US seeks $4.3bn for uranium to wean off Russia supply

The Biden administration is pushing lawmakers to support a $4.3-billion plan to buy enriched uranium directly from domestic producers to wean the US off Russian imports of the nuclear-reactor fuel, according to a person familiar with the matter. Shares of uranium companies surged.

Energy Department officials have met with key congressional staff, where they said such funding is urgently needed, said the person, who wasn’t authorized to publicly discuss the information. Energy officials made the case that any interruption in the supply of enriched Russian uranium could cause operational disruptions at commercial nuclear reactors, the person said. US nuclear energy industry participants have also been briefed on the proposal, said a second person familiar with the details. The plan requires approval from Congress.

The proposal aims to spur development of more domestic enrichment and other steps needed to turn uranium into reactor fuel, the person said. It would create a government buyer directly purchasing enriched uranium, including the type used in a new breed of advanced reactors now under development.

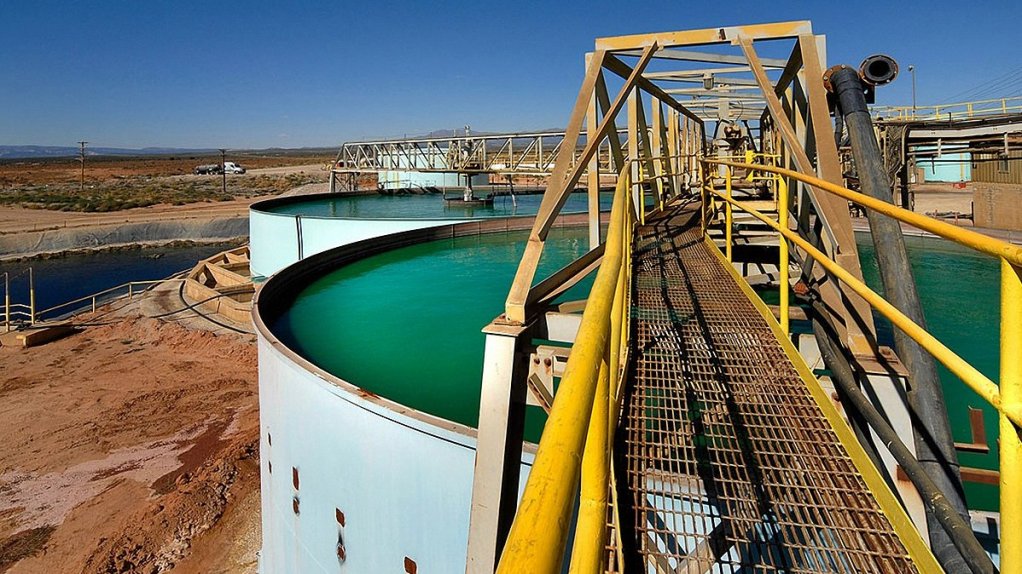

Still, it won’t be easy for the US to jump-start the domestic uranium industry. The country has only one remaining commercial enrichment facility -- a New Mexico plant owned by Urenco, a British-German-Dutch consortium.

URANIUM SHARES SURGE

The Global X Uranium ETF, an exchange-traded fund focused on the industry, jumped as much as 7.4% to its highest intraday price in a month on the news. Shares of uranium miners including Cameco and Energy Fuels soared along with nuclear fuel provider Centrus Energy.

The talks come as the Biden administration contemplates slapping sanctions on enriched uranium imports from Russia in response to the Kremlin’s invasion of Ukraine while considering prospects that Russia could also decide to halt imports. Russia accounted for 16.5% of the uranium imported into the US in 2020 and 23% of the enriched uranium needed to power US commercial nuclear reactors.

The Energy Department didn’t immediately respond to a request for comment. Energy Secretary Jennifer Granholm has called the US reliance on Russian imports a “vulnerability” for national and economic security, while drawing attention to the fact that US enrichment capacity has waned in part because of competition from state-subsidized sources.

The proposal dovetails with legislation introduced earlier this year by Senator Joe Manchin, the West Virginia Democrat who serves as a key swing vote, and Senator Jim Risch, an Idaho Republican, that would authorise billions of dollars in funding to increase the country’s domestic uranium enrichment capabilities. Other congressional backers of expanding US enrichment capabilities include Senator John Barrasso, a Wyoming Republican who serves as the top GOP member of the Energy and Natural Resources Committee.

Companies that could benefit from such a plan include Centrus Energy, the Bethesda, Maryland-based firm that is building an enrichment facility in Ohio, and ConverDyn, a joint venture between Honeywell International Inc. and General Atomics that provides uranium conversion services.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation