Seasonal peak sales offer glimmer of hope amid low confidence

Justin Schmidt

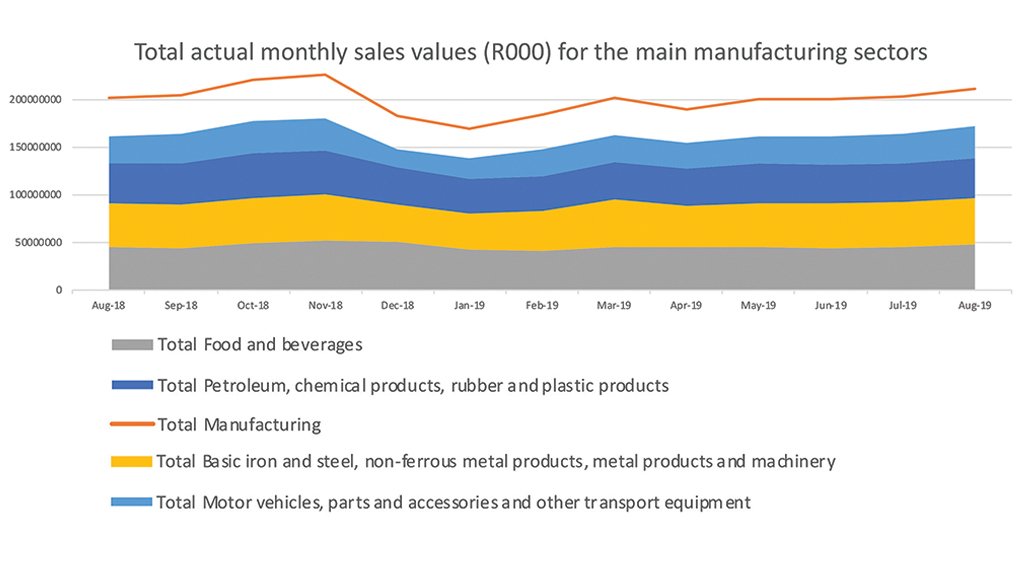

SALES SNAPSHOT: Monthly sales values for South Africa’s main manufacturing sectors

According to the Absa Manufacturing Survey, conducted by the Bureau for Economic Research, business confidence in the manufacturing sector fell to a 20-year low in the third quarter of 2019. The rate of cost increases ticks up, while volumes fall and selling prices move lower. This means that turnover and profitability remain under increased pressure. Domestic sales declined for a twenty-ninth consecutive quarter (barring the fourth quarter of 2014) and is currently well below the long-term average reading.

At the same time, export demand was also weak as export sales dropped, compared with the previous quarter. As a result of weak demand, production volumes are down for the seventh straight quarter. Factories are running well below full capacity, leading to fixed investment outlays being scaled back. The majority of respondents expect that conditions can deteriorate further in the next 12 months.

This is after real gross domestic product (GDP) growth bounced back by more than expected in the second quarter, according to Statistics South Africa. GDP grew by 3.1% quarter on quarter. On a seasonally adjusted and annual basis, GDP grew by 1.1% with real growth for the first half of 2019 coming in at just 0.5% year-on-year. Gross value added by the manufacturing sector expanded by 2.1% quarter-on-quarter in the second quarter after suffering an 8.8% decline in the first. This translates to a 1.1% year-on-year growth (seasonally adjusted) for the manufacturing sector.

As we move to 2020, we will start to see more tailwinds – specifically in the form of energy security and policy certainty. After two quarters of declines in fixed investment spending, the trend reversed in the second quarter, but businesses may continue to delay their decisions on fixed investment spending, given their lower confidence and outlook. It is necessary that these investments materialise during the first two quarters of 2020 as fixed investment is the base from which future growth can occur. We are moving into a period where the manufacturing sector traditionally sees its sales peak occurs in November each year (December for food and beverage manufacturers). The manufacturing sector witnesses 28% of its sales in the three-month period from September to November in 2018, while the motor vehicles, parts and accessories and other transport equipment subsector saw its proportion of sales as high as 31%. The food and beverage subsector experienced its sales peak in December with 29% of 2018 sales occurring between October and December.

As the sector hits its peak sales period, manufacturers will be building up inventory levels. Sales are 20% higher in that peak quarter. A greater amount of capital will be tied up in working capital in the form of higher levels of inventory and receivables. It is encouraging to note that there are customers and businesses that continue to see growth in this difficult environment. However, there are still some risks of load- shedding in the summer months, which would put manufacturers’ cash flow under even more pressure with lost sales and potentially inventory build-up. The effective management of working capital drives success.

Owing to the strong forward and backward linkages with other economic sectors, the manufacturing industry is a barometer of overall economic growth. Banks are therefore focused on supporting the manufacturing sector with its seasonal working capital needs.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation