Mina do Barroso lithium project, Portugal – update

Name of the Project

Mina do Barroso lithium project.

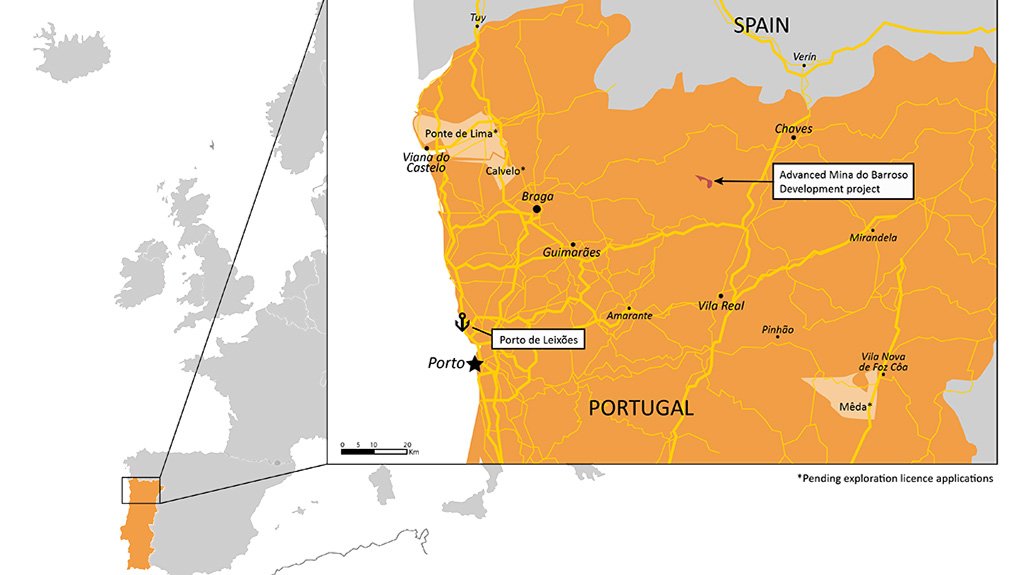

Location

Near Boticas, in northern Portugal.

Project Owner/s

Savannah Resources.

Project Description

A scoping study has confirmed that Mina do Barroso has the potential to be a major European producer of spodumene lithium, with robust project economics and the potential to deliver substantial shareholder value.

The study is considered a base case for the project, and is based on a mine and concentrator-only development for the production of spodumene concentrate.

The project will use a contract miner and fleet.

Conceptual openpit mine planning has been developed, targeting a plant feed rate of 1.3-million tonnes a year, with an estimated average life-of-mine (LoM) mill head grade of 1.02% (diluted) lithium oxide and an average overall strip ratio of 5.2:1 (waste:ore ratio). The project LoM will exceed 11 years.

The flowsheet comprises a combined 1.3-million-tonne-a-year dense-media separation and flotation circuit, with an overall plant availability of 85% for the recovery of spodumene. The study estimates average production of 175 000 t/y of spodumene concentrate at 6% lithium oxide.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $356-million and an internal rate of return of 63.2%, with a payback of 1.7 years.

Capital Expenditure

Initial capital expenditure is estimated at $109-million.

Planned Start/End Date

Construction is expected to start in the second quarter of 2019, with production expected to start in the first quarter of 2020.

Latest Developments

Portugal environment regulator APA has given the environmental-impact study on the Barosso project its preliminary approval, which Savannah Resources describes as “a major milestone”.

It will now progress to the next stages of the process, including a public consultation, which will then be evaluated by APA before final approval.

In January 2021, Savannah signed a heads of agreement (HoA) with Portuguese diversified energy group Galp Energia on a proposed strategic investment and alliance regarding the lithium field around the Mina do Barroso lithium project.

Galp intends to secure a 10% shareholding in Savannah’s Portuguese subsidiaries, which own Mina do Barroso, for $6.4-million in cash, which Savannah will use to progress the project’s definitive feasibility study.

The companies will also evaluate exclusive terms for an offtake agreement for up to 100 000 t/y of lithium concentrate from Mina do Barroso, equating to about 50% of its planned yearly production.

The agreement represents a significant step in commercialising the project and will be an important factor in securing financing for construction of the project.

Key Contracts, Suppliers and Consultants

Hatch (engineering services); PayneGeo (geological model and resource estimations); Minesure (analysis and definition of the scoping level mining inventory and contractor costs); Primero Group (primary engineering group and lead manager for the feasibility study); Knight Piésold (lead geotechnical and hydrological engineering); Quadrant (consultant on transport and logistics requirements), Nagrom (assay and metallurgical testwork services), ALS (assay and metallurgical testwork services); VISA Consultores (environmental-impact statement assessment); CV&A Consultores and S317 Consulting (stakeholder management strategy, community engagement plan and sourcing of European Union funding); and Noah’s Rule (financial adviser).

Contact Details for Project Information

Savannah Resources, David Archer, tel +44 20 7117 2489.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation