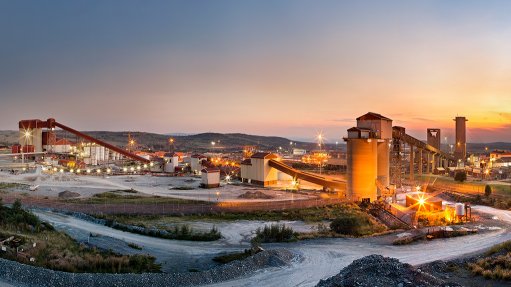

Krugersdorp plant converts furnaces to produce ferrochrome

NIMBLE OPERATION Mogale's swing plant operation, enables it to change its production capacity in line with market expectations

As a result of the upward trend in ferrochrome prices, Krugersdorp-based processing plant Mogale Alloys – owned and operated by global vertically integrated producer of speciality alloys Afarak Group’s African subsidiary, Afarak Mogale, has converted two of its four furnaces to facilitate ferrochrome production instead of silicomanganese.

The price of ferrochrome dropped to $1.85/kg in September last year, recovering to $2.29/kg last month, when

all four of Mogale’s operating furnaces started producing ferrochrome, said Afarak Group CEO Guy Konsbruck, in a statement. The first furnace conversion was completed in December 2016 and the second last month. This newest ferrochrome furnace is expected to produce an additional 2 300 t/m.

Konsbruck has previously commended Mogale’s swing plant operation, which enables Afarak to be “nimble” and change its production capacity in line with market expectations. He noted that, with the ferrochrome benchmark rising to an eight-year high in December, Afarak took steps to position itself to take advantage of the upswing.

Mogale operates four furnaces; two submerged arc furnaces and two direct current furnaces, with a combined production capacity of 110 000 t/y. The furnaces are capable of producing four key products namely: silicomanganese, plasma ferrochrome, charge ferrochrome and stainless steel alloy.

Afarak acquired the Mogale plant in 2009 as a means of accessing the bulk minerals processing sector in South Africa. Its website notes that the acquisition marked a “strategic step forward for the group by providing access to direct current furnace technology”, which has been in operation since 1983 at Mogale and is considered to be a centre of excellence.

In Afarak’s 2016 annual report, Konsbruck noted that its ferroalloys segment, which comprises the activities of three mines and the processing plant, all based in South Africa, faced a challenging year primarily due to the depressed markets for chrome ore. However, he added that the market upswing towards the end of last year resulted in the segment registering a significantly positive fourth quarter. This positive performance was expected to extend into the first half of 2017.

Capital expenditure (capex) within the ferroalloys segment of €2.6-million included the replacement of the furnace refractories, the acquisition of new plant vehicles at Mogale Alloys and the capitalisation of expenditure related to prospecting activities at the Vlakpoort mine, based in Limpopo.

Konsbruck emphasised in his statement that the metal markets remain volatile, noting that “the prices of chrome ore and ferrochrome are expected to remain strong in [the first] quarter of 2017, positively affecting Afarak’s financial performance”.

However, he stressed that it is difficult to predict the longer-term outlook. “Afarak will continue concentrating on its core activity, ferrochrome specialties. Our results for 2016 encourage us to continue moving forward with our strategy. “We will always continue pursuing our drive towards an efficient and effective organisation that creates value for all our stakeholders, including our shareholders.”

Meanwhile, opencast mining at the company’s Mecklenburg mine, in Limpopo, has resumed and preparations are under way to establish an underground operation, with the potential to access 20-million tonnes of chrome reserves.

The mine closed temporarily between the second and fourth quarters of last year, with preparations to resume mining starting in December. Afarak entered into a mining services agreement with contract mining company Pholagolwa Mining in January to continue opencast mining activities at Mecklenburg.

Full production will be 30 000 t of chrome ore and opencast mining production for the project is expected to be just more than 200 000 t of chrome ore. Afarak noted that the underground mining area has the potential to produce 4.5-million tons of chrome ore over the remainder of Mecklenburg’s life-of-mine, and that development of the shaft is scheduled to start later this year.

Aside from the Mecklenburg mine, Afarak owns the Vlakpoort chrome mine, which is also located in Limpopo, and the Stellite chrome mine, located just north of Rustenburg, in the North West.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation