Volcan gold project, Chile

Photo by Hochschild Mine Holdings

Name of the Project

Volcan gold project.

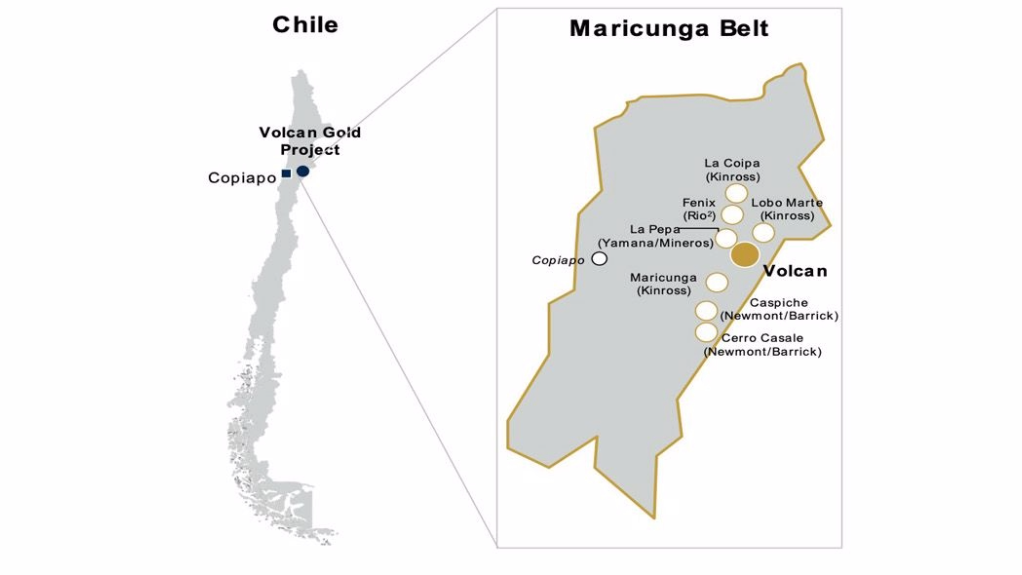

Location

Maricunga region of Chile.

Project Owner/s

Tiernan Gold Corp, a subsidiary of Hochschild Mine Holdings UK.

Project Description

The Volcan project had been dormant for many years until early 2022, when work was started to re-evaluate the project scope and economics in the current gold price environment.

The updated mineral resource estimate and a preliminary economic assessment (PEA) has confirmed that Volcan is a large resource capable of generating significant yearly gold production with substantial margins at current gold prices.

The project has measured and indicated mineral resources of 463.25-million tonnes grading 0.66 g/t gold and inferred resources of 75.02-million tonnes grading 0.52 g/t gold.

The PEA envisages an operation using two independent openpit areas – Dorado Oeste/Central and Dorado Este – each one with a dedicated noneconomic rock storage facility; independent access from both pits to the run-of-mine (RoM)/crushing pad; low-grade stockpiling near the RoM/crushing pad and 20-m-height benches.

The 22-million-tonne-a-year openpit, heap-leach operation will have a 13.6-year mine life. The mine will produce an average of 332 000 oz/y of gold in the first ten years of operations, with 3.8-million ounces produced over the estimated mine life.

The mine includes a processing plant designed to process 60000 t/d, with an average head grade of 0.63 g/t of gold.

The processing plant includes the primary crushing of RoM; an overland conveyor system to transport coarse material; coarse material stockpile; secondary crushing and screening in closed circuit; tertiary crushing; agglomeration and heap stacking; heap-leach pad and ponds; a sulphidisation, acidification, recycling and thickening plant; adsorption, desorption and recovery using carbon-in-column, desorption and regeneration; and a refinery.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at a 5% discount rate, of $826-million and internal rate of return of 21% at a $1 800/oz gold price.

Capital Cost

$900-million.

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

Ausenco Chile (PEA); Deswik Brazil (mine pit design, mine production schedule, and mine capital and operating costs); Micon International (work related to geological setting, deposit type, exploration work, drilling, exploration works, sample preparation and analysis, data verification and development of the mineral resource estimate for the project); and Gestión Ambiental Consultores (review of the environmental studies of the project).

Contact Details for Project Information

Hochschild Mine Holdings UK, tel +44203709 3260 or email info@hocplc.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation