Zim-focused gold miner aims for midtier status

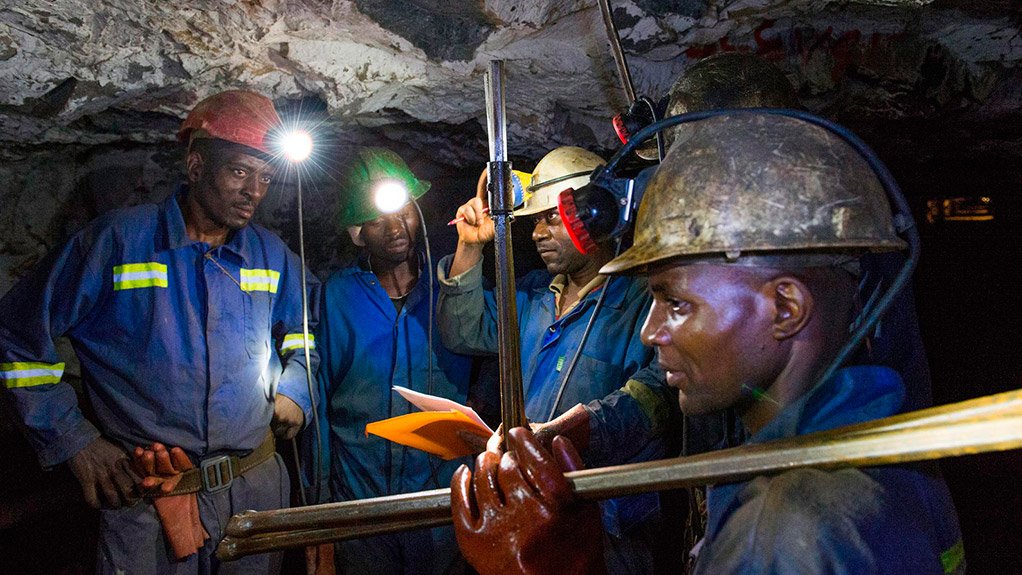

HOW MINE The mine was responsible for half of Metallon Corporation’s 2013 production

MZI KHUMALO South African businessman and co-founder of Metallon Corporation

ACTURUS MINE

MAZOWE MINE

REDWIN EXPLORATION

SHAMVA MINE

Zimbabwe-focused London-based gold miner Metallon Corporation is implementing a five-year strategy to become a midtier gold producer of 200 000 oz of gold a year by 2016, says Metallon CEO and deputy chairperson Mzi Khumalo.

He tells Mining Weekly that the strategy involves reducing costs, increasing production at the company’s four mines, developing a fifth mine – Redwing mine – expanding exploration projects and strengthening relations with all relevant stakeholders.

“We have prioritised working closely with all the parastatals in Zimbabwe, which . . . ensures that we find swift solutions to any challenges associated with mining in Zimbabwe,” says Khumalo.

Mining, as with any other business in Zimbabwe, is currently dominated by regulatory uncertainty, specifically with regard to the indigenisation policy, which stipulates that 51% of the country’s minerals belong to previously disadvantaged Zimbabweans. This means that investors can only hold a 49% share.

The regulation has led to reduced investment in the country’s mineral resources. However, Khumalo tells Mining Weekly that, despite these challenges, Metallon has reduced costs and was able to recover from the 2008 global recession, which significantly affected Zimbabwe.

He adds that there are several political issues in Zimbabwe that remain unresolved, subse-quently creating the negative perception among investors that it is a difficult place in which to work.

“But with the labour disputes and the difficulty of having to mine deeper currently facing South Africa, mining in Zimbabwe has become a walk in [the] park. Metallon is proof that it can be done – that the country is a good investment destination in Southern Africa,” states Khumalo.

About Metallon

Metallon has been operating in Zimbabwe since 2002. It owns and operates four mines in the country, including How mine, outside Bulawayo; and the Shamva, Mazowe and Arcturus mines, all outside the capital Harare. Metallon is also dewatering Redwing mine, near Mutare, and exploring at the Motapa and Midwinter projects.

The company produced 82 000 oz of gold in 2013 and aims to produce 100 000 oz this year.

Khumalo, a South African businessperson who cofounded Metallon in 2002, believes that, with Zimbabwe’s infrastructure, the country should be the destination of choice for potential investors.

He maintains that Zimbabwe’s infrastructure is better developed than, for instance, that of the Democratic Republic of Congo (DRC), which has attracted the interest of several investors in recent years.

“Zimbabwe has one of the best infrastructure settings in sub-Saharan Africa. While energy and water are a big problem in the mining industry, Zimbabwe has that in relatively good supply,” Khumalo explains.

He states that, as part of Metallon’s strategy to become a midtier miner, the company has an agreement with a Zimbabwe power utility to pay for electricity in advance.

Khumalo says it is possible to operate profitably despite the country’s indigenisation policy.

Further, he adds that Metallon has prioritised community development. Over the years, the company has helped to build schools and clinics for surrounding communities, which has earned the company credit towards its indigenisation quota.

“Mining is an opportunistic business; you mine where there are rich mineral resources. Zimbabwe has large, rich reserves that have not yet been explored properly. Metallon has found and invested in very rich resources and reserves.”

Meanwhile, Khumalo notes that government’s 2012 agreement, allowing mining companies to sell their processed minerals at market value using the US dollar instead of the Zimbabwean dollar, is one of the highlights in Zimbabwe’s recent mining history,

Metallon’s Zimbabwe Operations

Metallon’s flagship mining operation is How mine, which was acquired from mining major Lonmin in 2002 as part of five mines that also included Shamva, Mazowe, Arcturus and the Redwing development project. The mine has been an underground asset since 1942.

How mine has a central processing facility, which uses a combination of conventional milling and carbon-in-leach (CIL) processing. It has a Joint Ore Reserves Committee- (Jorc-) compliant resource of 1.7-million ounces of gold.

In 2013, How mine contributed half of Metallon’s production output, with 40 300 oz. It has a targeted production rate of 52 000 oz for 2014. The mine produced at an all-in cost of $650/oz in 2013 and has a targeted cost of $625/oz this year.

Shamva mine, also an underground mine, has been in production since 1893 and has produced 2.4-million ounces of gold to date. The mine’s ore is processed through conventional crushing, milling, gravity recovery and a combination of carbon-in-solution and carbon-in-pulp processing.

With a Jorc-compliant resource of two-million ounces of gold, Shamva mine produced 20 100 oz of gold in 2013 and is forecast to produce 26 000 oz in 2014. The mine produced at an average all-in cost of $1 156/oz last year and has a targeted all-in cost of $875/oz this year.

Meanwhile, Metallon’s Mazowe mine has been in production since 1980. It has two underground operations, with conventional crushing, milling, free gold recovery and CIL facilities.

Its current Jorc-compliant resource is 1.3-million ounces of gold. Production in 2013 was 10 400 oz, while this year’s target is 12 000 oz at $1 100/oz.

The company’s Arcturus mine, which has a Jorc-compliant resource of one-million ounces of gold, started production in 1907 and was placed on care and maintenance in 2008. Production started again in October last year.

In 2013, Arcturus produced 8 200 oz of gold and is forecast to produce 12 000 oz this year at a targeted all-in cost of $ 1 150/oz.

Metallon is also dewatering Redwing mine with exploration and development in place to bring the mine back to a 30 000 oz/y capacity. The dewatering is scheduled for completion this year with production to commence in 2015.

Metallon also has exploration projects in the DRC and is securing mineral rights in Tanzania’s goldfields, near Lake Victoria.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation