Wickepin kaolin project, Australia – update

Name of the Project

Wickepin kaolin project.

Location

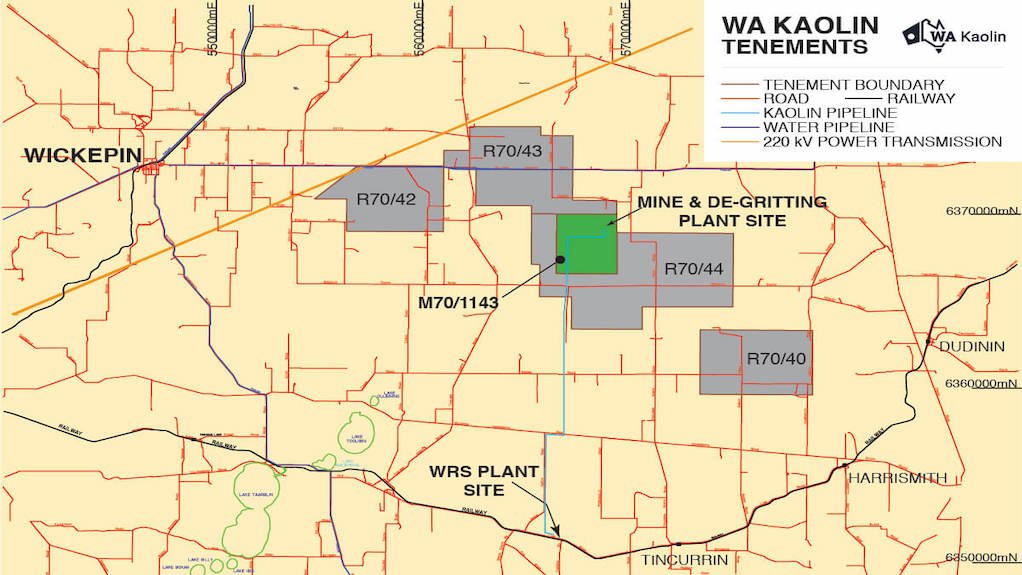

Near Wickepin, 220 km south-east of Perth, in Western Australia.

Project Owner/s

WA Kaolin.

Project Description

Wickepin is one of the biggest known remaining premium primary resources of kaolin globally and is characterised by its purity, quality and brightness.

The project currently comprises mineral resources of 644.5-million tonnes of high-grade premium kaolinised granite.

The project contains 30.5-million tonnes of kaolinised granite reserves within the mining lease, delivering a 31-year mine life.

Stage 1 is designed to develop a kaolin processing plant with a production capacity of about 200 000 t/y.

Stage 2 will increase production from 200 000 t/y to 400 000 t/y, with further modular increases to capacity to be implemented in line with market demand and funding capability.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a net present value, at 7% discount rate, of $257-million and an internal rate of return of 47%.

Capital Expenditure

Stage 1 capital expenditure is estimated at $18.07-million, with an additional $13.57-million for Stage 2.

Planned Start/End Date

Stage 1 is expected to be completed by the end of 2021.

Latest Developments

WA Kaolin will raise A$12-million through a share placement and share purchase plan, as well as a secured working capital loan facility, to fund Stage 1 of its Wickepin kaolin project.

Under the plan, eligible shareholders will be allowed to subscribe for up to A$30 000 worth of additional shares in the company, also 18c each. The plan will close on March 2.

To support the company’s ramp-up of Stage 2 development, WA Kaolin has also secured a loan facility of A$5-million provided by its Top 5 shareholder Gordon Martin. The A$5-million facility has a maturity date of three years from the date of advance at an interest rate of 8% a year, payable quarterly in arrears. A registered mortgage will be granted over the company’s East Rockingham property as security for this loan.

Meanwhile, the installation and precommissioning of the Stage 1 processing plant at the project remains on time and on budget. All process equipment has been fabricated and is on site, with installation due for completion by the end of the first quarter.

First production from Stage 1 is on track for the second quarter, with production to start at 25 t an hour nameplate capacity and steadily increasing to about 200 000 t/y by the end of 2022.

Throughout the development of Stage 1, WA Kaolin’s Kwinana proof of concept plant has continued operating, with kaolin shipments seeding and developing markets. As such, the company is experiencing unprecedented demand for its Stage 1 targeted production as new potential clients continue to emerge.

As a result of this strong customer demand, elements of Stage 2 capital expenditure of about A$4-million have been brought forward into the current Stage 1 construction phase to take advantage of cost savings and shorten the lead time to implement the next increase of production capacity from 200 000 t/y to 400 000 t/y.

“Our initial Stage 2 capex was estimated at A$13.6-million, as per our definitive feasibility study, and contemplated as being funded out of Stage 1 cash flow. Inflationary impacts, largely as a result of the Covid-19 pandemic, have cautioned the company to provide a contingency for an additional A$2.4-million in Stage 2.

“Based on around A$4-million spent on Stage 2 during Stage 1 and the fact that the company has achieved Stage 1 work to date on time [and] on budget, Stage 2 is likely to be brought on stream in less than 12 months for an additional circa A$12-million,” WA Kaolin CEO Andrew Sorensen has said.

Key Contracts, Suppliers and Consultants

AUSPAN (building works).

Contact Details for Project Information

WA Kaolin, tel +61 8 9439 6300 or email asorensen@wakaolin.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation