Photo by: Hochschild Mine Holdings

Name of the Project

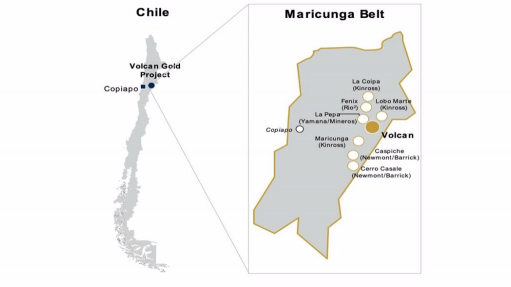

Volcan gold project.

Location

Maricunga region of Chile.

Project Owner/s

Tiernan Gold Corp, a subsidiary of Hochschild Mine Holdings UK.

Project Description

The Volcan project had been dormant for many years until early 2022, when work was started to re-evaluate the project scope and economics in the current gold price environment.

The updated mineral resource estimate and a preliminary economic assessment (PEA) has confirmed that Volcan is a large resource capable of generating significant yearly gold production with substantial margins at current gold prices.

The project has measured and indicated mineral resources of 463.25-million tonnes grading 0.66 g/t gold and inferred resources of 75.02-million tonnes grading 0.52 g/t gold.

The PEA envisages an operation using two independent openpit areas – Dorado Oeste/Central and Dorado Este – each one with a dedicated noneconomic rock storage facility; independent access from both pits to the run-of-mine (RoM)/crushing pad; low-grade stockpiling near the RoM/crushing pad and 20-m-height benches.

The 22-million-tonne-a-year openpit, heap-leach operation will have a 13.6-year mine life. The mine will produce an average of 332 000 oz/y of gold in the first ten years of operations, with 3.8-million ounces produced over the estimated mine life.

The mine includes a processing plant designed to process 60000 t/d, with an average head grade of 0.63 g/t of gold.

The processing plant includes the primary crushing of RoM; an overland conveyor system to transport coarse material; coarse material stockpile; secondary crushing and screening in closed circuit; tertiary crushing; agglomeration and heap stacking; heap-leach pad and ponds; a sulphidisation, acidification, recycling and thickening plant; adsorption, desorption and recovery using carbon-in-column, desorption and regeneration; and a refinery.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at a 5% discount rate, of $826-million and internal rate of return of 21% at a $1 800/oz gold price.

Capital Cost

$900-million.

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

Ausenco Chile (PEA); Deswik Brazil (mine pit design, mine production schedule, and mine capital and operating costs); Micon International (work related to geological setting, deposit type, exploration work, drilling, exploration works, sample preparation and analysis, data verification and development of the mineral resource estimate for the project); and Gestión Ambiental Consultores (review of the environmental studies of the project).

Contact Details for Project Information

Hochschild Mine Holdings UK, tel +44203709 3260 or email info@hocplc.com.