Araguaia ferronickel project, Brazil – update

Name of the Project

Araguaia ferronickel project.

Location

Pará state, Brazil.

Project Owner/s

Horizonte Minerals.

Project Description

A feasibility study has confirmed Araguaia as a Tier 1 project with a large, high-grade scalable resource, long mine life and low-cost source of ferronickel for the stainless steel industry.

The project has two principal mining centres – Araguaia nickel south (ANS) and Araguaia nickel north (ANN). ANS hosts the Pequizeiro, Baiao, Pequizeiro West, Jacutinga, Vila Oito East, Vila Oito West and Vila Oito deposits, while ANN hosts the Vale do Sonhos deposit.

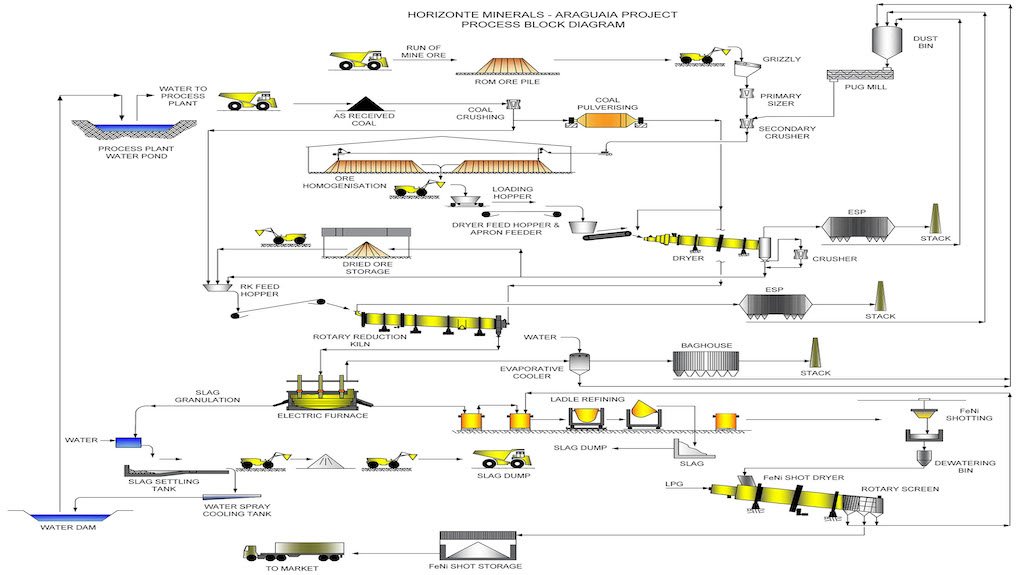

The feasibility study envisages an openpit nickel laterite mining operation that delivers ore from several pits to a central rotary kiln electric furnace (RKEF) metallurgical processing facility.

The deposits will be mined by contractors using conventional openpit truck-and-shovel techniques. No blasting will be necessary. Reverse circulation grade-control drilling will be completed at a 10 m × 10 m spacing, well ahead of mining. This, combined with visual control of the limonite and transition boundary, face sampling, stockpile sampling and ore feed sampling, supports a comprehensive mine-to-mill strategy that is designed to maintain consistent feed to the process plant.

Waste will be stored in external dumps near the pits. Ore will be transported to stockpile hubs near each deposit. Sheeting (using ferricrete extracted from the overburden) will be required to support trafficability in and around the mine during the wet season. Depending on plant demand, ore will be hauled from hub stockpiles or directly from the pits to the run-of-mine (RoM) at the RKEF process facility. Stockpiles on the RoM will be sheeted and classified according to ore type and chemistry for blending.

After an initial ramp-up period, the plant will reach full capacity of about 900 000 t/y of dry ore feed to produce 52 000 t/y of ferronickel containing 14 500 t/y of nickel.

The project has an initial 28-year mine life.

Araguaia’s feasibility study design allows for the future construction of a second RKEF process line, with potential to double Araguaia’s production capacity from 14 500 t/y to 29 000 t/y of nickel.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an estimated post-tax net present value, at an 8% discount rate, of $401-million and internal rate of return of 20.1%.

Capital Expenditure

The project has a capital cost of $443-million, including $65.3-million in contingencies.

Planned Start/End Date

The RKEF plant and project infrastructure will be built over a 31-month period.

The company aims to start production in early 2021.

Latest Developments

Horizonte Minerals has announced a proposed equity and debt funding package of $633-million that will complete the funding required for the construction of the Araguaia project.

The equity component of the package includes a $197-million equity fundraise comprising between $65-million and $75-million from La Mancha and $50-million from Orion in new shares, the placing of $75-million and a cornerstone subscription of $7-million from commodities major Glencore.

As part of their strategic investments, Orion and La Mancha have agreed to subscribe for $50-million and $15-million of convertible notes respectively.

Orion has also proposed that a member of its group provides a $25-million cost overrun debt facility.

Horizonte previously announced that it had signed a commitment letter of $346.2-million of senior debt from a syndicate of international financial institutes. The proposed senior debt facility comprises $146.2-million in the first tranche and $200-million in the second tranche.

The company also intends to raise $8-million through an open offer to holders of existing ordinary shares.

Horizonte has announced a conditional offtake agreement with Glencore, which will acquire 100% of the ferronickel production over ten years.

Key Contracts, Suppliers and Consultants

Ausenco Engineering Canada (process plant design).

Contact Details for Project Information

Horizone Minerals, tel +44 203 356 2901.

Tavistock, on behalf of Horizone Minerals, tel +44 207 920 3150 or email horizonte@tavistock.co.uk.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation