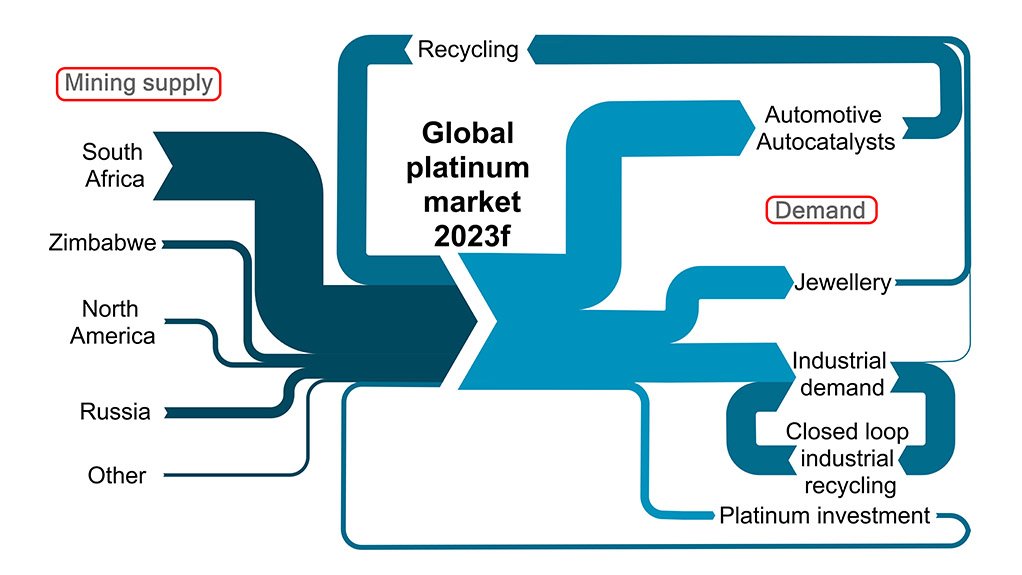

Platinum demand expected to grow

GLOBAL PLATINUM MARKET Platinum mining supply and demand schematic

Photo by WPIC Platinum Quarterly Q3 2022, Metals Focus

EDWARD STERCK Platinum is expected to benefit from the growth of a new end-use segment as the hydrogen economy takes off in response to the energy transition

With a global emphasis on renewable energy, platinum-group metals (PGMs) – particularly platinum – are expected to benefit from the growth of a new end-use segment, says global platinum market authority World Platinum Investment Council (WPIC) research director Edward Sterck.

This segment refers to platinum-based proton exchange membrane (PEM) technologies that enable the production and deployment of hydrogen for the energy transition.

“While hydrogen-related demand for platinum is relatively small in 2022 and 2023, hydrogen-related demand for platinum is expected to grow substantially through the rest of the decade and beyond, reaching as much as 35% of total yearly platinum demand by 2040,” says Sterck.

He also expects growth in demand for iridium and ruthenium – used with platinum in electrolysers and fuel cells respectively – owing to green hydrogen’s role in decarbonisation.

PGM scarcity is unlikely to constrain growth in platinum-related green hydrogen applications, owing to technical developments that have improved metal efficiencies, Sterck assures.

For example, a breakthrough in 2020 provided a platinum and iridium-based hydrogen electrolyser catalyst using up to 90% less iridium, while improving performance threefold.

It is also probable that, as hydrogen-related platinum demand increases, platinum and other PGMs will be recovered and reused, as is currently the case with industrial applications, with recycled metal supplementing primary mined supply.

“For platinum, it is also possible that, depending on overall PGM market dynamics and price differentials, increasing platinum deficits could, in the long run, result in a reversal of the current trend of platinum-for-palladium substitution in internal combustion engine (ICE) vehicles, liberating platinum for use in the hydrogen economy,” he explains.

Platinum Demand

A platinum deficit of 303 000 oz is forecast this year, and WPIC research estimates that this could herald a period of sustained deficits, with a deficit of 81 000 oz in 2024 deepening in 2025 and continuing to grow towards one-million ounces by 2027.

The swing to a deficit follows two years of significant surpluses, although Sterck points out that since the start of 2021, platinum imports into China have exceeded the country’s identified demand by considerable amounts, demand that is not captured by published supply and demand data.

“These excess imports are now largely geographically captive within China due to export controls, and therefore unavailable to meet any metal shortfalls outside of China, effectively absorbing much of the published level of above ground stocks. This has contributed to the platinum market tightness seen over the last year or so, and, in combination with the 2023 forecast deficit, this could materially impact price discovery,” he explains.

Meanwhile, platinum supply remains constrained and below 2019 pre-pandemic levels.

While producer margins have benefited from sustained high palladium and rhodium prices since 2019, operational disruption caused by the Covid-19 pandemic led to some delays to capacity capital spending, which further compounded the historically low levels of capital expenditure which were already in place pre-pandemic.

Long project development lead times also prevent short-term or deficit-related supply responses.

Recently, platinum mining supply has also experienced operational challenges, which Sterck expects to continue throughout 2023, owing in-part to energy supply constraints in South Africa. These might continue to negatively impact refined metal output, thereby limiting refined supply and providing additional upward support to the platinum price.

He adds that higher platinum prices could, in turn, reduce the volume of excess platinum purchases into China which may consequently dampen potential price appreciation.

Platinum Outlook

Sterck says the 303 000 oz deficit forecast for 2023 is primarily driven by both demand growth in the automotive sector, caused by an increase in platinum-for-palladium substitution and higher loadings, and already-committed industrial capacity additions.

“The forecast also anticipates a significant reversal from negative to positive investment demand, led by platinum bar and coin demand, with outflows from exchange traded funds still continuing, albeit at a greatly reduced rate. Growth in these areas will offset the continuing weakness of platinum jewellery demand.”

Based on the latest emission standards, which increase platinum loadings per vehicle, together with increased platinum-for-palladium substitution in gasoline-powered vehicles, the WPIC expects ICE-related automotive demand for platinum to peak in 2028 at 3.8-million ounces, compared to the forecast 3.3-million ounces in 2023.

He notes that fuel cell electric vehicles (FCEVs) are forecast to drive long-term demand growth for platinum, especially as the demand for ICE vehicles reduces in the longer term.

Supportive hydrogen policies could result in FCEV demand for platinum equalling current automotive demand by 2039, while Sterck says broad-based commercial adoption of FCEVs could bring this forward to 2033, adding three-million ounces to yearly automotive platinum demand in 11 years.

“A focus for us is to develop the market’s understanding of the importance of platinum-facilitated green hydrogen to the energy transition and the positive impact this could have on platinum demand. We estimate that green hydrogen could account for up to 11% of the carbon emission reductions needed to limit global warming to 2°C as set out in the Paris Agreement,” he concludes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation