Kumba lifts output, slashes costs, pumps cash, CFO quits

JOHANNESBURG (miningweekly.com) – South Africa’s biggest iron-ore mining company Kumba Iron Ore beat production guidance, slashed costs and pumped cash – but what was a successful 12 months to December 31 last year, was marred by two fatalities.

Controlling shareholder Anglo American said in a separate statement that it would report underlying Kumba earnings of $438-million for the year, which would take into account certain adjustments on Kumba’s reported headline earnings of R8.7-billion.

The realisation of full value for Kumba’s premium lumpy product in a rising iron-ore price scenario was accompanied by a 34% reduction in controllable costs, which resulted in strong cash flow generation pushing the company’s net cash position to R6.2-billion.

But there will be no resumption of dividend payouts as the board has deemed it more prudent to use the cash to remain ungeared.

This year will also see Kumba appoint a new CFO following the resignation of Frikkie Kotzee after five years of service.

Despite the company’s triumph in challenging and volatile iron-ore markets, controlling shareholder Anglo American is still intent on disposing of the company, which has been restructured under new CEO Themba Mkhwanazi, who has not only overseen the resetting of the cost base and stabilisation of operating performance with the help of technology, but has also presided over the settling of the tax dispute with South African Revenue Services and the return of the residual Sishen mining right.

“We can now focus on the business,” Mkhwanazi said in a media call.

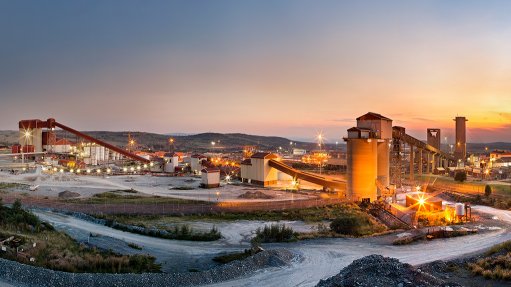

The Sishen and Kolomela mines, which both exceeded guidance, produced a combined total 41.5-million tonnes iron-ore and reduced the average cash breakeven price to $29/t against an average realised price of $64/t free on board – up 18% on last year.

The strong balance sheet is now supporting a conservative capital structure in the face of an expected moderation in prices and technological steps to increase productivity.

In order to ensure a smooth transition, Kotzee has agreed to remain with the company until Kumba’s annual general meeting on May 11.

Kumba chairperson Fani Titi noted Kotzee’s unwavering commitment to the highest levels of governance and announced the intention of the board to begin a search process of internal and external candidates to identify a successor.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation