Witwatersrand basin project – Qala Shallows Phase 1, South Africa – update

Photo by West Wits Mining

Name of the Project

Witwatersrand basin project (WBP) – Qala Shallows Phase 1.

Location

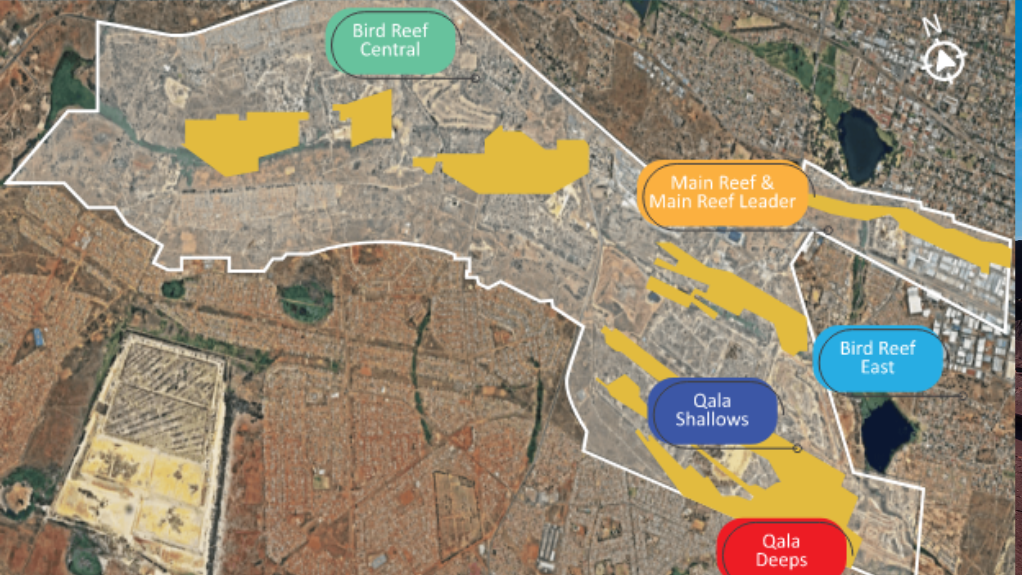

At the northern edge of the Witwatersrand basin, in the Central Rand goldfield, south-west of the City of Johannesburg, in Gauteng, South Africa.

Project Owner/s

West Wits Mining.

Project Description

Qala Shallows forms part of the WBP.

The updated results of the definitive feasibility study (DFS) have further enhanced the project’s promising outlook. The project has contained ore estimated at 1.01-million ounces.

The two Kimberley reefs – K9A and K9B – will be processed during the life of the project.

The Kimberley reef ore produced will be treated at an existing nearby plant on a toll treatment basis. A toll treatment agreement has been signed with the Ezulwini process plant facility and all ore produced will be truck-hauled to this plant, which uses the carbon-in-pulp process for gold recovery.

The updated DFS envisages production of 10.1-million run-of-mine tonnes, compared with 7.6-million in the DFS. Maximum production has increased from 699 000 t/y in the DFS to 839 000 t/y in the updated DFS, for overall production of 924 000 oz from 688 000 oz.

Steady-state production is estimated at 70 000 oz/y.

The mining method has been left unchanged from that used in the 2022 DFS. The only difference between the mining plans pertains to mining sequence and timing.

The updated DFS has determined that conventional breast mining in an underhand configuration is the optimal method for the deposit.

Life-of-mine (LoM), from construction to relinquishment, has increased from 15.7 years to 17.7 years.

Potential Job Creation

The project is expected to generate about 1 000 jobs over 18 years.

Net Present Value/Internal Rate of Return

The updated DFS has a pretax net present value (NPV), at a 7.5% discount rate, of $367-million and an internal rate of return (IRR) of 38%, with a payback of five years, compared with an NPV of $180-million and a payback of 4.1 years, in the August 2022 DFS. The IRR remains the same.

Capital Expenditure

Peak funding has decreased from $63-million in the August 2022 DFS to $54-million in the June 2023 updated DFS.

Planned Start/End Date

Phase 1 is expected to be completed in 2026.

Latest Developments

West Wits has reported a cash equivalent position of $1.4-million as at December 31, 2023, which, coupled with a proposed $15.8-million debt facility with the Industrial Development Corporation (IDC), and another possible $26-million from other partners, puts the company in good stead to develop the Qala Shallows project.

As the IDC progresses a due diligence investigation to finalise funding terms and mobilise resources, West Wits has been preparing the project for a startup as quickly as possible.

West Wits says all regulatory approvals are in place, including a mining right and environmental permissions, to enable production ramp-up upon the company securing project finance.

Apart from the IDC, West Wits has also received formal interest from the South African Wealth Fund and Wingfield partners of almost $26-million, which is about 50% of Qala Shallows’ peak funding requirement of $54-million. This due diligence is also under way.

West Wits has also been working with mining contractor Modi Mining to ensure the availability of necessary labour and skills to allow for a swift and efficient startup of operations in due course.

Ongoing engagements with mining equipment manufacturers and suppliers also enable the company to advance quickly towards finalising agreements for supply and maintenance, particularly for specialised plant equipment.

West Wits also has a prospecting right application – adjacent to the mining right site – under review by the South African mining authorities. This will provide the company with an extension of the Kimberley reefs south of Qala Shallows.

The company is still considering the potential for a standalone uranium and gold project around the Bird reef package within its mining right area. A potential option is to secure a strategic joint venture partner to develop the project as a separate operation from Qala Shallows.

Key Contracts, Suppliers and Consultants

Calgro M3 (secure potable water supply for the mine); and Modi Mining (labour and skills).

Contact Details for Project Information

West Wits Mining, tel +61 3 8692 9049 or email info@westwitsmining.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation