Teck slashes guidance, Covid delays Chile expansion by up to 6 months

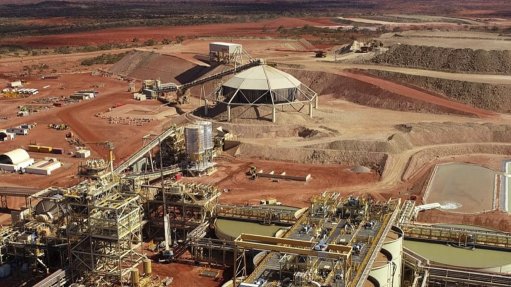

Canadian diversified miner Teck Resources said on Thursday that all its mines across Canada, Peru, Chile and the US, were producing and that it was gradually ramping up construction activities at the previously-suspended Quebrada Blanca Phase 2 (QB2) expansion project.

However, the company cautioned that Covid-19 had had a significant negative impact on prices and demand for its products and that its production for the year would be significantly lower than initially thought.

The coking coal and base metals miner has reinstated its previously suspended 2020 guidance, but with lower ranges. In the updated guidance, Teck will produce only half the steelmaking coal that it previously forecast.

Its coking coal guidance for the year is between 21-million and 22-million tonnes, compared with the initial forecast of 23-million to 25-million tonnes.

The miner is also forecasting between 145 000 t and 160 000 t of copper, between 315 000 t and 345 000 t of zinc for at least 155 000 t of refined zinc and between 3.4-million and 4.4-million barrels of bitumen. Its initial guidance was between 285 000 t and 300 000 t of copper, between 600 000 t and 640 000 t of zinc, for at least 305 000 t of refined zinc, and between 12-million and 14-million barrels of bitumen.

At the QB2 project, activities were gradually ramping up, with more than 3 000 people on site. As conditions allow, the company will have 4 000 people on site by the end of July and 8 000 by the end of October.

Teck had suspended construction activities at QB2 starting in March to help limit the transmission of Covid-19. The field workforce was reduced to 500 people in March, following demobilisation activities and it has since been gradually increased again to more than 3 000 people focused on critical path activities and other construction works.

The company noted that it spent $260-million in costs associated with Covid-19 in the quarter under review, of which $75-million were borrowing costs that would otherwise have been capitalised, had the construction of QB2 not been suspended.

“We expect to continue to expense some costs associated with the project suspension during the third quarter, as well as interest that would otherwise have been capitalised. Assuming a staged ramp-up proceeds through the third quarter as planned, the aggregate estimated impact from the suspension – including expensed costs – is anticipated to be between $260-million and $290-million, with a schedule delay of between five and six months.”

Further, Teck expected to construct more camp space at an incremental cost of between $25-million and $40-million, which would not have been required at QB2 if the pandemic was absent.

The company in the second quarter completed the Elkview Operations plant expansion, in British Columbia, while the Neptune Bulk Terminals upgrade project, in Vancouver, was progressing on time and within budget.

The company’s steelmaking coal business sold 5-million tonnes in the quarter, which was higher than originally expected despite steelmakers cutting production quicker, in response to Covid-19, than during the global financial crisis in 2008/9.

This while Chinese steel production returned to pre-pandemic levels during the quarter and established new average daily record highs in May and June.

Meanwhile, the Elkview Operations plant expansion increased its yearly capacity to 9-million tonnes, from 7-million tonnes previously. The Elkview Operations plant now replaces the Cardinal River Operations, which had higher production cost and produced lower quality steelmaking coal.

Taking into account the lower costs and higher average price for Elkview products and assuming a $150/t coal price and a $1.38 CAD:US dollar exchange rate, shifting production to an expanded Elkview Operations translates to an increase of about $160-million in annualised earnings before interest, taxes, depreciation and amortisation (Ebitda).

Teck reported adjusted profit attributable to shareholders of $89-million, or $0.17 apiece, in the quarter under review, while its adjusted Ebitda was $485-million.

This compared to $608-million adjusted Ebitda reported in the first quarter of the year, while adjusted Ebitda was $1.4-billion in the first quarter of 2018. Adjusted profit attributable to shareholders was $94-million in the first quarter of this year, compared with $587-million in the first quarter of 2018.

Steelmaking coal adjusted site cost of sales increased in the second quarter to $68/t with reduced production owing to Covid-19. Adjusted site cost of sales is expected to decrease over the remainder of 2020 and it expects to end the year below $60/t.

This expectation is owing to the company planning a declining strip ratio, the closure of its Cardinal River Operations, the Elkview expansion and benefits of its cost reduction programmes.

Since the launch of the company’s cost reduction programme during the fourth quarter of last year, it has realised about $250-million in operating cost reductions and $430-million in capital cost reductions.

Teck expects to sell between 5-million and 5.4-million tonnes of steelmaking coal in the third quarter and between 160 000 t and 180 000 t of Red Dog zinc in concentrate.

Further, the company advised that the Neptune Bulk Terminal upgrade project would secure a long-term, low-cost and reliable supply chain solution for the company’s steelmaking coal business unit. This project continued to advance during the second quarter, with major equipment deliveries on track.

Completion of this project is expected in the first quarter of next year.

Teck assured stakeholders in a results release that it had a strong financial position to weather more effects of the Covid-19 pandemic, with $3.8-billion available on its revolving credit facility, up to the end of 2024.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation