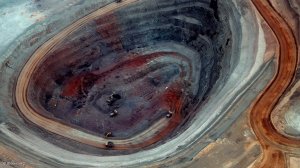

Oz Minerals sinks A$600m into Prominent Hill shaft

PERTH (miningweekly.com) – Copper and gold miner Oz Minerals has approved a A$600-million investment into its Prominent Hill operation, in South Australia, which would increase yearly copper production rates by about 23% and lower operating costs by about 20%.

The company on Wednesday approved the construction of a hoisting shaft at the Prominent Hill mine, which would extend the mine life from the current 9 years, to 15 years, to 2036, at six-million tonnes a year.

The shaft mine expansion also enables generational province potential with further mine life extensions possible as 67-million tonnes of resource remains outside the shaft expansion mine plan.

Operating costs for the expanded operation are estimated at A$64/t, compared with the A$80/t at current rates, while all-in sustaining costs would decline from the current $1.94/t to $1.59/t.

“We are thrilled to see a long and productive future for Prominent Hill with the Wira shaft mine expansion enabling access to areas previously thought uneconomic and opening up potential new prospects,” said Oz Minerals CEO Andrew Cole.

“Prominent Hill is a quality orebody and remains open at depth. The reliable performance of the operation and its consistent resource to reserve conversion rate were all influential in the decision.

“The shaft expansion creates an exciting new future for Prominent Hill with extended mine life and production rates enabling investment in lower emissions and other Oz Minerals environmental and workforce aspirations.

“For the first time we have used a carbon price in determining the project valuation, a practice we will adopt in other Oz Minerals projects going forward,” said Cole.

Work on sinking the Wira shaft is expected to start in the first quarter of 2022 and is scheduled for completion in 2024. The shaft operation is expected to start in 2025 around the same time the stockpiled ore from the original open pit is fully depleted. The average annual copper production is expected to be around 54 000 t and 108 000 oz of gold post 2025, some 23% more than expected in the current trucking operation.

Oz Minerals noted that the hoisting shaft would provide access to mineral resource outside the current trucking mine plan that would have been uneconomical via a trucking operation from around 2033.

Meanwhile, Oz Minerals on Wednesday also announced a 237% increase in net profit after tax for the half-year ended June, driven by operational performance, higher copper volumes and stronger prices.

Net profits after tax for the first half of 2021 reached A$268.6-million, compared with the A$79.8-million reported in the previous corresponding period, while underlying earnings before interest, taxes, depreciation and amortisation increased from A$251.2-million to A$561.2-million in the same period.

Net revenue for the first half of the 2021 financial year was reported at A$986.1-million, up from the A$575.7-million reported in the first half of 2020.

Oz Minerals reported that total production costs of concentrate sold were A$136.7-million higher than the comparative period mainly owing to production activity at Carrapateena, which had only commenced processing development ore during the previous comparative period.

Operating cash flows of A$457.4-million were A$306.7-million higher than in the comparative period, to higher customer receipts with higher copper volumes and prices. Higher revenues were partially offset by higher payments to suppliers with the Carrapateena mine now operating to planned capacity during the full half-year.

“This first-half performance, combined with robust market conditions and strong operating cashflow, informed the board’s decision to pay a fully franked special dividend of 8c per share. The board also decided to maintain the payment of a fully franked interim dividend of 8c per share consistent with our policy of paying a sustainable ordinary dividend from pre-growth cash flow, while having regard to near term, identified capital investment opportunities that create superior value, and the need to maintain a strong balance sheet,” said Cole.

“The board was keen for shareholders to share in the significant uplift in first-half profit, prior to heading into our next growth phase with expansions to commence this year at both Prominent Hill and Carrapateena and a decision on West Musgrave expected in 2022.”

Cole noted that during the first half, Prominent Hill had continued to sustain annualised rates above four-million tonnes a year, with work continuing at the bottom of the current life-of mine level to establish level infrastructure for the commencement of the bottom-up mining sequence.

“Simultaneous bottom up and top down mining will enable an increase to mining rates from 2022, to between four-million tonnes a year and five-million tonnes a year ahead of the shaft mine expansion which will enable mining rates of 6-million tonnes a year from 2025.

“Production at Carrapateena has continued to increase during the half year as expected. In January the board approved the block cave expansion, which replaces the lower portion of the current sub level cave footprint with a block cave to increase mine production to a proposed 12-million tonnes a year. The block cave decline early works are scheduled to begin in the fourth quarter of 2021 while the team continues to focus on debottlenecking and optimising the current sub level cave production rate to 5-million tonnes a year from 2023.

“The West Musgrave copper/nickel project progressed through the last stage of study with drilling at Nebo-Babel, increasing confidence in our understanding of the ore bodies,” Cole said.

He noted that the study team continued to develop the business case, with increasing levels of accuracy around project definition and optimisation. This included developing a business case around the development of a downstream intermediate nickel product. There remained strong alignment with representatives of the Traditional Owners and government approvals continued to progress as planned.

“The investment decision remains on track for 2022. The West Musgrave province strategy was also advanced during the first half with the integration of a targeted geophysics and drilling programme scheduled to commence in the third quarter of 2021 at the Succoth copper deposit located 13 km from Nebo-Babel. Succoth has the potential to add upside to the West Musgrave project.”

Meanwhile, at the Carajás East Hub, in Brazil, final ore was mined from the opencut mine at Antas with the pit to be used as a future tailings storage facility. The Covid-19 pandemic escalated in Brazil during the first half, impacting development progress at Pedra Branca, resulting in annual production guidance being revised lower.

“With additional mining equipment arriving at site in June, stope production is now expected to commence shortly allowing a transition from the processing of development ore to production ramp-up. We progressed further resource drilling during the first half with drill programmes conducted at Santa Lucia and Pantera which will enable mineral resource and study updates to outline growth opportunities in Brazil during the second half of the year,” said Cole.

Looking ahead at the full 2021, group copper production is expected to reach between 120 000 t and 145 000 t, while gold production would range between 205 000 oz and 228 000 oz.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation