Bowdens Silver project, Australia – update

Photo by Silver Mines Limited

Name of the Project

Bowdens Silver project.

Location

About 26 km east of Mudgee, in the central Tablelands region of New South Wales, in Australia.

Project Owner/s

Silver Mines Limited.

Project Description

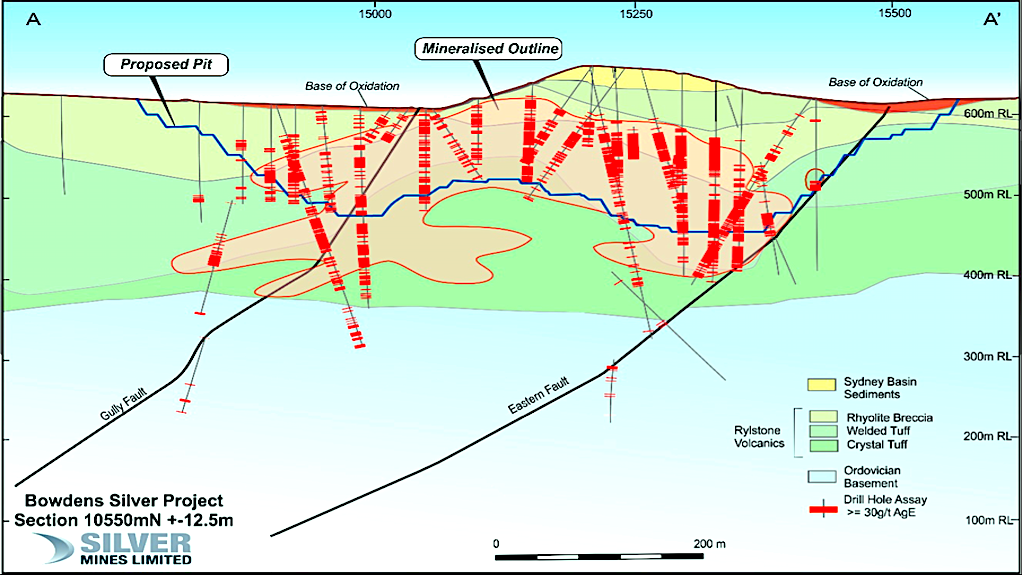

The project is the biggest undeveloped silver deposit in Australia.

The project comprises an opencut mine, developed in six stages feeding a new processing plant comprising conventional semiautogenous grinding mill and ball mill circuit, differential flotation, thickening and dewatering to produce two concentrates that will be sold for smelting and refining to finished metals. Plant capacity is designed for two-million tonnes a year and the open-cut mine has an initial life of 16 years.

The feasibility study has demonstrated that the project will produce an average of 3.4-million ounces of silver a year, together with about 6 900 t/y of zinc and 5 100 t/y of lead.

As a result of higher silver grades in the early stages of mining, average production during the first three years of operation will be about 5.4-million ounces of silver a year and 6 000 t/y of zinc and 5 200 tonnes t/y of lead.

Potential Job Creation

Peak workforce is estimated at 320 personnel during construction and 230 personnel during operations.

Net Present Value/Internal Rate of Return

The project has a net present value of A$143.9-million and an internal rate of return of 20.8%

Capital Expenditure

Initial capital costs are estimated at A$246-million, including mine development, a processing plant, a tailings storage facility and power supply.

Planned Start/End Date

The project is set to start operations in 2023.

Latest Developments

Silver Mines has completed an A$18-million capital raise to progress work at its Bowdens silver project.

The company reported on February 10 that it had completed a share placement to institutional, sophisticated and professional investors, issuing 112.5-million shares at 16c each.

The shares will be issued in two tranches, with the first 112.18-million shares to be placed under the company’s existing placement capacity, while the remaining 312 500 shares will be issued to directors in the company subject to shareholder approval at the company’s next general meeting.

The placement price of 16c a share represented a 19.5% discount to Silver Mines’ five-day volume weighted average share price.

The funds raised will be used to progress the Bowdens silver project, including exploration work at the project and at the company’s other projects, in addition to funding corporate and general working capital expenses.

Silver Mines reported a maiden mineral resource of 42.9-million ounces of silver equivalent at the Bowdens underground project in 2022. The company is

working on a scoping study that will consider potential underground mining scenarios beneath the planned openpit development, which is currently before the New South Wales Department of Planning and Environment.

Key Contracts, Suppliers and Consultants

GR Engineering Services (overall study management, metallurgical testwork analysis, process design, engineering design); AMC Consultants (geotechnical assessment, metallurgical testwork management, ore reserve estimation, mine design and scheduling); ATC Williams (tailings storage facility design); Jacobs Group (Hydrogeological Investigations and Modelling); RW Corkery & Co (environmental- and social-impact assessment); H & S Consultants (resource estimates); Barnson (road and site access); Energy Management Services (power supply); Bill Cunningham & Associates (product marketing and logistics); and Northshore Capital Advisor (financial analysis).

Contact Details for Project Information

Silver Mines Limited, tel+61 2 8316 3997 or email Info@silvermines.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation