Cyprium to raise A$35m for Nifty restart

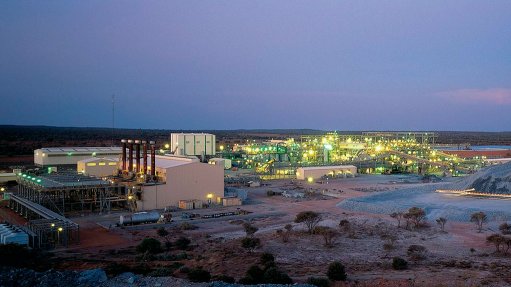

PERTH (miningweekly.com) – ASX-listed Cyprium Metals has announced plans to raise A$35-million to support the restart of its Nifty copper project, in the Pilbara.

The company has received firm commitments for the placement of 318.6-million shares from sophisticated and institutional investors, at a price of 11c a share. Each participant in the placement will receive one free attaching option for every one share to be issued, and the options are exercisable at 15c each and have a two-year period.

The issue price of 11c a share represents an 18.5% discount to Cyprium’s last closing price at the end of January.

The placement will be completed in two tranches, with the first 182.5-million shares to be issued under the company’s existing placement capacity, while the issue of the remaining 136-million shares and the options will be subject to shareholder approval.

Cyprium MD Barry Cahill on Monday said that the placement formed part of the financing package for the restart of the Nifty copper project.

The company previously said that for the debt portion of the Nifty copper project restart, Cyprium was targeting A$240-million to A$260-million of total debt funding, including cost overrun contingency and working capital, for the financing of the Nifty restart and project costs, which was expected to comprise of senior secured financing, subordinated debt, and offtake financing.

“The completion of the capital raising, which is conditional with the finalisation of the senior debt financing will allow Cyprium to commence our construction plans and the production of copper metal plate on site in the first half of 2024,” said Cahill on Monday.

“The restart project economics remain very robust and are further enhanced based on current copper prices of A$13 000/t which is above those applied in the Nifty copper project restart study.”

The previously completed restart study estimated that Cyprium would require a capital injection of A$149-million to restart Nifty, allowing the project to produce 25 000 t/y of copper cathode.

The restart is focused around the first phase of heap leach retreat and oxide openpit, and it is envisaged that the life will extend to the sulphide stage of the openpit with a considerably larger resource available.

From the placement proceeds, A$20-million will be applied as part of the company’s funding strategy to finance the restart of the Nifty copper project which will aim to provide a sustainable, secure and stable supply of copper metal at 25 000 t/y.

The remaining funds raised from the placement will be used to fund exploration activities, resource drilling, the costs of the capital raise, financing costs and for general working capital purposes.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation