Gold price drives record numbers for Evolution

PERTH (miningweekly.com) – Gold miner Evolution Mining has reported record free cash flows during the three months to September, as gold prices soared.

Gold production for the three months to September were down slightly at 191 967 oz, compared with the 194 886 oz produced in the previous quarter, while silver production declined from 184 693 oz to 182 948 oz.

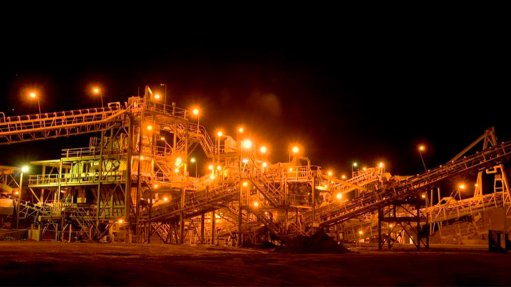

Evolution reported record production from the Cowal operation, which produced 75 807 oz of gold during the quarter, as well as from Ernest Henry, which produced a record 23 378 oz of gold.

Production at the Mt Rawdon operation was adversely impacted by the instability of the western wall in the September quarter, which resulted in gold production decreasing from 24 404 oz in the June quarter, to 19 250 oz.

Meanwhile, gold prices achieved during the quarter increased from A$1 858/oz to A$2 111/oz, prompting Evolution to report a record mine operating cash flow of A$278.7-million, a 30% increase on the previous quarter.

Net mine cash flows for the quarter also reached a record A$207.4-million, up 36% on the June quarter, while group free cash flow increased by 45%, to a record A$158.6-million.

Evolution sold 205 188 oz of gold during the quarter, with 25 000 oz delivered into the hedge book at an average price of A$1 676/oz, while the remaining ounces were sold into the spot market at an average price of A$2 171/oz.

Looking ahead, Evolution has maintained its group production guidance of between 725 000 oz and 775 000 oz for the 2020 financial year, with all-in sustaining costs (AISC) expected to reach between A$940/oz and A$990/oz.

The AISC guidance was A$50/oz higher than previously anticipated, accounting for an increase in royalty payments and lower by-product credits, as well as a revised mine plan at the Mt Rawdon operation, after further pit wall instability in the September quarter. This will require additional waste movement, and will restrict access to higher-grade ore for the remainder of the 2020 financial year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation