Oz Minerals rejects BHP's A$8.4bn offer

PERTH (miningweekly.com) – Copper miner Oz Minerals has rejected a surprise A$8.4-billion takeover bid from diversified miner BHP.

BHP submitted a non-binding indicative proposal to Oz Minerals at the end of last week, to acquire all of the company’s shares at a price of A$25 a share. The offer represented a 32.1% premium to Oz Minerals’ closing price on August 5, and a 41.4% premium to the company’s 30-day volume weighted average share price.

“Our proposal represents compelling value and certainty for Oz Minerals shareholders in the face of a deteriorating external environment and increased Oz Minerals’ operational- and growth-related funding challenges,” said BHP CEO Mike Henry.

“We are disappointed that the board of Oz Minerals has indicated that it is not willing to entertain our compelling offer or provide us with access to due diligence in relation to our proposal.”

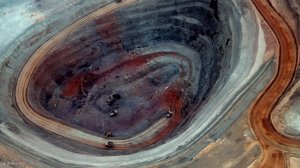

Oz Minerals MD and CEO Andrew Cole on Monday told shareholders that in coming to the decision to reject the offer from BHP, the board of directors felt that the indicative proposal did not adequately compensate shareholders for the unique nature of Oz Minerals’ core business, which represented a high-quality portfolio of copper and nickel assets in a Tier 1 mining jurisdiction with long mine lives, first quartile cost positioning and extensive strategic optionality.

The board also felt that the offer did not reflect the unique investment proposition which Oz Minerals provided as the only primary copper company in the ASX100, or the low carbon intensity of the company’s assets, relative to its peers, or the quality of the company’s growth projects, which include the West Musgrave asset where a final investment decision is due in the second half of this year.

“We have a unique set of copper and nickel assets, all with strong long-term growth potential in quality locations. We are mining minerals that are in strong demand particularly for the global electrification and decarbonisation thematic and we have a long-life resource and reserve base. We do not consider the proposal from BHP sufficiently recognises these attributes,” Cole said.

He added that the offer from BHP also did not reflect the potential synergies that could be derived from a combination of the assets, including operational synergies in South Australia, between the Olympic Dam, Carrapateena and Prominent Hill assets, or in Western Australia, between the Nickel West and West Musgrave operations.

Oz Minerals told shareholders that the indicative proposal from BHP was highly opportunistic, coming at a time when the LME copper price and the company’s share price had fallen from their recent peaks in March and January respectively, and that Oz Minerals had consistently traded above the proposed offer price for the equivalent of more than five of the last 12 months.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation