Turquoise Hill expects Oyu Tolgoi underground funding in place by year-end

TORONTO (miningweekly.com) – Rio Tinto-owned Turquoise Hill Resources has reassured investors that it expects to close financing for the $6.8-billion underground expansion of its massive Oyu Tolgoi copper/gold mine, in Mongolia, by the end of the year.

The expansion had been delayed for years over a tax dispute with the Mongolian government, as well as, to some extent, political turbulence.

The Mongolian government in September signed a request by the Multilateral Investment Guarantee Agency (MIGA) for host country approval (HCA) regarding guarantees to be issued by MIGA, in connection with the Oyu Tolgoi project financing.

Turquoise Hill billed the signing of the HCA as a significant milestone in the project financing timeline. In October, the project financing information circular was provided to the banking syndicate, allowing for each institution’s respective internal consideration and approval.

Rio Tinto had pledged to invest at least $250-million to $300-million in the construction of the underground section of the Oyu Tolgoi copper/gold/silver mine this year.

Construction was expected to start this year, marking progress for the long-stalled mine that was expected to boost Mongolia's economy by a third when it reaches full capacity in 2021.

Before the project was suspended in August 2013, underground lateral development at the Hugo North deposit had advanced about 16 km off Shaft 1. Sinking of Shaft 2, the main operations access and initial production hoisting shaft, had reached a depth of 1 168 m below surface, 91% of its final depth of 1 284 m.

The 96-m-high Shaft 2 concrete head frame had been built and sinking of Shaft 5, a dedicated exhaust ventilation shaft, had reached a depth of 208 m - 17% of its final depth of 1 174 m. Surface facilities, including offices and workshop, were in place to support initial preproduction development and construction.

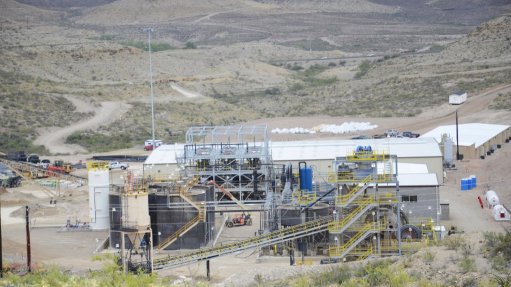

The Oyu Tolgoi mine had initially been developed as an openpit operation. A copper concentrator plant, with related facilities and necessary infrastructure to support a nominal throughput of 100 000 t/d of ore, had been built to process ore mined from the Southern Oyu openpit.

Long-term development plans for Oyu Tolgoi were based on a 95 000 t/d underground block-cave mine.

On May 18, Turquoise Hill, the Mongolian government and Rio Tinto announced the signing of the Oyu Tolgoi underground mine development and financing plan, which addressed key outstanding shareholder matters and set out an agreed basis for the funding of the project.

After filing the revised schedules for the 2015 Oyu Tolgoi feasibility study with the Mongolian Minerals Council in August, prestart activities were under way, in parallel with an update to the capital estimate, which was expected to be completed in the first quarter of 2016.

Q3 RESULTS

Turquoise Hill reported net income attributable to shareholders of $21.2-million, or $0.01 a share, for the three months to September 30, compared with a net loss of $94-million, or $0.05 a share in the comparable period of 2014 - an increase of $115.2-million. The increase was mainly attributable to a $227.3-million noncash impairment charge recorded in the three months to September 2014, on reclassifying its Mongolian coal subsidiary SouthGobi to being held for sale.

Revenue for the period dropped 12% year-on-year to $431.7-million, reflecting lower volumes of copper/gold concentrate sales, compounded by a fall in copper prices.

The third-quarter mix of revenue by metals was the result of inventory with higher contained copper and gold drawn down during the quarter, from concentrate produced in second quarter.

The company’s gross margin of 41.6% for the quarter was down from 46.4% in the second quarter, owing to the effect of lower copper prices.

All-in sustaining costs in the period were $1.52/lb, compared with $1.26/lb in the second quarter.

Oyu Tolgoi’s output was at record levels during the quarter, producing 56 000 t of copper, 123 000 oz of gold and 388 000 oz of silver.

Turquoise Hill owned a 66% stake in the Oyu Tolgoi mine, with Mongolian government agency Erdenes Oyu Tolgoi holding the balance.

Oyu Tolgoi was expected to produce 175 000 t to 195 000 t of copper and 600 000 oz to 700 000 oz of gold in concentrates for the full year. The company expected copper output to be at the top of the range, while gold output was expected to be in the middle of the range.

The company’s TSX-listed stock on Friday rose 3.03% to C$0.68 apiece, having lost nearly 28% in value over the past 12 months.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation