It’s responsible to invest in South Africa, says DRDGold as it approves R3.5bn capex

DRDGold CEO Niël Pretorius’ presentation covered by Mining Weekly’s Martin Creamer. Video: Shadwyn Dickinson

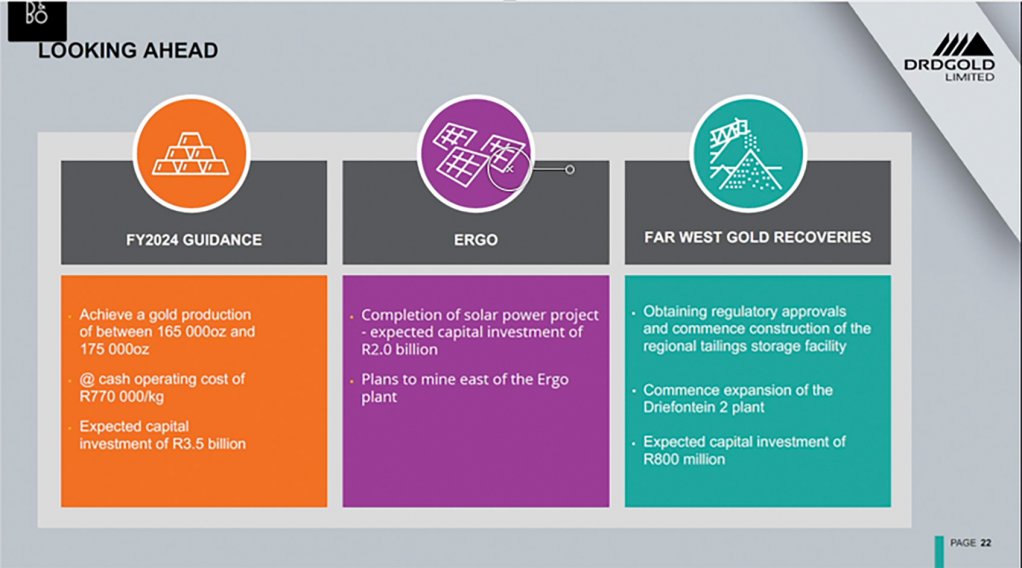

DRDGold's approved capital investment plan.

JOHANNESBURG (miningweekly.com) – The decision of DRDGold to expend capital of R3.5-billion this financial year is based on the cash-flush Johannesburg- and New York-listed gold-from-dumps mining company firmly concluding that it is responsible to investment in South Africa amid seemingly unstoppable private sector turnaround momentum.

The board has given the nod for R2-bilion of this year’s R3.5-billion capital expenditure (capex) to go into solar power and into long-term sustainability creating deposition facilities. (Also watch attached Creamer Media video.)

A big part of the R800-million expenditure in the Far West Gold Recoveries operation is for a tailings dam and, in the not-too-distant future, an amount not quite as high but similar will be invested at Ergo on the East Rand to expand the size and capacity of the Brakpan/Withok tailings facility.

Debt-free DRDGold, headed by CEO Niël Pretorius, had net cash of R2.47-billion as of June 30, after paying R515.3-million in dividends, re-investing capex of R1.1-billion and paying R314.8-million in income tax on a gold production of 169 820 oz in the 12 months to June 30 this year.

“A question that one has to ask when looking at these sorts of capex numbers is whether you are investing in an environment where it is responsible to invest this level of capital,” Pretorius said during the presentation of 2023 results, covered by Mining Weekly.

“When we switch on the television we maybe wonder. You read the Fraser Institute’s report and maybe wonder. You look at where capital is going and a lot of it is going away from South Africa and less is coming into South Africa.

“So, one has to reflect on this level of investment carefully before you commit your shareholders.

“We believe that it is responsible to invest in South Africa. We do believe that South Africa doesn’t stand or fall based on the quality of political governance in the country. There is a private sector and there’s a society which, when they join forces, become unstoppable and can really turn things round.

“Increasingly, in order to assess whether or not it is responsible to invest, one looks not so much at the kind of challenge that we face, but also at what the response is to those challenges, and the responses to some of those challenges have been remarkable.

“Firstly, what we are seeing is that the face of political leadership is systematically changing. We’re seeing a different kind of leader emerging, younger, dynamic with lots of energy, firm values. At the moment, maybe more at local and provincial level, but increasingly I think we’ll start seeing those faces and those profiles finding their way into the national leadership as well.

“People who are externally focused are genuinely wanting to deliver into the well-being of the constituency, so that certainly is changing. It’s going to take a while before it changes completely, but we are seeing very positive first indications of a change of face of political leadership.

“A second thing that’s really encouraging is that it seems private capital has found its voice. We’re seeing less in the way of nuanced utterances on the part of business leaders and more and more very prominent leaders are becoming involved in initiatives that contribute towards some of the very pressing challenges that we are faced with, like crime and logistics,” he said.

But amid all that, he noted that very recognisable groups and influential people, with command over vast capital, were activating the capital over which they had custodianship quite quickly to bring about positive change.

Very encouraging, he added, was the way private capital was being mobilised, exemplified by the volume of energy being generated from rooftop solar panels reaching the 4.4 GW level, which was equivalent to two phases of loadshedding.

“The private sector has come to realise that sitting around and waiting is not going to be the solution. We’ve got to jump at it and they are jumping at a rate that is catching us by surprise. Generating such a high volume of electricity so fast is not the conduct or behaviour of someone who has given up on the country.

“We’re seeing capital and young people at work. We’re seeing a different kind of energy. People not waiting for government to step in and fix it for them but communities doing it for themselves.

“The same sort of resilience that we’ve been working hard at as a company to overcome some of the challenges that we’re facing, we are undoubtedly seeing that becoming a feature also of more and more pockets of society, with South African people becoming an increasingly resilient people,” said Pretorius.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation