Hot Chili arranges nearly A$30m for Chile copper project

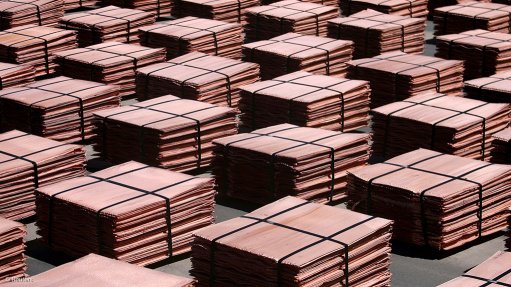

Costa Fuego is one of a limited number of globally significant copper developments not owned by a major mining company.

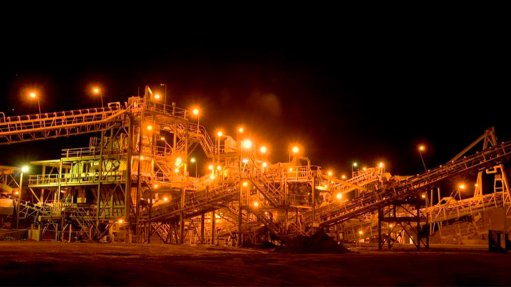

ASX-listed copper miner Hot Chili has arranged about A$30-million in funding to accelerate its Costa Fuego copper project, located in the coastal range of Chile.

The company, which also trades on the TSX-V, arranged a A$24.9-million private placement to institutional and professional investors through the issue of 24.9-million fully paid ordinary shares at A$1 each.

In addition, the copper firm will issue shareholders the opportunity to participate in a share purchase plan (SPP) to raise up to A$5-million at the same offer price.

Hot Chili said the proceeds from the placement and the SPP would provide up to 18 months in funding for the completion of the Costa Fuego prefeasibility study, completion of the water supply business case study and for the completion of environmental impact assessment work.

“We control large-scale assets in two of the most critical commodities of our time – copper and water – with two of the most desirable attributes – low-risk and near-term.

“The company has been receiving increasing interest from potential strategic funding parties in its advanced Costa Fuego copper/gold development and its recently announced water supply studies. This interest, in combination with a rising copper price environment, provides confidence to accelerate the company’s growth and development plans while preserving control of these assets for our shareholders,” said MD Christian Easterday.

He added that Costa Fuego was one of a limited number of globally significant copper developments not owned by a major mining company.

“Market conditions are indicative of the initial stages of a new copper price cycle being driven by a lack of new supply. The company is now well funded to take advantage of controlling the right assets at the right time in the right place,” said Easterday.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation