Zero Carbon lithium project, Germany – update

Photo by Vulcan Energy

Name of the Project

Zero Carbon lithium project.

Location

Höchst Chemical Park, outside of Frankfurt, in Germany.

Project Owner/s

Lithium developer Vulcan Energy.

Project Description

The project has a maiden probable ore reserve of 1.12-million lithium carbonate equivalent at 181 mg/ℓ lithium across the project’s Ortenau and Taro licences.

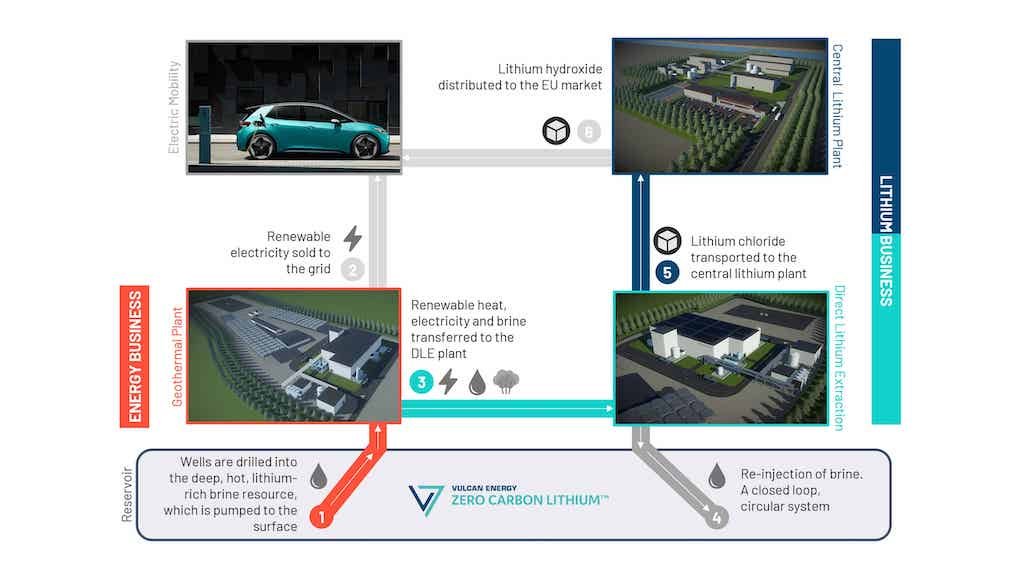

The prefeasibility study (PFS) proposes to draw on naturally occurring geothermal energy to power the lithium extraction process and create a renewable-energy by-product, with the operation not using any fossil fuels, requiring little water and having a small footprint.

The project includes a geothermal power plant for the production of renewable-sourced electricity at each brine extraction site. Direct lithium extraction (DLE) plants are co-located on the same sites for the extraction of lithium. The lithium chloride solution from the DLE plants will then be sent to a central lithium plant, where the solution is purified and converted into produce battery-grade lithium hydroxide monohydrate.

Multiple DLE and conversion plant capacity scenarios have been investigated as part of the PFS.

The full project will produce 15 000 t/y of lithium hydroxide, along with 73 MW of electricity.

Phase 1 considers the production of geothermal energy and lithium chloride through two plants, with lithium hydroxide produced at a central lithium plant (CLP). Phase 2 considers the production of geothermal energy and lithium chloride through three plants, with lithium hydroxide produced at a central lithium plant.

Phase 1 (Taro) will produce about 15 000 t/y of lithium hydroxide while generating 22 MW of electricity, while Phase 2 (Ortenau) will produce 25 000 t/y of lithium hydroxide, along with 51 MW of electricity.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The combined renewable-energy lithium project, with no phasing, has a positive after-tax net present value (NPV) of €2.25-billion and an internal rate of return (IRR) of 21%, with a payback of five years.

The proposed phased option shows an NPV of €700-million in Phase 1 and an NPV of €1.4-billion in Phase 2, with a payback of five and six years respectively.

Lithium, as a separate entity from energy, shows a post-tax IRR of 26%.

Capital Expenditure

The full project, with no phasing, has a capital expenditure (capex) of €1.74-billion.

Phase 1 has capex of €700-million and Phase 2 €1.14-billion.

Planned Start/End Date

The proposed full project, with no phasing, will start in 2024.

Phase 1 and Phase 2 are proposed to start in 2024 and 2025 respectively.

Latest Developments

Vulcan Energy Resources has signed a memorandum of understanding (MoU) and termsheet with European chemicals producer Nobian to assess the feasibility of jointly developing Vulcan's CLP.

Vulcan has previously secured a plot for the construction of the CLP at the Höchst chemical park near Frankfurt.

The joint development project will be phased, accompanied by a joint progress decision at the end of the second phase. Project investment from Nobian will be discussed on market terms following the conclusion of the definitive feasibility study (DFS).

Phase 1 of the development will result in the two companies jointly conducting the DFS, development, construction and operation of the CLP, while Phase 2 will result in the operation of Vulcan's electrolysis demonstration plant at Nobian's existing site at Höchst.

Phase 3 will be done partly in parallel with Phase 2, and will comprise the design and engineering, construction, startup and joint operation of the CLP on a commercial scale. Vulcan and Nobian will also discuss chlorine and hydrogen offtakes, which are planned by-products of Vulcan’s CLP.

The CLP is intended as a processing hub, processing lithium chloride from multiple combined geothermal and lithium sorption plants into lithium hydroxide monohydrate.

From the CLP, the lithium hydroxide monohydrate is intended to be transported to Vulcan’s European customers in the battery and electric vehicle industry, significantly lowering the transport footprint of the current lithium supply chain.

Vulcan is targeting Phase 1 commercial production of the CLP for 2024.

Key Contracts, Suppliers and Consultants

gec-c (geothermal plant design); Hatch (direct lithium extraction and lithium processing plant design, engineering and cost estimates); Geo-T (engineering studies and cost estimates for the geothermal plant, as well as the subsurface well design and production study); GLJ (review and sign-off on the maiden probable Joint Ore Reserves Committee ore reserves); APEX Geoscience (resource modelling and estimation for the Upper Rhine Valley project lithium-brine indicated resources used in the PFS); IBZ Salzchemie, among other providers (laboratory testwork); and Optiro (financial modelling).

Contact Details for Project Information

Vulcan Energy, tel +61 8 6189 8767 or email info@v-er.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation