Waterberg platinum group metals project, South Africa – update

Photo by Platinum Group Metals

Name of the Project

Waterberg platinum group metals (PGMs) project.

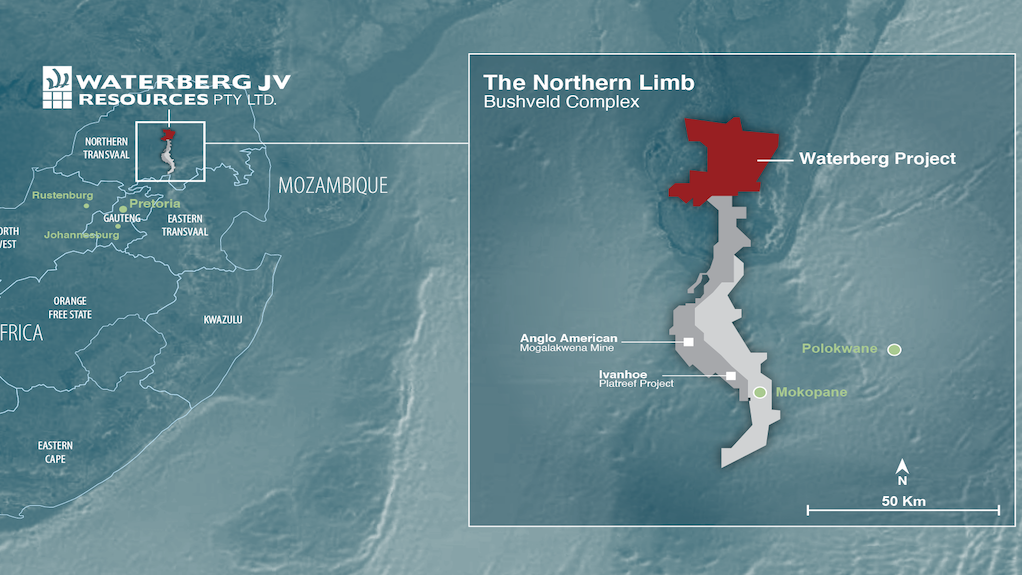

Location

About 85 km north of Mokopane, in Limpopo, South Africa.

Project Owner/s

Waterberg Joint Venture (JV) Resources, or Waterberg JV Co, a JV between Platinum Group Metals, or PTM (37.05%); Impala Platinum Holdings, or Implats (15%); Japan Oil, Gas and Metals National Corporation, or Jogmec (12.195%); Hanwa Co (9.755%); and black economic-empowerment partner Mnombo Wethu Consultants (26%). As a result of PTM's 49.90% ownership in Mnombo, the company has an effective interest in the Waterberg JV of 50.02%.

Project Description

The 2019 definitive feasibility study (DFS) mine plan envisages production of 4.8-million tonnes of ore a year and 420 000 platinum, palladium, rhodium and gold ounces a year in concentrate.

The mine will initially access the orebody using two sets of twin decline tunnels, with fully mechanised longhole stoping methods and paste backfill used for mining. Paste backfill allows for a high mining extraction ratio, as mining can be completed next to backfilled stopes without leaving internal pillars.

Maintaining safety and reliability are key mine design criteria. As a result of the scale of the orebody, bulk mining on 20 m to 40 m sublevels using large underground equipment, and conveyors for ore and waste transport, will provide high efficiency.

Potential Job Creation

The project will create about 1 100 new highly skilled jobs.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $982-million and an internal rate of return of 20.7%. This is based on the 2019 DFS prices of palladium – $1 546, platinum – $980, gold – $1 548 and rhodium – $5 036 ($/R:15).

Capital Expenditure

Capital expenditure is estimated at $874-million, including $87-million in contingencies. Peak project funding is estimated at $617-million, based on 2019 commodity prices and costs.

Latest Developments

PTM has reiterated its focus on advancing the Waterberg project.

The company's near-term objectives include the advancement of the Waterberg project to a development and construction decision, including the arrangement of construction financing and concentrate offtake agreements.

Before project financing and a construction decision can be undertaken, project concentrate offtake or processing will need to be made.

On October 18 last year, the Waterberg JV approved, in principle, the preconstruction work programme of about $21-million over a 23-month period ending on August 31, 2024.

The work programme is focussed on project infrastructure, including initial road access, water supply, essential site facilities, a first phase accommodation lodge, a site construction power supply from State-owned power utility Eskom and advancement of the Waterberg social and labour plan.

An update to the 2019 Waterberg definitive feasibility study (DFS) is also planned, including a review of cutoff grades, mining methods, infrastructure plans, scheduling, concentrate offtake, dry stack tailings, costing and other potential revisions to the project's financial model.

From the work programme, an initial budget of about $2.5-million has been approved for expenditure. The initial budget includes 32 infill boreholes and several geotechnical holes.

Meanwhile, the Stage 2 budget for $3.6-million has been approved for expenditure. The budget includes DFS update engineering, preconstruction engineering and electrical power supply engineering, as well as the permitting and licensing of construction aggregate borrow pits identified near the Waterberg mine site.

PTM says the initial budget and the Stage 2 budget are being funded pro rata by the JV partners. Subsequent expenditures in accordance with the work programme are subject to expected approvals for the next sequential time period, beginning on September 1.

The company continues to work closely with regional and local communities and their leadership on mine development plans to achieve optimal outcomes and value for stakeholders.

The company has also said that it is considering commercial alternatives for mine development, financing and concentrate offtake.

Obtaining reasonable terms for Waterberg concentrate offtake from an existing smelter or refiner in South Africa is considered the preferred option and discussions with such parties are ongoing, PTM says.

As an alternative to a traditional concentrate offtake arrangement, the company is assessing the economic feasibility of building a matte furnace and base metals refinery, either with or without partners, to process Waterberg concentrate.

A previous DFS technical report for the Waterberg project in 2019 stated that additional smelting capacity may need to be built in the industry to treat the flotation concentrate from Waterberg and the other potential Platreef miners.

A matte furnace and base metals refinery, therefore, is envisioned by PTM as a separate business from the Waterberg JV, which could provide fair market concentrate offtake terms for the Waterberg JV and, possibly, other PGM miners.

Discussions with potential participating partners and investors are ongoing.

Key Contracts, Suppliers and Consultants

Stantec Consulting International and DRA Projects SA (DFS).

Contact Details for Project Information

PTM, tel +27 11782 2186 or email info@platinumgroupmetals.net.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation