Motheo processing plant expansion, Botswana – update

Photo by Sandfire Resources

Name of the Project

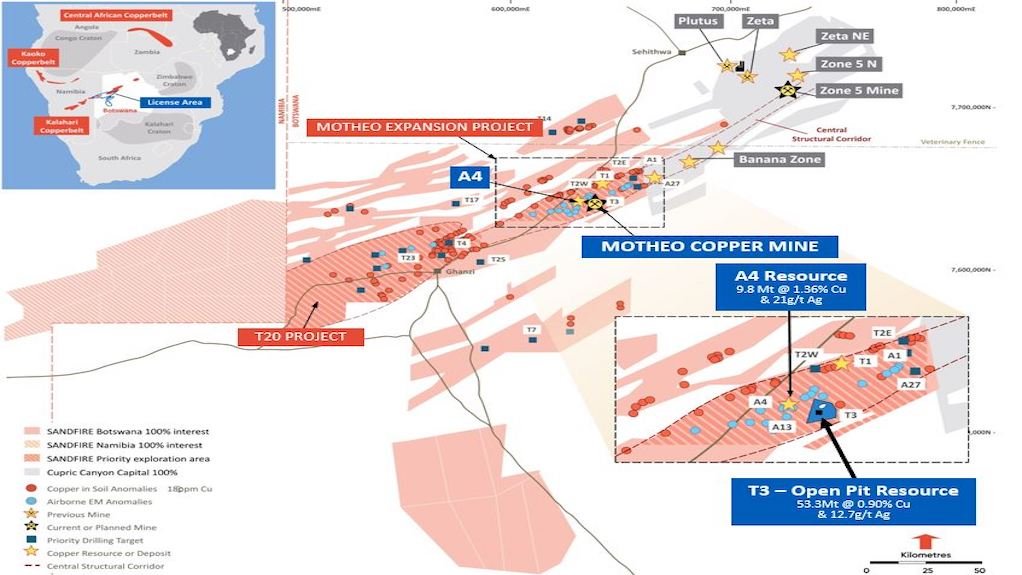

Motheo processing plant expansion.

Location

Botswana.

Project Owner/s

Sandfire Resources.

Project Description

A prefeasibility study (PFS) has confirmed the strong business case for the development of the Motheo project’s A4 deposit as part of the expanded

5.2-million-tonne-a-year Motheo production hub strategy.

The A4 deposit has estimated openpit ore reserves of 9.7-million tonnes grading 1.2% copper and 18 g/t silver.

The A4 PFS outlines the first additional satellite deposit to the Motheo copper mine, expanding plant production from 3.2-million tonnes a year to 5.2-million tonnes a year over its five-year mine life. Estimated copper production contained in concentrate over the life of the A4 openpit is estimated at 105 000 t.

Mine facilities include surface mining operations at the A4 deposit, expansion of the processing plant and supporting infrastructure.

The Motheo project has a total mine life of 12.5 years.

Potential Job Creation

Sandfire reported in August 2022 that there were more than 1 700 personnel on site.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at a 7% discount rate, of $682-million and an internal rate of return of 36%, with a payback of 2.9 years from the start of production.

Capital Expenditure

Total preproduction development capital has increased to $366-million, incorporating the development costs for the A4 openpit and an updated cost forecast for the Motheo plant to account for increased steel costs, foreign exchange movements and Covid-19-related disruptions.

Planned Start/End Date

First production in the June quarter of 2023.

Latest Developments

Sandfire Resources has launched a A$200-million fully underwritten entitlement offer to repay debt and fund working capital at its Motheo operations.

The company will undertake a 1-for-8.8 accelerated nonrenounceable entitlement offer at A$4.30 a share, representing a 10.2% discount to Sandfire’s last trading price and a 9.3% discount to its theoretical ex-rights price.

The company is expected to issue 46.6-million new shares under the entitlement offer, representing about 11.4% of its current issued capital.

The entitlement offer will be divided into an institutional entitlement offer, which is expected to raise A$150-million, and a retail entitlement offer, expected to raise a further A$50-million.

About A$50-million of the capital raised will be used to repay an outstanding corporate debt facility, with A$60-million used to strengthen the balance sheet and provide working capital, while a further A$60-million will go towards growth and exploration projects, including MATSA mine extension drilling and ore reserve growth, Motheo A4 progress and Kalahari copper belt near-mine exploration.

The entitlement offer will ensure that the company is well positioned to execute its growth strategy, and has the balance sheet strength and flexibility to continue to pursue its growth objectives across its portfolio. In addition to enhancing financial flexibility, it will also provide additional working capital at Sandfire’s existing operations, where the company is focused on continued operating results at MATSA and delivering the Motheo copper mine, scheduled to begin production in 2023.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Sandfire Resources, tel +61 8 6430 3800.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation