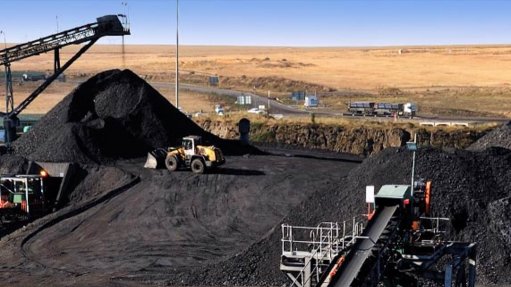

Waterberg coal project, South Africa

Name and Location

Waterberg coal project (WCP), Limpopo, South Africa.

Client

Waterberg Coal Joint Venture Partners (WCJVP), comprising Firestone Energy, Sekoko Resources and Waterberg Coal Company (WCC).

In April 2013, ASX-listed WCC acquired 45.88%, or 1.63-billion shares, of dual-listed Firestone Energy, resulting in WCC acquiring 32.36% of the coal producer. WCC also acquired 480-million Firestone shares from its 25%-owned subsidiary Sekoko Resources, separately from the takeover offer, representing a further 13.52% interest in Firestone.

Project Description

The project consists of eight farms in the Waterberg coalfield, totalling 7 979 ha. The identified area over the Smitspan farm (first-phase base case) indicates a mine layout of 507 ha, extending for 3.5 km from east to west and for 1.8 km from north to south. The project partners have previously reported a Joint Ore Reserves Committee-compliant resource statement of 3.88-billion tonnes of coal, of which 2.07-billion tonnes are in the measured category.

The project proposes the development of an opencast mining operation to produce ten-million tonnes a year of coal for State-owned power utility Eskom for an initial term of 30 years, pursuant to the memorandum of understanding (MoU) that the WCJVP entered into with Eskom in March 2012.

The project includes the design, manufacture, supply, delivery, assembly, installation and commissioning of a 22-million-tonne-a-year coal-handling and preparation plant in a phased approach within an engineering, procurement and construction framework.

Meanwhile, the WCP and energy utility Eskom continues to discuss the “outstanding requirements” to convert the WCP’s offtake MoU into a coal supply agreement (CSA).

The requirements still outstanding include coal specification finalisation, final pricing, delivery dates and providing Eskom with a satisfactory due diligence report on the definitive feasibility study (DFS). The WCC aims to resolve these requirements early this year.

The proposed CSA will result in the WCP delivering coal to Eskom for an initial 30-year term.

The Eskom project has an estimated capital cost of about R6-billion.

The Export Project

The WCJVP recently announced that infrastructure engineer Ardbel had completed a DFS on the viability of a standalone export project, in the south of the WCP area.

Stage 1 of the export project will likely result in the build-up to two-million tonnes a year of export product, with first coal to be produced during quarter two of 2016.

Based on the draft DFS, the project team is undertaking an optimisation exercise on the mine and production plan to increase production to four-million tonnes of coal over four years by adding additional plant modules.

The WCC says that, based on the results of the DFS and the optimisation exercise, the WCP partners are in discussions with certain banks and potential coal offtake partners regarding funding arrangements for the proposed development.

A technical due diligence is being compiled by independent technical experts Snowden Group for bank project financing to develop the export project.

Net Present Value/Internal Rate of Return

Not stated.

Value

The project is forecast at a capital cost of R1.6-billion.

Duration

Subject to the completion of the funding arrangements, the export project is expected to start construction in July 2015.

Latest Developments

Firestone is conducting an optimisation study to review the WCP’s capital requirements, to enhance the viability of the four-million-ton-a-year thermal coal project.

The WCP partners are confident that the optimisation process will derive positive outcomes, resulting in considerable reductions in capital funding requirements for the project.

The company has also completed a definitive feasibility study for the proposed development of an export project mine, encompassing the optimisation study, which includes consultation with world-class plant designers and competitive contract vendors for the mining and processing facilities and services.

During the quarter ended June 30, the WCP partners and their consultants revised the original washing process plans to enable production of a higher-quality coal suitable for the export market.

Additionally, the optimised plant design allows for flexibility to produce a higher-quality power station feed product. This product will be stockpiled during the export-grade coal mining phase until the potential independent power production (IPP) platform is completed.

Using this product as IPP feed will result in optimal resource use and a barren waste dump.

The WCP partners have also started negotiations with experienced processing and services providers for a build, own, operate (BOO) dual-module plant, each with a 550 t/h capacity. The proposed plant design has configured a two-stage wash process, providing greater flexibility in product-quality output.

“The advantage of such a design is clearly an ability to optimise a given product output mix to meet a range of commercial coal requirements including export quality, IPP platform feedstock and Eskom-specification product from the one plant,” Firestone has said in a statement.

Firestone is confident that adopting a BOO strategy, in conjunction with experienced operators, will significantly reduce upfront capital requirements and provide for a swift progression to mining and production. This is expected to be completed by September.

Meanwhile, the partners are also in talks with several parties for the award of the mining contract. The company has indicative pricing on a rand per run-of-mine ton, which is within the parameters of the WCP partners' financial modelling and their costings in the DFS, the company has said.

Meanwhile, the WCP partners have, through Sekoko Coal, entered into an agreement with the Lephalale municipal council to take over the management and operation of the ten-million-litre-a-day Paarl wastewater treatment plant.

In return, WCP will have access to treated water from the plant for 30 years, with the option to extend the agreement by a further term.

The deal will provide WCP with sufficient water for the proposed export development, as well as Stage 1 of its proposed IPP development.

The export project is expected to start up towards the end of the fourth quarter.

Key Contracts and Suppliers

SRK Consulting (feasibility study); Coffey Mining (geotechnical investigation) and Ardbel, an ELB Engineering Services and DRA Group joint venture (preliminary design and basic engineering works).

On Budget and on Time?

Not stated.

Contact Details for Project Information

WCC, tel +27 10 594 2240, fax +27 10 594 2253 or email info@waterbergcoal.net.

SRK Consulting, tel +27 11 441 1111, fax +27 11 880 8086 or email johannesburg@srk.co.za.

Coffey Mining, tel +27 11 679 3331, fax +27 11 679 3272 or email Coffey.Africa@coffey.com.

Ardbel, tel +27 11 032 1150 or email info@ardbel.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation