Weekly Coal Index Report

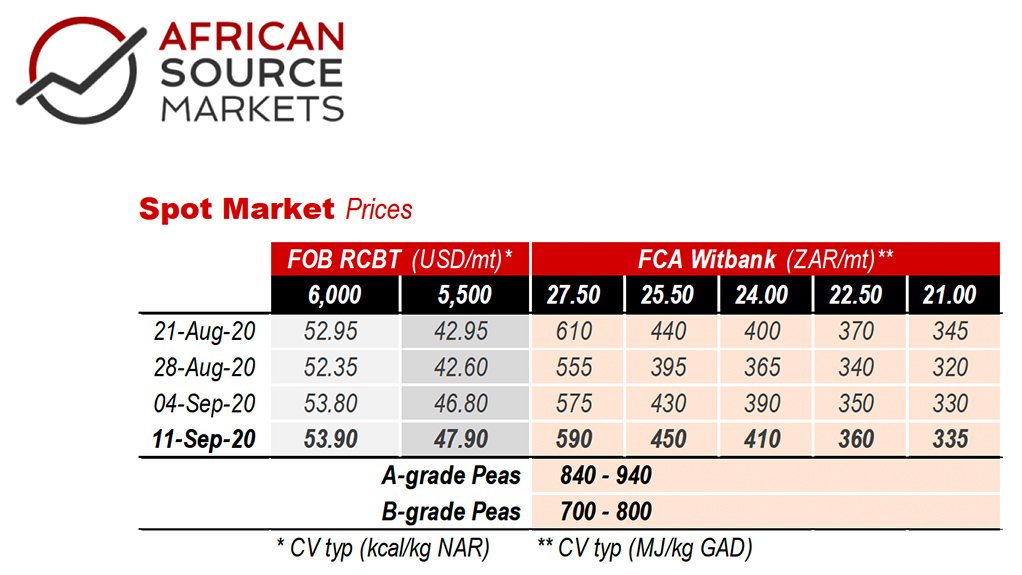

Weaker capesize freight rates helped FOB prices edge higher, whilst pressuring delivered markets.

Firmer power and gas prices also helped strengthen physical bids for Dec-20 tonnes, with the back end of the curve steepening as prompt prices remain lifeless. Colombian coal supply from Cerrejon remains blocked as the strike continues. A cynic with an eye for history would note that Colombia always seems to endure strikes, derailments etc. whenever coal prices are weak.

China’s manufacturing and construction complex is ramping up again, following widescale flooding which has interfered with industrial activities and left much of China’s food supply under severe strain. However, this demand is unlikely to filter through to imported coal prices, as most domestic industrial producers have been denied coal import permits.

In a race to the bottom, several Indonesian coal producers have taken to selling coal below cost price, which clearly cannot last very long.

Meanwhile, Summer in the southern hemisphere is looking to be hotter, wetter and stormier again, with the chances of a La Nina event squarely on the cards. This could disrupt both local coal handling for Eskom within South Africa, as well as port activities at both RBCT and Newcastle.

In a win for conservationists, Zimbabwe has now banned coal exploration in its National Parks.

There is every reason to believe that price “should” keep grinding upwards for now, with momentum remaining positive. However, what should be concerning for the bulls is the lack of a strong upwards push by now. Perhaps this may only come when the signal line breaks into positive territory, assuming that momentum can be maintained until then.

The momentum pattern is in a similar position to last year’s as it neared Q4, although by this time price was already responding strongly positively. When momentum turns around and starts heading back down, will be a crucial moment for the coal market. Will the market see the legendary Q4 rally this time, or not?

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation