Araguaia ferronickel project, Brazil – update

Photo by Horizonte Minerals

Name of the Project

Araguaia ferronickel project.

Location

Pará state, Brazil.

Project Owner/s

Horizonte Minerals.

Project Description

A feasibility study has confirmed Araguaia as a Tier 1 project with a large, high-grade scalable resource, long mine life and low-cost source of ferronickel for the stainless steel industry.

The project has two principal mining centres – Araguaia nickel south (ANS) and Araguaia nickel north (ANN). ANS hosts the Pequizeiro, Baiao, Pequizeiro West, Jacutinga, Vila Oito East, Vila Oito West and Vila Oito deposits, while ANN hosts the Vale do Sonhos deposit.

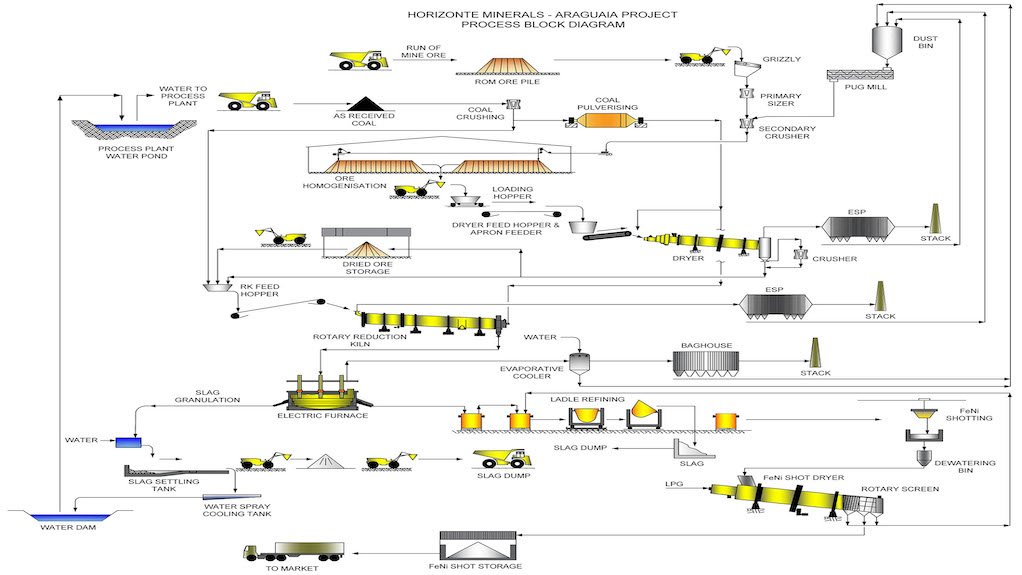

The feasibility study comprises an openpit nickel laterite mining operation that delivers ore from several pits to a central rotary kiln electric furnace (RKEF) metallurgical processing facility.

The metallurgical process comprises a single line (Line 1) RKEF to extract ferronickel from the ore. After an initial ramp-up period, the plant will reach full capacity of about 900 000 t/y of dry ore feed to produce 52 000 t of ferronickel, which in turn, will contain 14 500 t/y of nickel over a 28-year life-of-mine. The ferronickel product will be transported by road to the Port of Vila do Conde, in the north of the state, for sale to overseas customers.

Included in the study is the option for future construction of a second process line (Line 2), which would double Araguaia’s production capacity from 14 500 t/y of nickel up to 29 000 t/y of nickel.

The Stage 2 expansion gives a 26-year mine life.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The Stage 2 expansion generates an estimated net present value of $741-million and an internal rate of return of 23.8%.

Capital Expenditure

The project has an initial capital cost of $443-million.

Planned Start/End Date

The project remains on track to deliver its first nickel in the first quarter of 2024.

Latest Developments

Horizonte Minerals has awarded contracts for the Line 2 feasibility study at its Araguaia nickel project to publish the results of the study in the second half of 2023.

The principal contractors are Snowden, Environment Resources Management, Reta Engineering, Draft Solutions and Afry Poyry.

Horizonte states that these groups are all key contributors to the engineering, costing and construction work under way on Line 1 at Araguaia and have extensive knowledge of the project.

Line 2 will deliver greater production flexibility, lower capital intensity and increased operating margins. As part of the feasibility study, an option will be designed into the flow sheet to allow for a portion of the furnace product from Line 2 to be converted to nickel matte, enabling Araguaia to produce not only high-grade low-impurity ferronickel but also matte that can be upgraded to feed directly into the electric vehicle battery chemistry supply chain.

The Araguaia plant has been designed and optimised to allow for the build-out of Line 2, with key fixed infrastructure sized to support both lines, reducing the overall cost of developing Line 2.

The construction of Araguaia Line 1 remains on budget and on schedule to produce first nickel in the first quarter of 2024.

Key Contracts, Suppliers and Consultants

Ausenco Engineering Canada (process plant design); FLSmidth, Metso Outotec, Uvån Hagfors Teknologi Inteco Melting and Casting Technologies (equipment supply and technical support); and Hatch (furnace contract).

Contact Details for Project Information

Horizonte Minerals, tel +44 203 356 2901.

Tavistock, on behalf of Horizonte Minerals, tel +44 207 920 3150 or email horizonte@tavistock.co.uk.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation