Inside Diamond Mining Icons - Joint Ventures between Botswana and De Beers

By: Sheila Khama

In many ways Botswana is a small country, but the exception is diamond mining in which the global center of gravity shifts inward. The country has the second largest reserves after Russia’s Alrosa mines based on carats and the world’s largest reserves based on value. Thanks to these reserves, Botswana’s annual diamond production peaked at 31million carats.

Botswana also boosts the most technologically advanced diamond sorting facilities worldwide. Behind these milestones are companies owned jointly by Botswana and De Beers. In this extract, which is the second of four articles on Botswana’s diamond industry, featured on my -www.sheilakhama.com/blogs, I offer a glimpse of the history, governance structure and contributions by joint ventures (JV) companies. That is Debswana Diamond Company (Debswana), and Diamond Trading Company Botswana (DTCB). I also look at De Beers Group which is jointly owned by Botswana and Anglo American Corporation plc (AAC plc).

The Mining JV: Debswana was incorporated in 1969 and by law the JV and not De Beers was granted mining rights. Based on the Government’s legal right to acquire equity in mineral development projects, upon De Beers’ discovery of the first three mines in 1967, Botswana acquired a 15% stake and increased it to 50% following discovery of a fourth mine in 1972. By then it had become clear that the first deposits were larger than originally estimated while the fourth mine (Jwaneng) was outstandingly richer and from day one it was a game changer. On the day of its commissioning in 1982, former President Sir Masire dubbed it, ‘The Prince of Mines and A Gem Among Gems.’ It proved worthy of the accolades and by the late 1990s it accounted for nearly 60% of company revenue albeit only 40% of production. The revenue transformed the fortunes of Botswana and De Beers, but especially the country which started from humble beginnings.

Behind the Scenes: From the onset, the company was led by a board of directors with an equal number of shareholder representatives. Importantly, board decisions are taken unanimously. In the beginning, Anglo American Corporation of South Africa (AACSA) and De Beers assumed operatorship, but the company has been independently managed since 1992. Though it is common for one of the partners to be the operator, the reality is the practice is not necessarily welcome much less easy to implement. This is regardless of whether the partnership involves a government. In this respect the Debswana JV is no exception. The issue comes down to divergence of interests leading to strategic misalignment and often mistrust. Rightly or wrongly, the general view is that secondees from the operator are partial to the interests of their employer. Information access and superior technical know-how led to suspicion of abuse of this by De Beers. But with about 40 graduates in the country at independence Botswana’s leaders had little choice and Botswana accepted that from a technical and commercial perspective, finding an independent operator would have been self-defeating. Whether the operator abused its position depends on whom one asks. But research shows that given organizational differences between governments and corporations, this lack of trust should not come as a surprise. Research also suggests that if managed proactively, the board of directors can minimize this tension. www.watersStreetPatners.com Based on more than 50 years of existence, its hard to suggest Botswana and De Beers did not succeed on this front.

Corporate Cash Cow: The stability of the partnership was helped a lot by the extraordinary financial performance of Debswana. Though De Beers shouldered development costs for the first three mines and benefited from an accelerated cost recovery regime, the company achieved this in just 17 months. So profitable is the JV that it pays dividends every five weeks except in times of market crisis. The split of financial distribution between the shareholders is 80.8% to 19.2% to the Government based on the latter’s range of tax income streams whereas De Beers only receives 50% of dividends and commission from its sales contract. Those in the industry will recognize the unusual nature of this financial performance. So, at an estimated 20% of GDP about 80% of foreign earnings as well as about 60% of diamond supply and more than 50% of De Beers revenue, Debswana’s impact on the economy and return on investment therefore has been phenomenal. In January 2023, Bank of Botswana data showed that annual diamonds sales earned US$4.588 billion in 2022. These financial performance indicators are what separates Debswana from other diamond mining companies.

Impact Investing: The financial indicators speak for themselves but what of social impacts? Admittedly difficult to follow the money on such a brief narrative. But the Government negotiations strategy in 1969 was to leverage the development of the mine to deliver social services and infrastructure. So, in addition to mine infrastructure, De Beers funded and managed public projects for housing, water, electricity and multi-user airports and roads as well as hospitals and schools in the vicinity of the mines. The value of the Public Private Partnerships (PPPs) is easy to see, but what is less obvious are the merits of opting for these types of benefits relative to financial payments. In countries with limited capacity for public finance management, or in cases where the Government wants to speed up economic impacts, PPPs are preferrable. They can also avert the risk of the political economy through State capture.

Though Debswana has benefited from technological skills transfer from De Beers on JV operations in mining, sorting, valuing and security, more could have been done. De Beers’ Centers of Excellence and R&D laboratories are logical partners for Botswana’ universities and research institutions. Yet, for 40 years little was done to leverage the opportunity. At a time when the world seeks to digitize economies, the opportunity cost could be significant.

A Worthy Legacy: De Beers brand has done well thanks to its JV and association with Botswana. In stark contrast to the company’s South African experience, Botswana’s image and its positive impact on the company is undeniable. This factor goes contrary to the commonly held view of African countries as the underdog with little value on matters of reputation and brand stature. Botswana’s track record of governance, mining laws on ESG matters set high environmental and social performance standards. From a Diversity, Inclusion and Equity (DEI) perspective, by 2022, women constituted about 22% of Debswana workforce. A far cry from the C19th South African diamond mining that sadly dominates the image of the industry despite progress made. And the De Beers brand is better for it.

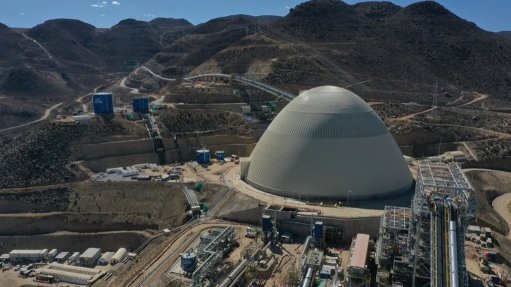

Sorting and Valuing: As with other countries in Africa, Botswana aspires to extract more value through diamond processing and the DTCB JV is the link. The home of the JV is a state of the art facility funded by De Beers and equipped by De Beers using inhouse technology. The project cost US$82million in 2008 and the building is owned by the JV. DTCB started as an agent of De Beers Global Sightholders and sold aggregated diamonds to factories in Botswana. The factories have grown from 10 in 2008, to 16 in 2009 and to 38 by 2023. The 2022, annual value of the goods sold to the local factories was US$950million with over 3500 jobs. The company boasts more than 99% of citizen manpower and together with Debswana’s achievements, this is something to be proud of given where the journey began.

The question is, is this enough? Again, it depends on whom one asks. It also depends on how one views the role of the company versus that of the Government on matters of national development. One school of thought argues that national development is a matter for a national government while another suggests that companies must play a more direct role in delivery of social welfare. Either way, the pressure is unlikely to lessen, and the partners will increasingly be challenged especially in a single industry economy. The JV partners should therefore brace themselves and work together to tackle greater expectations. Anything else undermines the JVs and is counterproductive.

Botswana Owns De Beers Group: One of the less understood features of the relatioship is Botswana’s 15% equity in De Beers Group in partnership with AAC plc. Botswana’s share dates back to 1987 when De Beers Group swapped Debswana stockpiled diamonds for equity following a sustained market depression. The equity was only 2.5 % but has changed over the years leading to 15% by 2006. Botswana has two seats on the board which it has held since inception. When the Oppenheimer family-owned company sold its 40% interest in De Beers Group in 2011, AAC plc and Botswana had the right of first refusal to acquire the shares. Botswana opted not to exercise this right and through this effectively gave AAC plc a controlling share. Botswana’s decision is somewhat bizarre given the finite nature of mineral resources, the need to find future sources of revenue and recent suggestions that historically the deal has not been equitable. It also goes against the grain given the call by African governments to take greater control of natural resources from multinationals.

Nevertheless, in dealing with De Beers Group, the challenge for Botswana is how to balances its interests in the company with those of the two Botswana JVs and answer is through a strong voice on the board of De Beers Group. This access increases understanding of the business and deepens Botswana’s potential influence on De Beers Group strategies in relation to the Botswana entities and competitors. It is an enormous opportunity which if deployed systematically, could help mitigate the risk of adverse impact of De Beers strategies on national goals. But so far, De Beers and Botswana act as if they do not have this common interest and instead negotiations show very little alignment and an arm’s length approach instead.

From a governance perspective the Botswana JVs need to be more transparency. The decision not to publish financials does not meet standards for transparency, accountability and public participation. De Beers’ parent company ACC plc is listed in the FTSE and discloses accordingly. Debswana and DTCB can use AAC plc to benchmark some of the practices. Otherwise, undeniably, the partnership has been very successful, and the JVs are iconic in the industry.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation