Afarak reports solid results in challenging market

Specialist alloy producer Afarak Group increased revenue by 3.6% to €95.3-million during the six months to June 30, up from €92.1-million in the comparable period in 2022.

Processed material sold decreased by 15.5% to 12 855 t, down from 15 205 t in the 2022 interim reporting period. However, tonnage mined increased significantly to 162 971 t, up from 39 109 t during the comparable 2022 period.

Earnings before interest, taxes, depreciation and amortisation (Ebitda) to June 30 were €15.1-million, down from €24.5-million in the interim period to June 30, 2022. The group's Ebitda margin also declined to 15.8% during the half-year period, from 26.7% in the 2022 interim period.

Profit for the half-year to June 30 was €10.5-million, down from €21.2-million in the comparable 2022 half-year period.

“The ferro-chromium market typically slows down both in demand and price in the third quarter owing to the summer break. The prices for low-carbon ferro-chrome have reduced substantially during the first half of the year, but now seem to have found a bottom. The low-priced imports from China and India in 2023 have led us to reduce our output, especially of standard grades.

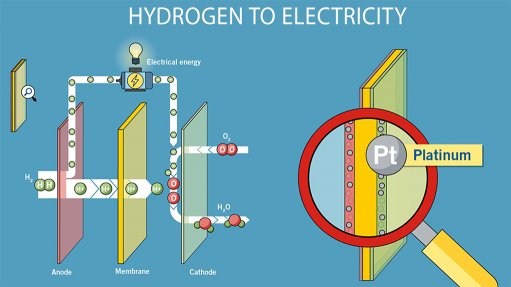

“We do not expect substantial changes during the second half of 2023 in that respect. Afarak has been for many years now the only Western producer of low carbon ferro-chrome, a critical material for the production of the aerospace, automotive, green energies, and various other industries,” the company said in a statement.

Afarak CEO Dr Roman Lurf comments that the interim results were solid under challenging market conditions.

“Our specialty segment showed sustainable profitability with stable demand in our core markets US, Europe and Japan, although the global low carbon ferro-chrome demand and its market prices have decreased substantially over that period.”

For the second half of the year, Afarak foresees an ongoing challenging market environment with further weak global market prices, combined with low demand.

“A lot will depend on the central bank's inflation strategy, the recent government policies such as the US Inflation Reduction Act, the European Union’s proposed Green Deal and the further development of the present geo-political tensions both in Europe and South-East Asia as well.

“Nevertheless, we are confident about remaining profitable owing to being the top-quality low carbon ferro-chrome producer in the global market and our ongoing cost reduction and productivity improvement programmes in place,” he said.

The company's ferro-alloys segment, which is based on its mining activity in South Africa, is continuously improving and has been profitable in the first half of the year. For the second half, Afarak expects further positive developments, driven by continuous business- and development-improvement initiatives.

Afarak also intends to resume the development and operations in its Magnochrome refractory project, in Serbia, to strengthen its business model through further diversification. Initial investments in the facilities should be launched during the second half of the year.

“The planned integration of the LL-resources Group into Afarak is expected to show first synergy effects during the fourth quarter of 2023, and we are very positive about the additional revenue and profit streams triggered and added by the combination of both organisations,” said Lurf.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation