Dugbe gold project, Liberia – update

Name of the Project

Dugbe gold project.

Location

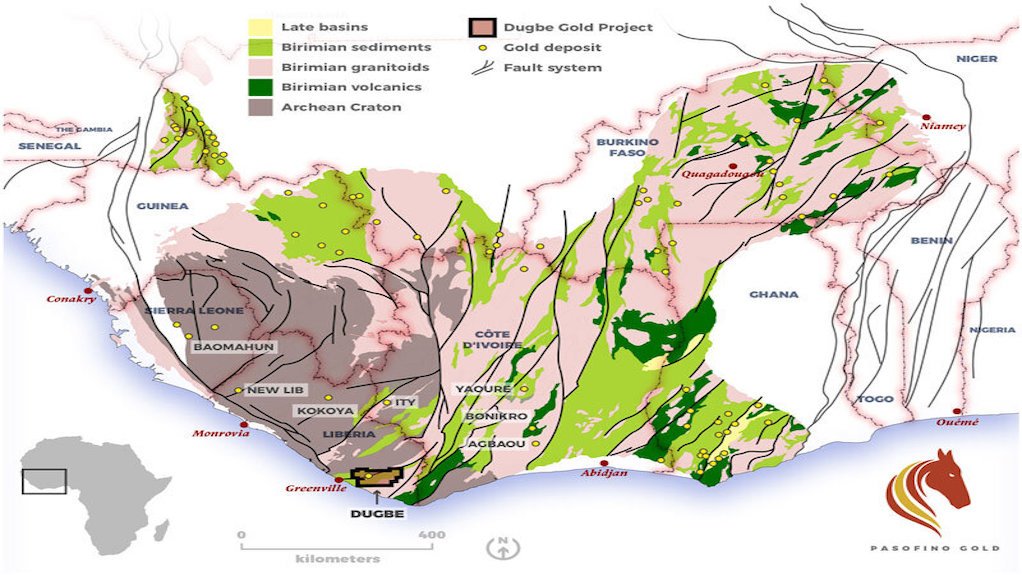

South-eastern Liberia.

Project Owner/s

Hummingbird Resources.

Canadian miner Pasofino Gold has an earn-in agreement for a 49% stake in the Dugbe project, with Hummingbird maintaining a controlling interest of 51%.

Project Description

A preliminary economic assessment (PEA) has established Dugbe as a foundation for a new gold district in Liberia.

The project comprises the Tuzon and Dugbe F deposits, both of which are amenable to openpit mining.

The planned openpits will be mined using conventional truck-and-shovel methods to supply mill feed to the run-of-mine tip, near Tuzon, and waste to the respective pits’ waste stockpile facilities.

The processing plant design has been based on a typical semiautogenous grinding and ball milling circuit, followed by a carbon-in-leach (CIL) gold recovery circuit.

The PEA envisages a five-million-tonne-a-year operation producing an estimated 2.5-million ounces of gold a year over a 14-year mine life.

Steady-state production is estimated at 188 000 oz/y, with peak production of 226 000 oz in Year 8 of operation.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The PEA has estimated a pretax net present value, at a 5% discount rate, of $825-million and an internal rate of return of 34%, at a conservative base gold price of $1 600/oz.

Payback is estimated at 2.8 years (undiscounted).

Capital Expenditure

Initial capital expenditure is estimated at $391-million.

Planned Start/End Date

Not stated.

Latest Developments

Pasofino Gold has released an update for the Dugbe gold project, with a feasibility study scheduled for completion in April.

Feasibility study work has confirmed that gold recoveries of between 85% and 91%, depending on whether a straight CIL with flotation circuit is selected.

Current trade-offs are aimed at the selection of the optimal process to achieve the best financial outcomes.

Open pittable resources include 57-million tonnes of material grading 1.58 g/t with 2.88-million ounces of gold.

Pasofino intends to prioritise the extraction of this higher-grade component of the overall resource to support a higher head-grade during the early years of production.

Favourable results from the on-site geotechnical work should allow for steeper pit slopes to be developed, which, in turn, should translate to lower strip ratios.

Mining dilution has decreased to an average of 8.7%, from 10% in the 2021 PEA.

Energy costs have dropped from $0.212/kWh to $0.172/kWh. This expected benefit is expected to result in lower energy costs per tonne treated.

All other disciplines are well advanced, with the feasibility study more than 70% complete.

The environmental- and social-impact assessment scope has been approved by the Liberian Environmental Protection Agency.

Comprehensive biodiversity fieldwork has identified areas of lower sensitivity, allowing for the location of key project infrastructure, consequently reducing environmental impact. Continuous community engagement has been undertaken throughout the development of the project.

Updated results show continual strong progress towards delivering an economically robust feasibility study as highlighted by the PEA released in June 2021.

Hummingbird has noted that after completion of the feasibility study in April and, subject to meeting certain conditions in the earn-in agreement, Pasofino is on track to earn a 49% interest in the project (prior to the issuance of the government of Liberia's 10% carried interest).

The company has also indicated that Pasofino, once the 49% earn-in is completed, intends to exercise its right under the earn-in agreement to acquire 100% ownership of the project by exchanging Hummingbird's 51% controlling interest in the project for a 51% controlling interest in Pasofino.

This exchange is subject to certain conditions and receipt of all required approvals, including the approval from the TSX-V.

Key Contracts, Suppliers and Consultants

DRA Global (lead consultant); SRK Consulting; and Epoch Resources (PEA).

Contact Details for Project Information

Pasofino Gold, tel +1 416720 2540 or email contact@pasofinogold.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation