a significant copper miner when the industry’s largest players are all seeking to expand production of the wiring metal. BHP and Rio Tinto are actively looking to grow their copper exposure, while Glencore is pursuing an unsolicited $23-billion takeover bid for Canada’s Teck Resources, chiefly to acquire its giant South American copper mines.

Barrick’s move mirrors a wider groundswell of dealmaking interest across the world’s biggest miners — particularly focused on metals like copper and lithium that will be central to decarbonizing the global economy.

COPPER CHASE

The Canadian company also faces its own unique set of challenges. Barrick, once the world’s largest bullion producer, is wrestling with gold output at its lowest level since 2000 after a multiyear strategy to cut debt and sell off assets. Meanwhile, perennial rival Newmont is on track to close a deal with Newcrest Mining that would cement its status as the biggest gold producer, leaving Barrick little chance of catching up anytime soon.

Bristow has spoken emphatically about the need for gold companies to enter the race for copper growth. He’s said that copper output is critical “if you want to be relevant” in mining, and last year launched an ambitious $7-billion copper project in Pakistan that aims to be operational by 2028.

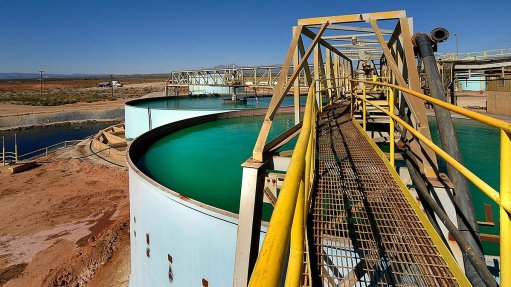

Canada’s First Quantum has long been viewed as a takeover target in the mining industry, primarily for its massive copper mine in Panama. The operation, which accounts for about 1.5% of global copper production, recently emerged from a monthslong dispute with the Panamanian government.

First Quantum also owns copper, gold and nickel mines in Africa, Australia, Europe and the Middle East.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation