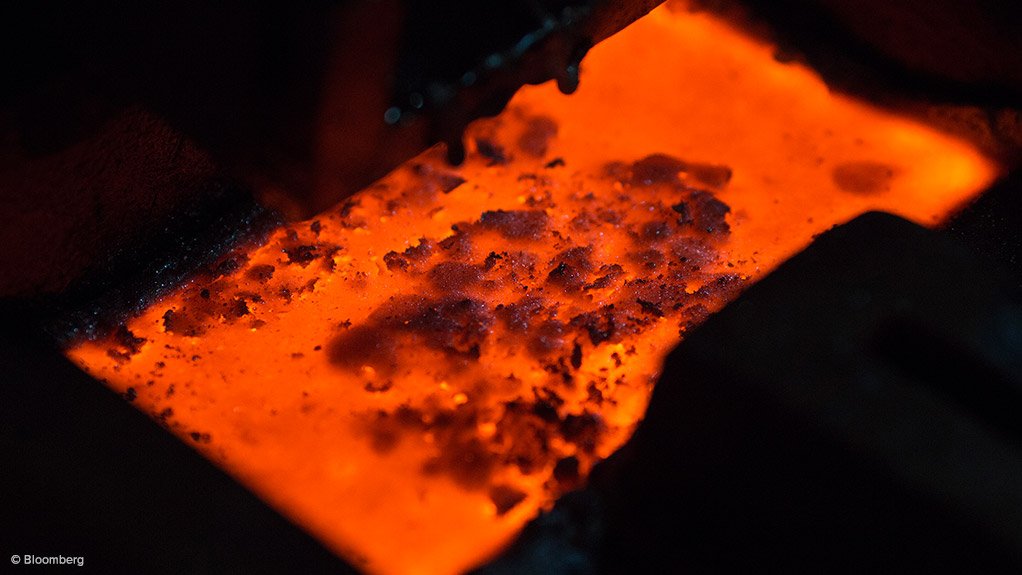

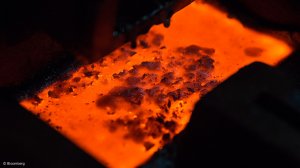

Newcrest approves first stage of Cadia expansion

PERTH (miningweekly.com) – The board of gold miner Newcrest Mining has approved a A$685-million investment for Stage 1 of the Cadia expansion project, in New South Wales.

The Stage 1 expansion includes the start of the next cave development and increasing the process plant nameplate capacity from the current 30-million tonnes a year to 33-million tonnes a year.

Newcrest on Tuesday said that mining from the new cave development is expected to start in 2023.

Total capital expenditure for the new cave development has been estimated at around A$595-million, with the timing of the development expected to ensure that the Cadia mine production rate is sustained above 30-million tonnes a year as production from the currently operational caves start to decline from 2024.

A Stage 2 expansion, which is currently in feasibility study, would cost an estimated A$180-million and would see Newcrest increase the plant capacity to 35-million tonnes a year, along with recovery improvements targeted for completion late in 2022, ahead of the completion of the cave development.

“This expansion plan is an improvement on the previous 2018 prefeasibility study (PFS), with an estimated additional 1.8-million ounces of gold production and 67 000 t of copper production, and an estimated A$800-million increase in projected free cash flow generation by Cadia over its life,” said Newcrest MD and CEO Sandeep Biswas.

“The capital investment has an estimated 21.5% rate of return and ensures Cadia remains a tier-one asset for many years to come.”

The expanded project is estimated to have a mine life of 45 years producing an average of 381 000 oz of gold and 81 000 t of copper over the life-of-mine, delivering a net present value of A$1.17-billion, with a pay-back period of less than eight years.

In addition to the Stage 2 feasibility study, Newcrest is also undertaking a PFS for the development of another cave following the Stage 1 expansion. This study is slated for completion in 2021.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation