Weekly Commodities Market Wrap

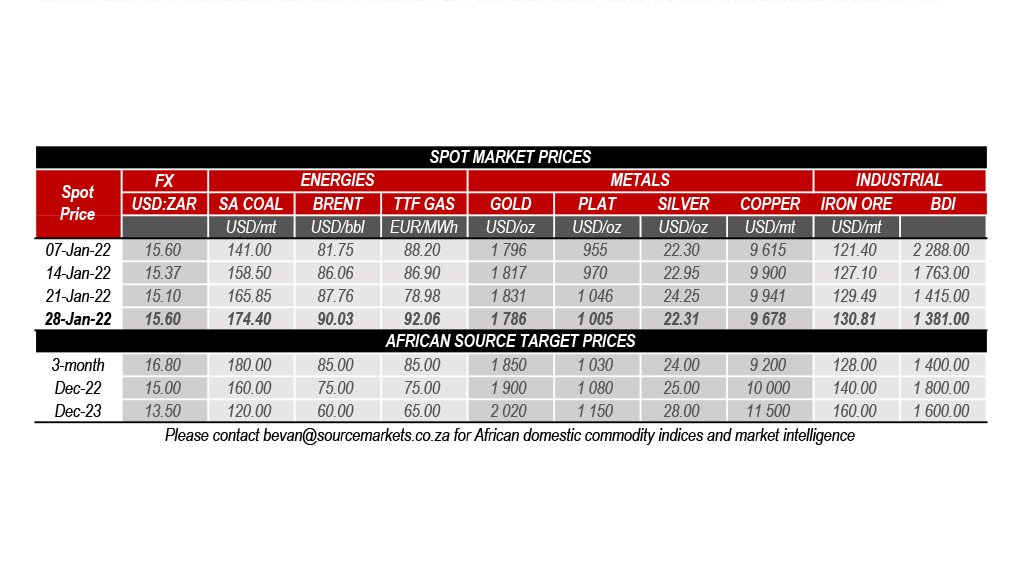

ENERGIES - European gas concerns continue to dominate, as traders realise Europe does not have enough port capacity for US LNG to replace Russian pipeline flows. What's more, around 30% of Europe's regasification capacity is in Portugal and Spain, with limited interconnections to European markets. The back end of the natgas curve, as well as European power also saw impressive gains, pushing coal higher too on the back of juicy clean dark spreads, even as carbon rallied higher as well. Coal traders rolled calendar spreads out to 2024, steepening the backwardation. Crude continued its flat price rally, with OPEC+ due to meet Feb 2nd to decide latest supply policy. Profit taking led to most energy markets coming off the boil towards week end as spot bids were finally hit by sellers.

METALS - With stock and crypto markets wobbling, precious metals haven't performed as most gold bugs would have liked. However, as the US Fed remains reticent to raise rates and kill inflation, gold enjoyed a small rally over the week with GOFO rates looking up as well. Fundamental monetary shifts are in play now with China about to launch its CBDC post winter games, and the US about to regulate crypto markets as a pre-emptive strike. There was a drawdown in LME base metal inventories across the board although copper warehouse stocks remain high and price is likely to moderate quite significantly from here, even as Chinese industry starts up again post lunar new year.

INDUSTRIALS - China's January iron ore imports look set to be the highest ever on record, and ore prices duly rallied on the week. However, this was more pronounced on the back end of the curve, as traders hope for a pickup in Chinese construction activity later on. At close to operating costs, ship owners are praying that rates have bottomed, trading at seasonal lows usually seen around Chinese lunar new year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation