Sedibelo’s green platinum resolve firmed up by first-of-a-kind ESG appointment

Arne Frandsen interviewed by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

JOHANNESBURG (miningweekly.com) – In a mining investment world increasingly dominated by environmental social and governance (ESG) demands, the resolve of Sedibelo Platinum Mines to be a green platinum group metals producer has been firmed up by the timely first-of-a-kind appointment of a chief ESG officer.

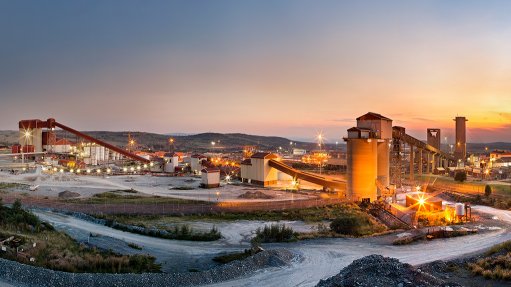

As chief ESG officer, Lael Bethlehem has been assigned to to lift ESG to the next level at Sedibelo’s Pilanesberg Platinum Mines in South Africa’s North West.

Bethlehem’s appointment comes atop the revolutionary Kell technology already setting a high green mining bar and gives her direct responsibility for Sedibelo’s green energy drive and the decarbonisation of operations.

Already, Kell will see to these operations using only a fifth of the electricity normally associated with the smelting of platinum group metals (PGMs) – plus eliminate the emission of noxious gases associated with conventional pyrometallurgical production.

Moreover, tests already undertaken indicate that complete independence from the coal-based national electricity grid is potentially attainable if hydrogen-based power generation solutions are combined with solar power, where a big push is expected under Bethlehem at the Pilanesberg Platinum Mines, which have a resource of 90-million platinum, palladium, rhodium and gold (4E PGM) ounces.

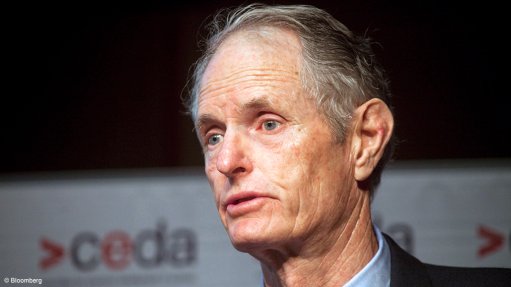

Pallinghurst Co-CEO and Sedibelo chairperson Arne Frandsen, who spoke to Mining Weekly in a Zoom interview, emphasised the intensifying need for green credentials, coupled to Sedibelo’s own strong belief that going green across the entire value chain is the right thing to do in a world fighting an all-important battle against climate change. (Also watch attached Creamer Media video.)

Frandsen views producing PGMs in an emission-free manner as the ideal way to underpin the role that PGMs play in fuel cells, hydrogen and a world obliged to go green. He regards delivery of green ounces as being crucial.

Kell is poised to assist enormously in all of this as it provides Sedibelo with on-site control of each and every link of the production chain, all the way through to the refined finished product.

The date when net-zero ounces emerge from Pilanesberg Platinum Mines is poised to be way ahead of the low-carbon achievements other mining companies are targeting.

Against the background of the latest chief ESG officer appointment, Frandsen was asked to elaborate on the full potential benefit that this title will bring with it.

“It’s part of the new world. ESG is not only a nice to have any longer. It is something that we have always adhered to at Pallinghurst, and our investment companies, but instead of it being on page 40 in the annual report, this is now page 1 stuff.

“This is the key thing because when people put money to work, they want to make sure that it is put to work with someone that is actually operating in a way that you would want your money to operate within. ESG is absolutely critical. We came up with the title and Lael Bethlehem is the world’s first chief ESG officer,” he said.

Mining Weekly: How high is your new chief ESG officer expected to lift the bar at Sedibelo’s Pilanesberg Platinum Mines?

Frandsen: She is reporting only on ESG and renewable and sustainable matters. She thinks of nothing else. It is about making that available and making sure that we adhere to that. She is sitting at the adults table at the head of the table and what she is preaching is the thing that we as a team will adhere to.

Mining Weekly: What are the chances of becoming completely independent of the national electricity grid?

Frandsen: You’ve hit it as a matador again. That is the single largest objection. Not that we don’t have a good relationship with Eskom. We have a very good relationship with them, and it has been so for more than ten years, but I think that if you are a big user of electricity, that you do what you can do, to ensure that you don’t tap more from the net. There is a lot of usage from other people, and I’ve said to my team that this is one of the key parameters that I will measure success on – if we can have a zero-carbon footprint mine that is delivering material, and is not dependent on Eskom burning coal; if we can actually produce an ounce of green platinum. Where through the Kell process and through renewable energy push, we can deliver that to the end user without carbon footprint.

Mining Weekly: Do you think green platinum group metals have a chance of ever attracting a price premium?

Frandsen: In my world, absolutely, it should have a premium. In the real world, I kind of believe it’s going to be buffet, and that this is going to be the plate that is going to be emptied first. So, if you have your green platinum, I’m sure that you are going to get blue chip customers that really like it because its green. Maybe, we can then enter into long-term offtake agreements that are more favourable to us than otherwise. But sometimes it is also about doing the right thing. This is in my mind doing the right thing and if we want to give fuel cells and green hydrogen a chance of being in the race for the decarbonisation of the Western and Eastern world, then I think it is absolutely crucial that what we can deliver is a green ounce of metal, because if it’s dirty platinum, it kind of defies the purpose in trying to decarbonise the world, if you use a lot of carbon in producing it.

Mining Weekly: What is the green advantage, if I can put it that way, of being able to control the entire value chain, from mining to refined metal, and the end product?

Frandsen: It’s nothing different to being one of the fine wine makers from the Western Cape. You control your vineyard, you control your cellar, you control your selling of the final bottle. If you’re buying a lovely bottle of fine red wine from the Western Cape, you know exactly where the grapes are from. You know how they have been maintained, and that the vines have been pruned. You have that entire story, and that is important when you and I go and buy our premium bottle of wine. It’s going to be the same with the materials. It’s just a question of time. When we are going to sell to a Tesla or a Volkswagen or a Toyota, who would want to buy our PGM ounces, they will come and they will not only look at the platinum we are producing, because that’s a generic product, but they will want to know where it is mined, what is the safety in the mine, what is the carbon footprint of that. They want us to be able to show them that entire chain, and that blockchain of being able to demonstrate that we're in control of each link of that chain, and that is what we are able to do at Sedibelo, and that’s what really excites me.

Mining Weekly: Will your main focus be on platinum, palladium and rhodium, are those the big three, or do you intend to go much further?

Frandsen: I think we can go much further. Whatever we’re going to produce out of our mine of PGMs and gold, we can produce that with that kind of stamp on it, and nowadays the auditors of such statements are becoming much more stringent and something that you can rely on. We’re already talking to people who can certify that this is how we can produce our ounces. If you think about it, it’s not only that we can get off the grid and not only that no carbon would have been used to produce our PGM ounces, but it’s actually that we can bring all of that in and further the decarbonisation of the world, and that is very important. That gives, in my mind, fuel cells an extra boost, because if you can deliver that out of South Africa, we again are making sure that we become relevant in the discussion going forward about decarbonisation.

Mining Weekly: What about training? Are people going to be able to cope with this new way of doing things and the new technology?

Frandsen: We are blessed with a lot of very skilled workers in South Africa and we have some of the finest universities that are producing very smart individuals. When I go out to the Sedibelo mine and I look at our 1 600 employees, I’m very proud. These are very well educated, forward looking youngsters and some of the old guard are also looking at doing the right thing. To take that experience, because we have mining experience in South Africa, and we should be very proud of that – but take those decades of experience and let the new ideas spring from that knowledge base. That’s very important and as we see how the transferring of knowledge is taking place and new ideas are fermenting in South Africa, I’m very excited about the future.

Mining Weekly: People are talking in terms of becoming zero-carbon by 2050. What target is Sedibelo setting? It seems that net zero could be achieved at Pilanesberg Platinum Mines far sooner than the 2050?

Frandsen: I would want to achieve net zero far faster that. I will refrain from telling you what my target is to my management team. If you take the zero away from the fifty, then you get more to a realistic amount of time. I want to do it in five years.

Mining Weekly: When are we likely to see that first green platinum ounce being produced?

Frandsen: We’ll build the Kell plant. Lael is very busy on formulating our renewable energy strategy. To no surprise, solar is going to play a very big role in that. Solar is something we have a lot of experience with in South Africa. Lael has herself been involved in Upington with some of those very big projects that have been built up there. You have heard from many of our fellow miners that their commitment to solar is big as well. But we also have some other ideas to complement the solar. But it is important to point out that it’s easy to sit down and blame Eskom because that’s an easy target. But I kind of feel that we all have a responsibility to ask what can we do to change this? Maybe the answer is that we shouldn’t tap into the grid if we can avoid it. Maybe we should find an alternative source of electricity and we are now allowed to do that in South Africa, and I think that the commitment that we have at Sedibelo to take renewables absolutely seriously with Lael’s appointment, should be a sign that we are willing to do our part, too.

Mining Weekly: Have you got land available for solar?

Frandsen: Yes, we can build the solar power plant next to the mine, absolutely.

INDUSTRIAL DEVELOPMENT CORPORATION

Sedibelo shares an interest in Kell with South Africa’s State-owned Industrial Development Corporation (IDC) and Kell technology developer Keith Liddell, whose company Lifezone has the exclusive rights to exploit the patents and technology. The IDC is also a 15.7% shareholder in Sedibelo.

Regarding the Triple Crown expansion project in the Pilanesberg Platinum Mines, initial ground breaking is planned in the first quarter of next year.

Triple Crown involves expanding operations at Pilanesberg Platinum Mines into contiguous deposits of Sedibelo Central, Magazynskraal and Kruidfontein – known as the Triple Crown properties.

Triple Crown is expected to deliver lower-cost product and has an estimated resource base of more than 60-million 4E PGM ounces.

The existing concentrator plant at Pilanesberg Platinum Mines has the capacity to process the Triple Crown ore as well as ore from the mine’s existing opencast operations. With minimal reconfiguration, Triple Crown upper group two (UG2) and Merensky ore will be blended and processed through the existing Merensky plant, thereby reducing capital expenditure as well as significantly lowering operating cost.

While the UG2 orebody has a chrome content that toll treaters tend to penalise, Kell finds chrome no problem and takes it in its stride.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation