Glencore's 2022 cobalt production up, along with oil, nickel, ferrochrome

Glencore CEO Gary Nagle.

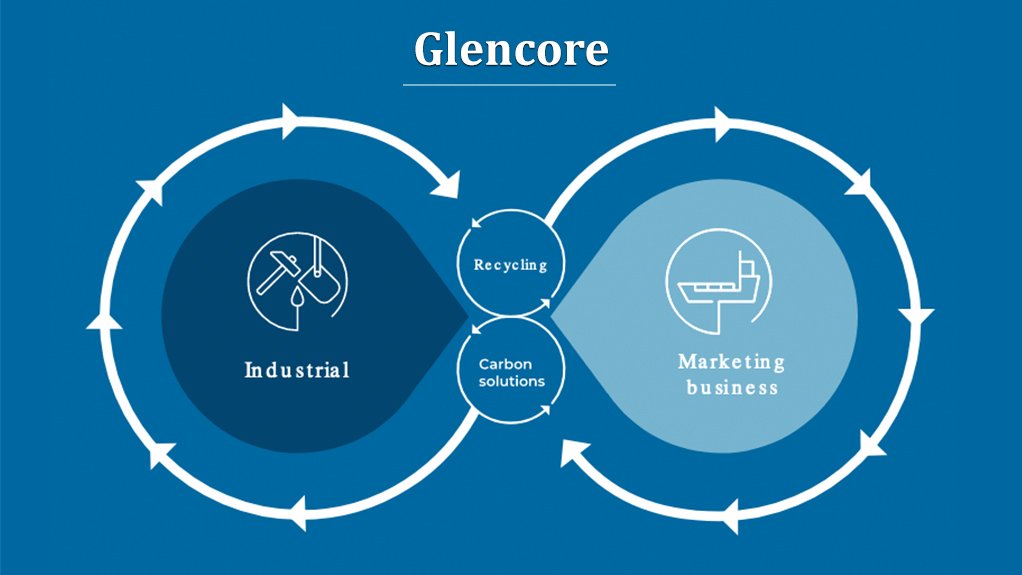

Recycling, carbon solutions emerging features of Glencore's industrial and marketing businesses.

JOHANNESBURG (miningweekly.com) – Mining and marketing company Glencore produced 40% more cobalt last year, along with 16% more oil, 5% more nickel and 1% more ferrochrome.

Although coal production of 110-million tonnes was 6.7-million tonnes higher, on a like-for-like basis, overall group coal production fell by 7%, primarily owing to wet weather challenges and an extended community blockade in Colombia, where Glencore now owns 100% of Cerrejón.

Following the restart of the Mutanda mine in the Democratic Republic of Congo (DRC), the London- and Johannesburg-listed company last year produced 43 800 t of cobalt, 12 500 t more than in 2021.

Entitlement interest oil production of 6.1-million barrels of oil equivalent was 0.9-million barrels higher than 2021 on a full year’s production from the Alen gas project in Equatorial Guinea.

Own sourced nickel output of 107 500 t was 5 200 t higher than 2021 on Koniambo mine in New Caledonia running two production lines for most of 2022 and the absence of a maintenance shut at Australia’s Murrin Murrin, which was partially offset by lower production at INO caused by strike action in Canada and Norway.

Attributable ferrochrome production of 1 488 000 t was 1% up on that of 2021.

Copper production of 1 058 100 t was 12% down on 2021, owing to the sale of Ernest Henry mine in Australia, ongoing geotechnical constraints at Katanga in the DRC, planned mining sequence changes at Collahuasi in Chile, and a lower contribution from Mount Isa in Australia.

Zinc production of 938 500 t was 16% lower on the disposal or cessation of South America operations, closure of Matagami mine in Canada, and lower volumes from Mount Isa as Lady Loretta approaches the end of its mine life.

“Overall, 2022 production volumes were in line with our revised guidance from October 2022, with final quarter sequential production increases delivered across most of our key commodities, including copper, zinc, nickel and coal,” Glencore CEO Gary Nagle stated in a release to Mining Weekly.

“During the year, however, we saw a mixed overall production performance. Copper and zinc volumes reflect the base effect of asset sales, notably Ernest Henry and Bolivia, Katanga’s geotechnical constraints and supply chain headwinds in Kazakhstan.

“Nickel volumes benefitted from operating two lines at Koniambo for the majority of the year, partially offset by Canadian industrial action.

“Overall coal volumes rose during the year with the acquisition, in January 2022, of the balance of Cerrejón that we did not already own, however, on a like-for-like basis, group production actually declined by almost nine-million tonnes (7%), primarily due to abnormally wet weather,” Nagle added.

REALISED COAL PRICING

The average Newcastle coal settlement prices for 2022 was $360/t. After applying a portfolio mix adjustment of $115/t to reflect, for example, movements in the pricing of non-Newcastle quality coals, coking coal margins and the lag effect of 2021’s fixed-price contracts, an average thermal-equivalent realised price of about $245/t can be applied across all coal sales volumes, Glencore stated.

“Realised coal prices were higher than our forecast,” Barclays Equity Research stated in a note.

Fourth-quarter production beat the forecast of Morgan Stanley Research as well as its consensus estimates across coal, copper and zinc by 5% to 8%.

“We expect shares to outperform peers on the back of today's results,” Morgan Stanley added in a note.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation