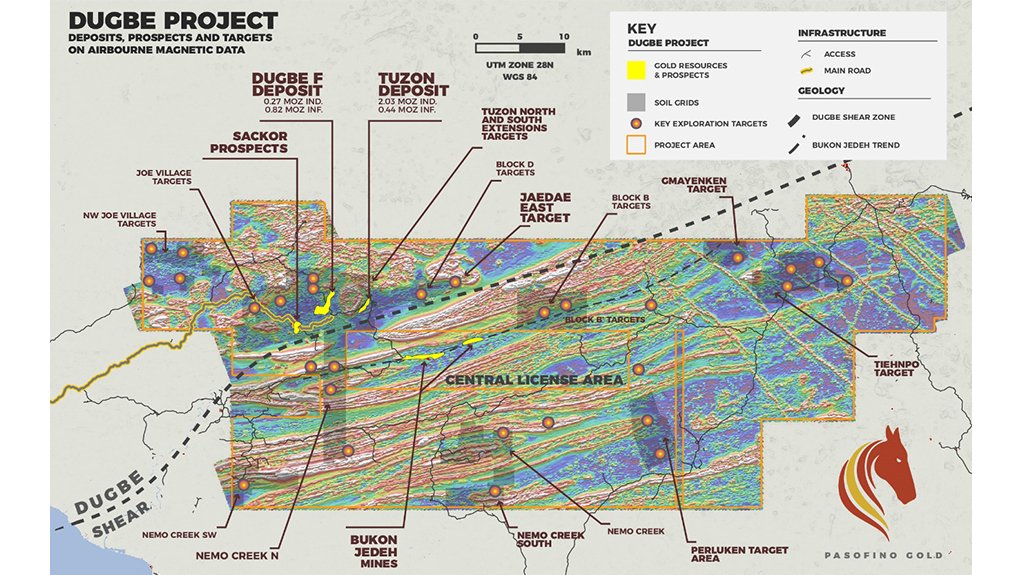

Dugbe gold project, Liberia – update

Name of the Project

Dugbe gold project.

Location

South-eastern Liberia.

Project Owner/s

Hummingbird Resources.

Canadian miner Pasofino Gold has an earn-in agreement for a 49% stake in the Dugbe project, with Hummingbird maintaining a controlling interest of 51%.

Project Description

A preliminary economic assessment (PEA) has established Dugbe as a foundation for a new gold district in Liberia.

The project comprises the Tuzon and Dugbe F deposits, both of which are amenable to openpit mining.

The planned openpits will be mined using conventional truck-and-shovel methods to supply mill feed to the run-of-mine tip, near Tuzon, and waste to the respective pits’ waste stockpile facilities.

The processing plant design has been based on a typical semiautogenous grinding and ball milling circuit, followed by a carbon-in-leach gold recovery circuit.

The PEA envisages a five-million-tonne-a-year operation producing an estimated 2.5-million ounces of gold a year over a 14-year mine life.

Steady-state production is estimated at 188 000 oz/y, with peak production of 226 000 oz in Year 8 of operation.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The PEA has estimated a pretax net present value, at a 5% discount rate, of $825-million and an internal rate of return of 34%, at a conservative base gold price of $1 600/oz.

Payback is estimated at 2.8 years (undiscounted).

Capital Expenditure

Initial capital expenditure is estimated at $391-million.

Planned Start/End Date

Not stated.

Latest Developments

Pasofino Gold has entered into a nonbrokered private share placement to raise $5.5-million, of which about $4.5-million has been subscribed for by Turkish miner Esan.

The funding provides sufficient capital for Pasofino to complete the definitive feasibility study (DFS) on the Dugbe gold project and for he miner to finish its earn-in conditions as per the entities’ joint venture agreement.

The study is on track to be delivered in the second quarter of 2022.

This fundraise follows the mineral resource estimate update announced by Pasofino in November, which confirmed a NI 43-101-compliant measured and indicated gold resources of 3.4-million ounces.

Hummingbird CEO Dan Betts has said that Pasofino’s successful capital raise enables the company to complete the feasibility study work on the Dugbe project.

“We are particularly encouraged by the material uplift in the measured and indicated resources recently announced by Pasofino, which should pave the way for a robust DFS showcasing solid project economics”.

Further, the material investment by Esan will add “significant value” to the project as it gains momentum, he adds.

Key Contracts, Suppliers and Consultants

DRA Global (lead consultant); SRK Consulting; and Epoch Resources (PEA).

Contact Details for Project Information

Pasofino Gold, tel +1 416720 2540 or email contact@pasofinogold.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation