Mind The Gap

Written by: Jaco Lotheringen MD of Ukwazi

A well-known fact about mining businesses is that they are highly susceptible to the cyclical environment of the supply of, and demand for commodities – something that is unlikely to change. When examining decreasing commodity prices over the last three years, uranium yellowcake has been the exception, with a recent upward trend. Gold has remained relatively stable, but platinum group metals (PGMs) and copper have seen a substantial decline from the highs achieved in early 2021. Bulks such as manganese ore, iron ore, bauxite and specifically coal, are materially down from the peaks reached late in the COVID-19 pandemic, while chrome has not regained its pre-2017 commodity crisis levels.

Many operations, particularly across Southern Africa, are currently facing significant challenges. These difficulties can be attributed to logistical hurdles associated with Transnet, alongside considerable post-COVID-19 production cost escalations and the added pressure of lower commodity prices. As a result, most mines are facing inward, prioritising cost control and aligning production with forecasted rates for saleable products. The responsibility for consistently meeting the strategic plans communicated to the market, investors, and stakeholders, therefore, rests squarely on the shoulders of the mine's production team.

Bridging the gap

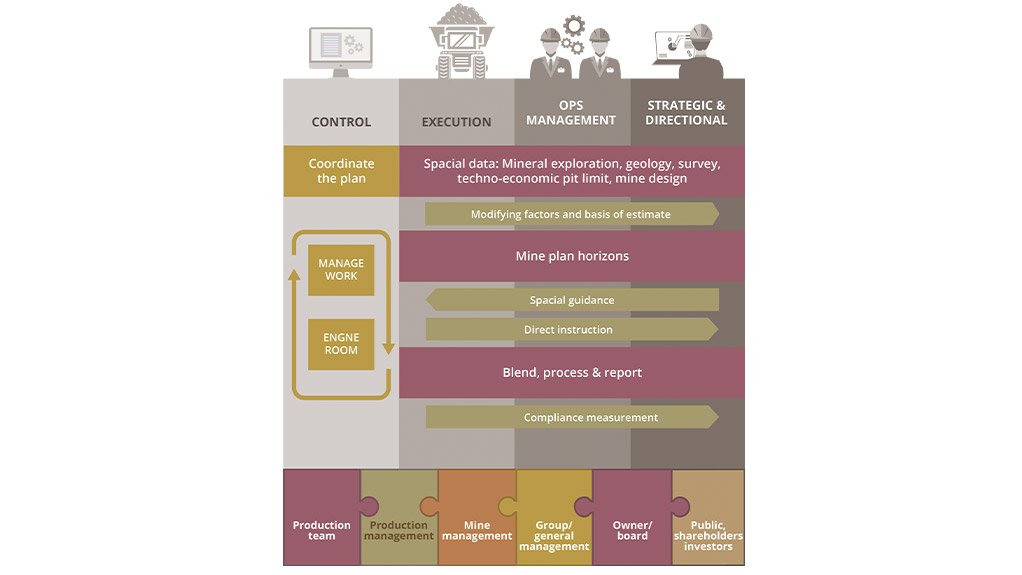

Whenever you travel on the London subway there are signs that warn you, “Mind the Gap”. In recent years, the disparity between strategic mining plans and the practical, implementable mining plans accessible to mining operational teams, has grown considerably. This gap subsequently fosters widespread uncertainty within the execution environment i.e., what must be done and the how of what can be done practically.

In the same vein, while most mining organisations do adhere to well-defined planning horizons and put notable effort in producing these plans - in a sequential manner and at specific intervals - they often lack practical guidance. The plans formulated as the foundation for the mine budget should provide comprehensive and practical direction to mine management, aiding the implementation plans and serving as a benchmark for evaluating the mine's performance and the efficiency of its operational teams.

At Ukwazi, we strongly believe that when a plan serves as a benchmark for evaluating a mine's performance or its operational team, it should be tailored for those specific purposes; aligning with the business' strategic objectives while also providing clear, instructional guidance. Simply put, it must extend beyond providing spatial guidance alone. Attempting to mitigate the resulting execution risk within the short-term operational planning horizon through rolling monthly and weekly plans is insufficient for most complex mining operations. This approach simply does not guarantee the sustainability of safe and high-quality production, as mines operate in a highly sequential and spatially controlled manner.

Closing the gap

As you increase uncertainty by imposing top-down strategic models for operational control, frustrations will mount, and needless stress will burden an already demanding production environment; making it progressively difficult to retain outstanding operational and mining management teams. As such, the uncertainty gap between organisational objectives and operational targets needs to be reduced by developing pragmatic and cohesive mining budget plans that are audience-driven and outline sufficient practical requirements. It should be all about creating certainty.

The result? A production team well-positioned to perform in line with their respective KPIs and organisational incentives. Moreover, a higher degree of certainty can be attained by applying mine activity design principles within a suitable planning timeframe. This involves shaping consecutive mining activities to correspond with a business’ strategy, streamlining pit preparation and practical deployment.

To support our clients and their operational management teams, we have established an expert team to specifically focus on the mining budget plan horizon. These plans align with strategic mine plans to fulfil a mine owner's objectives, including shareholder returns. They also offer a level of detail that provides clear and practical instructions for crafting short-term operational execution plans and designs to notably reduce the levels of frustration in the mining production environment.

So, how do we effectively close the gap? Well, ultimately mining engineering and mine planning constitute pivotal technical and organisational disciplines. The effective implementation of the budget mine planning horizon requires active engagement from the intended audience, the operational team in this case, and a technical team that has insight into the strategic objectives of the mine, and an in-depth understanding of the sequential nature of mine deployment. Further to this, the operational teams should receive outputs that equip them with the practical tools needed to adequately meet their requirements. At the end of the day, cultivating this collaborative approach should be a standard practice in every mining organisation.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation