Third consecutive year of coal export decline from Richards Bay Coal Terminal

Richards Bay Coal Terminal’s presentation covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer

Graph showing third year of coal export decline from Richards Bay Coal Terminal.

Photo by Richards Bay Coal Terminal

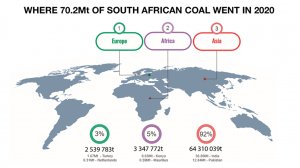

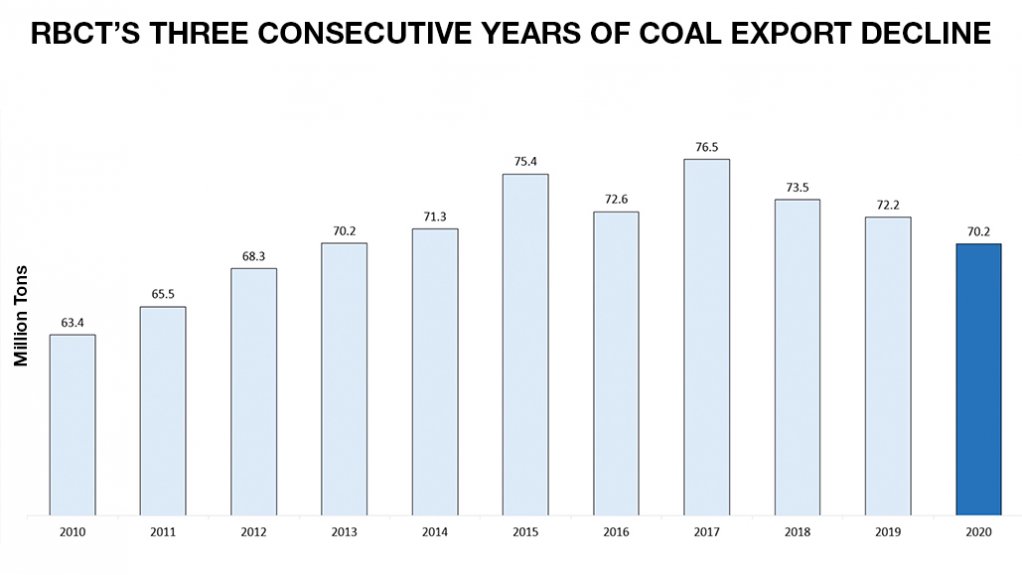

JOHANNESBURG (miningweekly.com) – Coal exports from South Africa’s Richards Bay Coal Terminal (RBCT) last year declined for the third consecutive year, with the 70.2-million tons exported to mainly Asia and single-digit percentages to Africa and Europe, taking exports back to what they were in 2013.

In 2020, two-million fewer tons were exported than the 72.2-million tons of 2019, which was itself 3.3-million tons lower than the 73.5-million tons exported in 2018.

The record level of 76.5 Mt set in 2017 still stands, but RBCT is hoping to beat it this year, and has retained the 77 Mt target for 2021, against the background of coal exports to China beginning to arise.

“We did get a surprise this year when we started to see some exports going to China. We’re looking very positively into that, and looking into what it means for the future,” RBCT chairperson Nosipho Siwisa-Damasane noted during RBCT’s virtual media conference, in which Mining Weekly participated. (Also watch attached Creamer Media video.)

RBCT is not in the business of selling coal, but has noted the first coal leaving South Africa for China since 2014, with roughly 654 000 t of coal exported to the Asian giant in 2020.

RBCT expressed itself as being at the ready to help the South African coal industry as best it can to ensure that South African coal is attractive as opportunities present themselves.

“I understand there have been some vessels that have gone in January to China and it does seem that it is an opportunity for South African coal,” RBCT CEO Alan Waller stated.

Coal buyers have interacted with SGS, RBCT’s on-site laboratory service provider, to understand sampling methodologies that would need to be met should parties want to export coal to China.

In 2020, 92% of South African coal went to Asia, with India and Pakistan being the biggest takers; 5% went to Africa and 3% to Europe. Africa is down about 1% from last year.

The private-sector-owned terminal continues to work very closely with the State-owned Transnet Freight Rail (TFR) and Transnet National Ports Authority (TNPA), which continues to bode well, the Covid-19 pandemic notwithstanding.

“We actually run a seamless supply chain,” said Siwisa-Damasane in praising both TFR and TNPA for the collaboration RBCT receives.

RBCT’s coal exporting parties are made up of Anglo Operations, ARM Coal, Exxaro Coal, Glencore Operations South Africa, junior miners, Kangra Coal, Koornfontein Mines, Mbokodo, Optimum Coal Terminal, Sasol Mining, South African Coal Mine Holdings, South Dunes Coal Terminal, South32 Coal Holdings, Tumelo Coal Mines and Umcebo Mining.

South32’s transaction with Seriti, which is close to finalisation, does not impact RBCT as a terminal.

“Our shareholder pretty much remains the same, although its name will change. But it’s normal operations from that point of view,” said Waller.

“The Anglo transaction and its divestment process is at an early stage. Again there, we don't anticipate any changes or challenges to the RBCT structure in terms of the way the organisation works. All of those transactions are dealt with in terms of our shareholders’ agreement.

“The points of interest would be the continuing situation regarding Koornfontein Mine and Optimum Coal Terminal. With regards to Koornfontein Mine, the creditors did approve the business rescue plan for Koornfontein Mine with Black Royalty Minerals. The business rescue practitioners and Black Royalty Minerals continue to engage in terms of their roll-out plan.

"RBCT does have engagement sessions with them on a regular basis to understand and to answer questions and clarify certain issues and we’re still awaiting a formal approach from them to the RBCT board, but that transaction is at quite an advanced stage, so we certainly expect something to happen pretty soon in that regard.

“In terms of Optimum Coal Terminal, Optimum Coal Terminal and Optimum Coal Mine are obviously very closely related. The Optimum Coal Mine plan was, I think, approved by creditors in roughly October last year. We understand that the legal hurdles they had to get over have been resolved. There was a due diligence process that needed to be taken by the interested party there, which to the best of my knowledge was due to be completed by the end of January this year.

“So, again, that process would appear to be getting to the end. Just to note, the Optimal Coal Terminal plan has not been issued and on the basis of that, RBCT is not really in a position to express an opinion as to where we are in terms of that transaction. No formal approach has been made to the RBCT board at this stage in terms of that transaction, but at least there appear to be positive developments in that regard,” Waller added.

RBCT received coal from 65 collieries in 2020.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation