Weekly Commodities Market Wrap

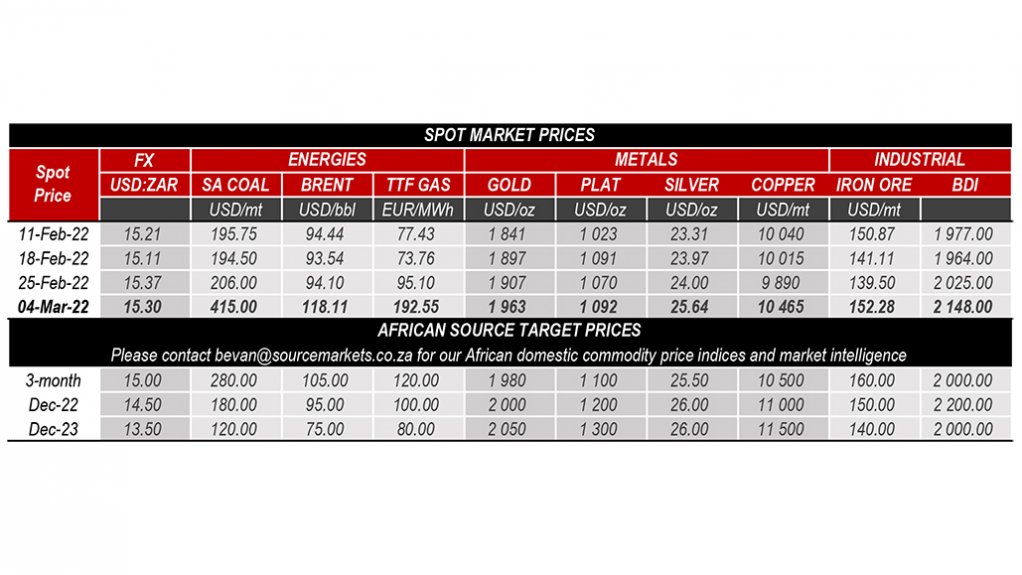

ENERGIES – The price gyrations in oil, gas and coal have been spectacular and eye-watering. Coal has been the biggest winner in the European Union (EU) energy complex by far.

But this is very much a spot crisis, as curves remain steeply backwardated. With most distressed buyers having already covered replacement supplies, we are likely to be at or near the high-water mark now.

In saying that, even two-year forwards are pricing significantly higher than recently, suggesting that the impact in Europe will be felt for some time to come.

All of a sudden, climate concerns seem no longer as important as EU domestic energy security. Even uranium prices have woken from their slumber as speculation mounts that the EU will delay closures of nuclear plant now. For the impact on domestic South African coal and fuel prices, please refer to our detailed weekly energy reports.

METALS – Precious metals have rallied but it is quite clear that gold has lost much of its allure as a "safe haven" investment. With the prospect of a wider EU war, the yellow metal should really be shooting the lights out, but a certain (Russian) central bank is likely also selling into the physical market at the moment.

Crypto currencies have proved to be absolutely useless as a safe haven investment, correlating almost 100% with other risk on / off investments. Compared with energies and wheat prices, metals are proving to be lacklustre although both aluminium and copper remain very well bid, with official LME stocks declining as buyers seek to secure their own stocks.

The biggest recent gainers in price though are nickel and lithium, with supply chain worries for these critical minerals and metals now front of mind.

INDUSTRIALS – Iron-ore remains bullish, even as construction in Asia cools. Wind power in Europe looks set to soar and steel is thus going to be in significant demand in the Atlantic.

South African manganese miners should get in touch with us, as they really need an international price marker to wake up the sleepy manganese market too.

It's simply not getting what it deserves at the moment. Freight prices are picking up with a huge swing in dry bulk interest into the Atlantic vs. the Pacific. It's not likely, but should the Straits of Hormuz and the Suez eventually also fall under the control of the Russia:China axis, then South Africa once more becomes a crucial European fuelling point for vessels and their crew.

Shades of the 1600s all over again.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation