Fruitful discussion under way on exploration incentivisation – Minerals Council

Minerals Council South Africa’s Junior and Emerging Miners Desk head Grant Mitchell.

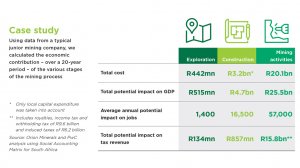

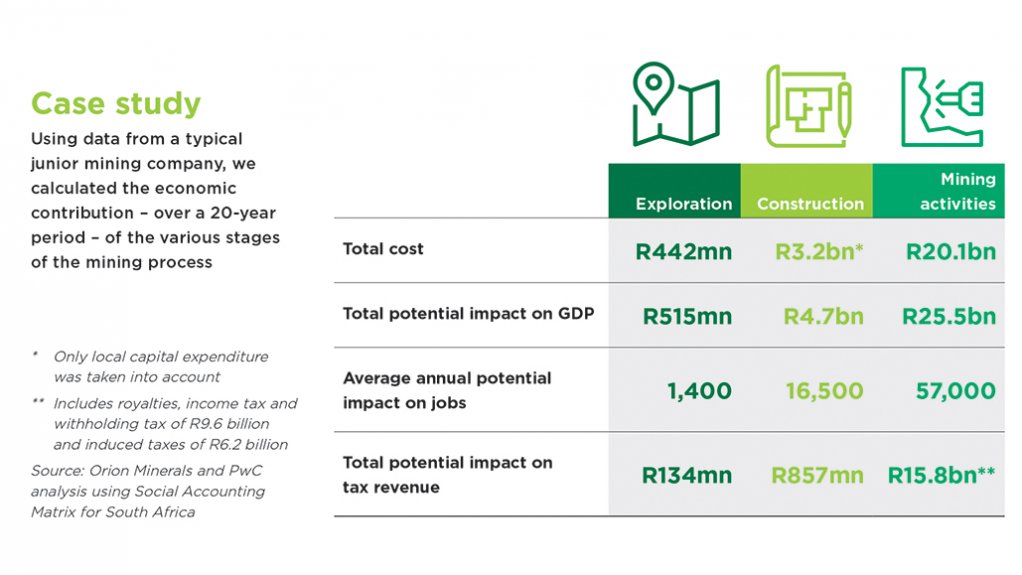

Flow-through leaves National Treasury net positive.

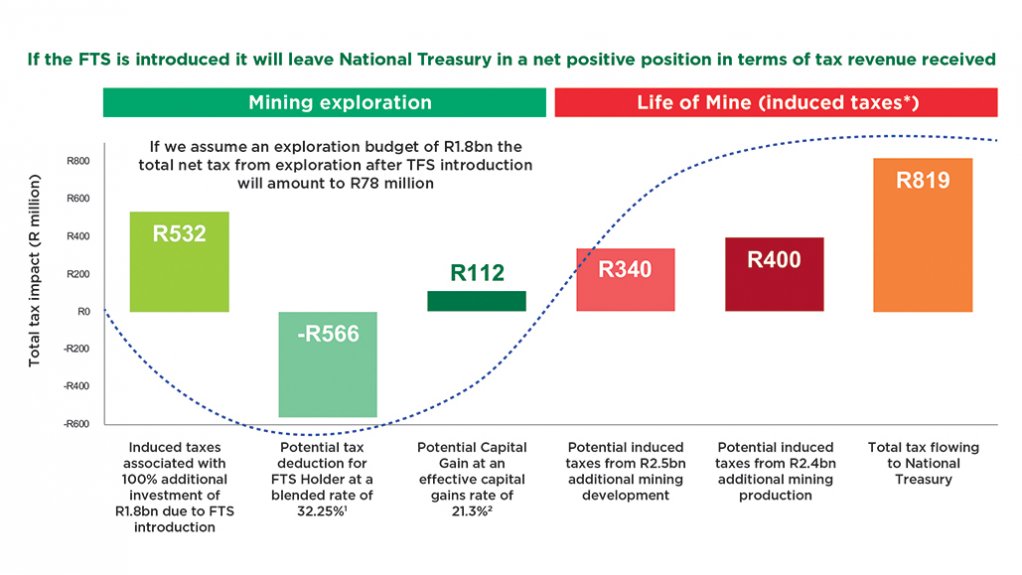

Junior case study.

JOHANNESBURG (miningweekly.com) – Fruitful discussions are taking place on flow-through shares to incentivise junior mining and exploration, Minerals Council South Africa’s Junior and Emerging Miners Desk head Grant Mitchell said on Thursday.

In response to Mining Weekly, Mitchell said the Minerals Council was doing a lot of work to facilitate engagements between the Johannesburg Stock Exchange and its junior, emerging and exploration members and associations.

This follows JSE origination and deals head Samuel Mokorosi telling Mining Weekly on Monday that the JSE is going all out to attract junior mining and exploration companies, making it easier for companies to get on to the exchange and to remain on the exchange, while ensuring that investor protections were of the highest calibre.

Mokorosi is encouraged by the government's one-year review of its exploration strategy and its reference to the flow-through shares concept, the impending cadastral system installation and clarity on triple black economic empowerment to reinvigorate small-cap listings.

Minister of Mineral Resources and Energy Gwede Mantashe has set a target for South Africa to attract 3% to 5% of global exploration dollars. Without an efficient tax incentive system and cadastral in place this will not be possible, the Minerals Council noted in an October 2020 fact sheet. Also, the small end of the JSE currently has very few junior resource companies.

At Wednesday's post-annual general meeting media briefing, outgoing Minerals Council CEO Roger Baxter noted these facts in response to Mining Weekly: “In the Toronto stock market, they’ve got 1 600 listed junior resource companies. On the Sydney stock market, they’ve got about 600, and on the JSE, there are only about 12. Why the difference? Is it because we're unattractive as a mining and listing destination? No, none of those factors.

"The factors are the Canadians have got a set of specific incentives that encourage the flow-through of venture capital funding from people from a tax perspective to invest in junior resource mining and their listing requirements are generally fairly small and they raise capital and they go and find deposits. They become a hub and they become very specialised at doing it. Even more recently announced is a $4-billion extra subsidy that Canada will provide for people looking for critical minerals, as an example,” said Baxter.

Mokorosi, encouraged by the appetite around battery-related minerals and renewable energy inputs, sees South Africa as being well placed at the right time for the green revolution that is sweeping the world.

“It’s giving me some comfort that we're seeing both private sector and government look to taking advantage of these developments,” Mokorosi added.

But South Africa’s fiscal framework still does not have the same incentives around encouraging junior resource companies to set up in South Africa or to look for capital in South Africa.

“The other critical reason to bear in mind is that Canada has a well-established, well-entrenched venture capital mindset, as does Australia. In South Africa, our investment community are generally fairly conservative and favour big mutual funds. People are not going to invest R100 if they are going to lose their cotton socks in doing so, especially if their return rate is in a liquidated company," said Baxter.

“In South Africa, the return on a liquidated company is about 20c in the rand, whereas in a country like Canada, their liquidation and business rescue rules are quite different, so you get a much higher rate of return if you go into a failed company, even if it’s a junior resource company, which is venture capital funded.

“There are two things we need to do. First of all, fix the domestic requirements around what you need to lodge for a junior company exploration permit. It must be much shorter, like 20 to 40 days. It must be on a transparent mineral cadastral system, because these companies have a business model where the CEO, chief geologist and chief bottlewasher are the same person.

“They raise capital using the flow-through shares through the stock exchange that they find the most useful, which is obviously Toronto. They raise $10-million. Their objective is to go and find something, prove it up as quickly as possible, and sell it to a major. That’s how they make their money. That’s their business model and half of global exploration is driven at that level.

“What we need to do in South Africa is just understand how we should compete and that has been part of the conversation we’ve been having with the Department of Mineral Resources and Energy to encourage much more junior resource companies to list.

“For some of the smaller companies, to list on any stock exchange is a very expensive business and the cost-benefit of listing on a stock exchange versus raising private equity capital may be a lot more to do on a stock market, so that’s why many are going the private route, but I think there are lessons we can learn from both Canada and Australia,” said Baxter.

Mitchell pointed out that research conducted by the Minerals Council had assessed the direct positive impact that exploration would have on the South African economy, in terms of contribution to gross domestic product, revenue for the State and jobs created. When a discovery is made which leads to the development of a mining project, this will have a positive impact across the fiscus as well as on job creation.

The JSE has presented to the junior members of the Minerals Council, which has facilitated the communication. The other stimulus is the Junior Mining Accelerator Programme aimed at introducing the smaller companies to financial markets and taking the complexity out of listing on the JSE.

Two small black entrepreneurial exploration companies are on the programme and both have reported that it has really been beneficial. Minerals Council provided the funding to get the small companies up to capacity, particularly black-owned and -managed companies.

“It’s a very exciting development,” said Mitchell.

“I’ve talked about two things for two years – mining cadastre and flow-through shares – and we’re starting to see leverage. The request for proposals put out for the cadastre appears a lot better than the previous one so let’s hope that we get a reputable company to do it, and that will be a very good start, and then the flow-through shares has got to work with it.

“There are people inside government who see the value of the flow-through model and the discussions around flow-through shares are showing encouraging signs,” said Mitchell.

Effort was made to introduce the flow-through share scheme model ten years ago, but it has never quite taken off. A year was spent working on a proposal for South Africa.

Major law companies made available their tax directors and also appointed a team of economists to look at the impact that flow through shares would have on South Africa and also on exploration.

The flow-through promotion document was sharpened into becoming a toolkit which National Treasury could then implement. It’s built into the South African tax laws. No legislation needs to be changed A few minor amendments would enable it to fit the South African tax regime. It’s a Canadian model adapted to South Africa.

It was presented to National Treasury in 2020 and then everything went quiet.

However, at the start of 2022, Treasury put out the message that it was relooking at the flow-through share concept, with the Council for Geoscience also taking an interest.

“It’s looking more positive,” said Mitchell.

Exploration has an immediate socio-economic impact and is important for socio-economic development in South Africa.

Every R1-billion spent on exploration by mining companies potentially contributes about R1.2-billion to gross domestic product through direct, indirect and induced impacts, 3 200 direct, indirect and induced jobs and R0.3-billion is added to total government revenue through direct, indirect tax collection.

THE FLOW THROUGH SHARE MODEL EXPLAINED

The basic idea of the flow-through share model is that the exploration expenditure of the operating company is foregone in favour of the investor. This model can be explained as follows.

The investor concludes a subscription agreement with an operating company for the issue of and the subscription for a share called a flow-through share.

This share provides the investor with all the rights of an ordinary shareholder but also a right to deduct exploration expenditure incurred by the operating company which will reduce its normal tax liability.

The operating company incurs exploration expenditure which qualifies for a deduction from its taxable income and chooses to renounce a portion or the full amount of such expenditure to the holders of the flow-through shares in the year in which such expenditure has been incurred.

The operating company loses its right to deduct such expenditure to the extent that the expenditure has been renounced.

The holders of the flow-through shares then become entitled to deduct their portion of the expenditure renounced by the operating company from their taxable income. This deduction is in aggregate limited to the expenditure incurred by the investor in acquiring the flow-through shares.

SUCCESS IN CANADA

After the Second World War, the Canadian government realised that although it was well resourced in minerals, the sector was not growing as it should, being consistently below its potential. As a result, in 1958 the federal government introduced flow-through shares to encourage investment into the mining sector.

As more countries became attractive destinations for mining foreign direct investment and the competition for capital intensified, Canada scaled up its financial innovation by introducing super flow through shares. The difference between regular and super flow through shares is that the former attracts a 100% deduction write-off for exploration while super flow through shares have an additional 15% federal tax credits for grassroots exploration.

In Canada, regular and super flow through shares have stimulated and financed exploration and development; positioned Canada as a global leader in mining finance and exploration expertise and developing strong capital markets and exploration management expertise unique to Canada, and created new job opportunities.

As a result, from 2000 to 2018, Canada attracted on average US$2-billion a year in exploration expenditure. South Africa in contrast, only attracted US$194-million a year.

Exploration is a high-risk activity. Large mining houses largely engage in brownfield exploration, however, most greenfield exploration is conducted by junior mining companies who rely on venture capital raised in capital markets. Tax incentives are necessary to attract investors into exploration ventures. The Canadians have been highly successful in developing these specialist junior exploration companies largely by using the flow through share tax incentive model to attract equity investors into the sector.

Mining is a significant driver of the South African economy. For example, in 2019 mining contributed 7.8% to gross domestic product, was the largest earner of foreign revenue bringing in R421.7-billion in export earnings, and directly employed 454 921 people. In addition, the knock-on effect of mining into the broader South African economy is substantial, once service providers and suppliers to the industry are taken into account. Anecdotal evidence suggests that for each mineworker employed, ten people are directly dependent on mining activity.

Without a vibrant exploration sector, the life of the South African mining industry will be finite.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation