Receive our free daily newsletter:

Gold slid on Monday pressured by technical selling, following a fierce 3% rally in the previous session, as raging Israel-Hamas war sent investors scuttling to the safe-haven bullion and pushed...

Gold jumped more than 2% and was set for its best week in seven months on Friday, as conflict in the Middle East lifted safe-haven demand for the metal, combined with expectations that the U.S....

The R1-billion solar project being developed by Chariot Transitional Power and Total Eren in North West province is on track as planned to be completed end 2024. In doing so, it will contribute to...

The world’s biggest miners including BHP Group and Rio Tinto Group will face growing pressure from investors to properly measure their carbon footprints, according to an international research...

Building out and scaling up a global green hydrogen ecosystem collaboratively is at the heart of an American-Australian business partnership announced this week amid 30-plus countries already...

London- and Johannesburg-listed diversified mining company Anglo American has signed a memorandum of understanding with Mitsubishi Materials Corporation to collaborate on the creation of a copper...

Diversified miner Anglo American has appointed Matt Walker as CEO of its marketing business, following Peter Whitcutt’s decision to step down after 33 years with Anglo American. Walker, who is...

The technical team of the JSE AltX- and Aim-listed Jubilee Metals Group is innovating a waste leach circuit for the treatment of copper and cobalt tailings, as part of its Northern Refining copper...

An independent evaluation process has confirmed that there is a high degree of interoperability between the Responsible Gold Mining Principles (RGMPs) and the Responsible Gold Guidance (RGG),...

Copper 360’s mining school in the Northern Cape is attracting attention from international mining schools and global agencies wanting to partner with it. “We’ve received a lot of requests,” Copper...

The United Nations Conference on Trade and Development (Unctad) has called on the global community to provide support for green industrial policies in commodity-dependent developing countries to...

The global coal industry may have to shed nearly one-million jobs by 2050, even without any further pledges to phase out fossil fuels, with China and India facing the biggest losses, research...

The global refined zinc market will see a surplus of 248 000 metric tons in 2023 compared with a previously forecast deficit of 45,000 tons due to slower than expected demand growth, the...

Research company BMI has revised its average copper price forecast for the year to $8 550/t, down from $8 800/t previously. Prices in the year-to-date as ]at September 19 averaged $8 628/t.

Circularity is already practised at many mine sites, which use circular principles to reduce waste and conserve water. But to achieve full circularity for products – from production to consumption...

Despite a challenging fundraising landscape in the private equity sector, Appian Capital Advisory has secured substantial commitments for its third fund (Fund III), which is targeting mid-tier...

JSE- and NYSE-listed Gold Fields has appointed Mike Fraser CEO and executive director of the company with effect from January 1, 2024. Fraser is currently CEO of Aim-listed Chaarat Gold Holdings....

The world’s metal traders are enduring one of their toughest periods in years, even as an international race for minerals thrusts the industry into the geopolitical spotlight like never before....

The violence in Israel will likely prompt a move into safe-haven assets as investors closely watch events in the Middle East to gauge geopolitical risk to markets. Gunmen from the Palestinian...

Multinational mining and metals processing group Sibanye-Stillwater has approved the start of the second phase of its Keliber lithium project, which includes the construction of the concentrator...

If the 5 066 outstanding mining and exploration permits were approved, South Africa could begin to see a shift in the economy within 12 to 18 months, new Minerals Council South Africa CEO Mzila...

South Africa, with its incredible minerals endowment and extraordinary untapped potential, is definitely under-explored, Anglo American CEO Duncan Wanblad said in response to questions after...

Anglo American said it is cutting corporate office jobs across several countries, as unions said its South African iron-ore business plans to lay off scores of workers at its head office. The...

World-renowned conservationist Jane Goodall reminded hundreds of scientists present at the 12th Oppenheimer Research Conference in Midrand that if the world carries on with a business-as-usual...

Global gold industry membership organisation the World Gold Council (WGC) has appointed Sibanye-Stillwater CEO Neal Froneman as chairperson and DRDGold CEO Niël Pretorius as a director. Froneman...

The surplus in the global nickel market is expected to widen to 239 000 metric tons in 2024 from 223 000 tons this year, the International Nickel Study Group (INSG) said on Tuesday, signalling...

The emerald green of Zambia and the ruby red of Mozambique are continuing to give exceptional gemstone hues to Southern Africa, Mining Weekly can today report. Zambian emeralds, which are among the...

Higher temperatures and more intense storms haven’t changed the fundamental challenge of climate policy: Countries around the world must find politically feasible ways to zero out emissions without...

The European benchmark ferrochrome price for the fourth quarter of 2023 is $1.53/lb, 1.32% up on the third quarter of 2023, Merafe Resources advised its shareholders on Monday. The main focus of...

Mining giant BHP has noted that global collaboration a significant quantum of capital would be required in order to source the critical minerals needed to drive decarbonisation. Speaking at the...

It is too early to expect the start of a new sustaining upcycle for commodities, Macquarie states in its latest quarterly outlook for global commodity markets. In a nigh 100-page commodities...

Close to half a century of local manganese mastery by Manganese Metal Co of Mpumalanga is placing South Africa – a manganese mining and refining country – in pole position, amid a flurry of global...

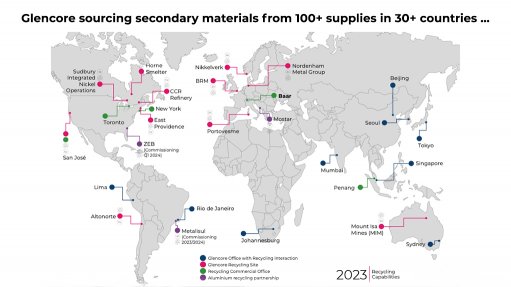

Although Glencore’s earnings contributions from recycling activities are not material at this stage, the growth potential to the diversified mining and marketing company from circular economic...

Research Reports

Projects

Latest Multimedia

Latest News

Showroom

Supplier & Distributor of the Widest Range of Accurate & Easy-to-Use Alcohol Breathalysers

VISIT SHOWROOMFlameBlock is a proudly South African company that engineers, manufactures and supplies fire intumescent and retardant products to the fire...

VISIT SHOWROOMImmersive Technologies is the world's largest, proven and tested supplier of simulator training solutions to the global resources industry.

VISIT SHOWROOMWe supply customers with practical affordable solutions for their testing needs. Our products include benchtop, portable, in-line process control...

VISIT SHOWROOMPress Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation