Implats studying three new projects as three approved projects get under way

Implats record financial results presentation covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

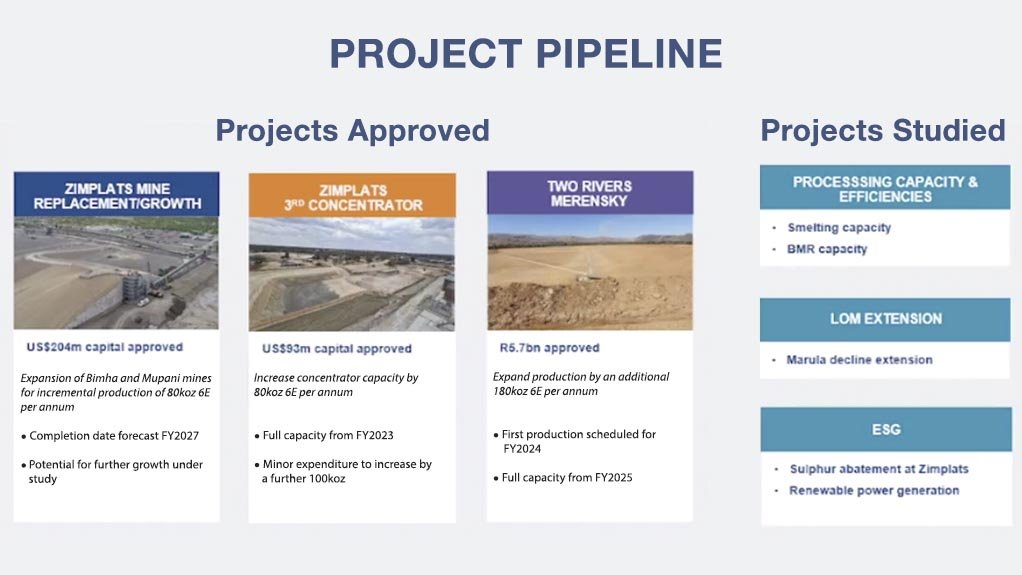

Implats' project pipeline of three board approved projects and three still being studied.

JOHANNESBURG (miningweekly.com) – Platinum group metals (PGMs) mining and marketing company Implats is studying three new projects at the same time as three already approved projects get under way at a combined capital expenditure of close to R12-billion, Implats CEO Nico Muller has announced.

During this week’s presentation of record financial results covered by Mining Weekly, Muller calculated that the amount of capital expenditure (capex) required for the growth projects would be R5.7-billion for the expansion of the Two Rivers PGMs mine in South Africa and about R6-billion for replacement and growth investment at Zimplats in Zimbabwe.

Muller said that the first of the three projects still being studied is focused particularly on downstream beneficiation in the form of additional smelting capacity as well as increasing the capacity of the base metals refinery (BMR) in South Africa. (Also watch attached Creamer Media video.)

The second project study centres on life-of-mine (LoM) extensions, and the most near-term project is a feasibility that is being prepared for board consideration in November. This involves an extension to the decline of the Marula mine, in Limpopo, to provide an additional ten years to Marula’s current 13-year LoM.

The third project under study is an environmental, social and governance, or ESG, capital investment. Most noteworthy is sulphur abatement at Zimplats and Implats' ambition to achieve carbon neutrality in 2050 through increased consumption of renewable power.

While these studies proceed, three projects at a capital cost of close to R12-billion are getting under way following board approval.

The three projects approved and under way include:

- the R5.7-billion Two Rivers Merensky project, near Steelpoort, in Limpopo;

- the US$204-million Zimplats’ mine replacement and growth project in Zimbabwe;

- and the US$93-million Zimplats’ third concentrator project, also in Zimbabwe.

The Two Rivers Merensky project is in the early stages of development. The aim of this project is to ramp up the production capacity of the Two Rivers mine by 180 000 oz of six element (6E) output a year.

First ore from the Two Rivers Merensky project production is expected in 2024 and full capacity in 2025.

This project is in the early stages of development. Site preparation, in the form of geotechnical assessments and surveying, is being carried out for the additional concentrator plant and procurement for the decline development on the Merensky reef horizon has been initiated.

The expansion of the Bimha and Mupani mines for the incremental production of 80 000 oz/y of 6E output represents the first phase of the expansion. The new concentrator will have all the internal mechanics to process 180 000 oz, other than the front end required to treat ore in addition to the 80 000 oz.

“In order to do that, all we have to do is provide facilities to receive the additional concentrate and the front end, which comprises of a crushing circuit.

“The expansion of Bimha and Mupani accounts for the 80 000 oz and we are currently evaluating different options for the additional 100 000 oz to bring the full expansion eventually to 180 000 oz,” said Muller, who calculated total capex of about R6-billion, which compares with the R5.7-billion approved for Two Rivers.

The Johannesburg- and New York-listed company's record financial results for the 12 months to June 30 were the result of higher volumes being sold into a strong PGMs pricing environment.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation