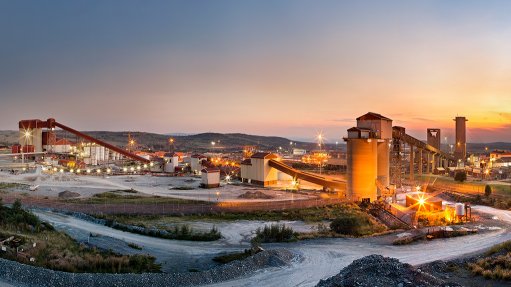

Paladin posts Q3 loss despite Langer Heinrich performing well

TORONTO (miningweekly.com) – TSX- and ASX-listed uranium producer Paladin Energy has reported an adjusted loss of $14.8-million, or $0.01 a share, for the third quarter ended March 31, as an improved performance at its Langer Heinrich mine, in Namibia, was undercut by weak sales volumes.

The performance was in line with analyst forecasts. Net profit swung to $3.8-million, or $0.01 a share, compared with a loss of $49.2-million, or $0.02 a share, a year earlier.

Sales revenue of $20.8-million for the period was 22% higher year-on-year, after selling 595 000 lb of uranium oxide (U3O8). Langer Heinrich produced 1.3-million pounds of uranium.

The average realised uranium sales price for the quarter was $34.67/lb U3O8, compared with the average TradeTech weekly spot price for the quarter of $32.73/lb U3O8.

Despite sales being weak, they were expected to be made up in the June quarter with 57% to 69% of expected sales already shipped, the company advised.

Recent opportunistic debt repurchases have strengthened Paladin’s balance sheet and improved its funding flexibility. Discussions regarding a strategic transaction continued to progress, Paladin stated.

The company reported a record low C1 unit cash cost of production of $24.13/lb for the March quarter, compared with guidance of $23/lb to $25/lb, a decrease of 5% from $25.38/lb in the December 2015 quarter.

The underlying all-in cash expenditure per pound of uranium produced for the three months was $31.60/lb, representing a decrease of 33% compared with the all-in cash expenditure for the three months ended March 31, 2015, which was $46.87/lb.

Paladin advised that issues at tailings storage facility No 3 were likely to result in the loss of 150 000 lbs of U3O8 output in June.

The Perth, Western Australia-based miner advised that Langer Heinrich was expected to produce about 4.8-million pounds of U3O8, 200 000 lbs lower when compared with the previous guidance of 5-million pounds.

The company expected to maintain a weighted average sales price premium to spot of about $4/lb, with Langer Heinrich C1 cash costs expected to range between $24/lb and $26/lb.

The company’s Kayelekera mine, in Malawi, remained on care and maintenance, pending higher uranium prices.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation