Novagold and chairman Kaplan lambaste short-seller report

Dual-listed NovaGold Resources on Monday published two statements lambasting the recent report by short-seller J Capital Research (JCAP), in which it expressed its doubt over the mining firm’s plans to build a mine with gold major Barrick Gold in Alaska.

In a detailed and lengthy response, NovaGold goes through the JCAP report line-by-line, highlighting what it believes are misleading and false statements.

President and CEO Greg Lang also confirmed that NYSE American- and TSX-listed NovaGold is assessing the legal options available to it in various jurisdictions.

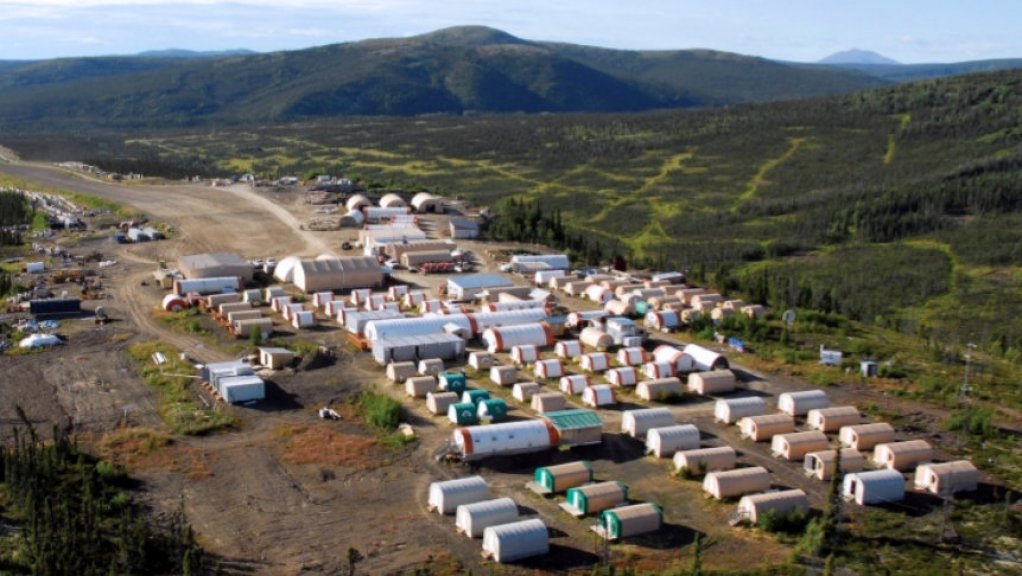

NovaGold and Barrick are advancing the Donlin project, which with measured and indicated resources of about 39-million ounces of gold is considered one of the largest and highest-grade known openpit gold deposits, in Alaska. But JCAP argues that the deposit is “so remote and technically challenging that the mine will never be built”.

In its report, JCAP has slammed NovaGold management for misleading investors with “subjective presentations” of information about the deposit over a period of 15 years.

“Over those years, they’ve been treating this 12-person concept company like an ATM, awarding themselves base salaries that rival those of the CEOs at Newmont and Barrick and total compensation packages comparable with those at Rio and BHP. If the information from the company’s feasibility studies were presented in a more honest light, investors would understand that the Donlin deposit, of which they own 50%, is not feasible to put into production at any gold price,” JCAP had said in its May 28 report.

But on Monday NovaGold’s chairperson and biggest shareholder, Thomas Kaplan, had strong words for JCAP, dismissing the report as “blatantly misleading” and said that “pathetic does not begin to describe it”.

“In that report, the company believes that JCAP, masquerading as a research firm, is perpetrating, what is known as a short-and-distort scheme designed to nefariously inject the market with misleading and false negative information about the company to drive the price of its security down in order to allow those with short positions to quickly cover them at an artificially low price and, in doing so, derive a quick profit on the backs of unsuspecting shareholders,” said Kaplan.

Separately NovaGold issued a detailed response to JCAP. In that response, the mining firm argues that the short-seller firm exhibited a “fundamental lack of knowledge of geology, engineering, topography, technology, accounting and financing assessment methodology as it attempted to denigrate NovaGold and its assets”.

The company also says that JCAP’s “misrepresentations, convenient omissions, and intentional muddling of chronology, events and data, as well as inappropriate comparisons and consistent reliance on unidentified, questionably credentialed ‘experts’, exposed its deep lack of legitimacy”.

NovaGold affirmed that its management team was steadfast in its strategy towards successful execution of the project, when the gold price, market conditions and project optimisation render it ready for development.

Since the May 28 JCAP report, NovaGold’s stock on the NYSE American fell by 43% to $8.06 a share and on the TSX by 50% to $10.75 a share.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation