Standard Bank offers mining finance and research expertise

SUITABLE SOLUTIONS Standard Bank has a dedicated division within the bank that understands the specific risks associated with mining projects

Photo by Standard Bank

PETER VON KLEMPERER The African mining sector still offers great opportunities to investors

Photo by Standard Bank

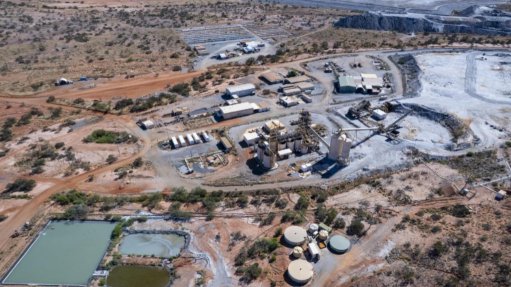

INVOLVED The banking firm is involved in a number of projects across Africa

Photo by Standard Bank

CARIG POLKINGHORNE We see infrastructural development as crucial to unlocking potential

Photo by Standard Bank

South African financial institute Standard Bank has four key sectors in its corporate investment division, namely: mining and metals, oil and gas, telecoms, power and infrastructure which is closely linked together, particularly when it comes to operating within Africa.

“Over time we have seen Africa receiving increased attention from our clients, it is our goal to be relevant to them as they look at operating across the African continent. The African mining sector still offers great opportunities to investors, and that is why, we believe, Standard Bank is at the forefront in offering the financial and research resources to those wanting to participate in this market,” says Standard Bank executive VP: mining and metals investment banking Peter von Klemperer.

Mining Industry Challenges

During 2013, the South African mining industry has been subjected to ongoing labour issues, which have created a sense of turmoil. Globally, mining houses are facing stiff challenges in areas such as: depressed commodity prices, increased environmental standards, issues around power and infrastructure, carbon taxes and the need to reduce production costs.

Von Klemperer comments that from time to time, the mining sector goes through these waves where there are issues to be highlighted.

“I don’t think we should underestimate some of the challenges to operating a mine in the South African landscape, nor should labour issues be looked at in isolation, as they are but one of many challenges the sector faces.

“The biggest challenge the industry faces – in South Africa and elsewhere - is controlling costs. The pressure of labour issues contributes to the management of these costs. At the end of the day, you cannot control the exit price of the underlying commodity; you can only influence the cost of production of the commodity. The factors that have impacted upon production costs have also led to questions being asked around the continued drive to increase production. In South Africa, we need to ask ourselves how competitive we are in relation to our peers. Despite all the challenges that the sector is facing globally we still view the mining sector as a good investment. Zambia and the Democratic Republic of Congo’s (DRC’s) continued growth for example, represents the largest ever experienced in Africa by the base metals sector,” comments Von Klemperer.

“One of the major attractions of mining exploration in Africa is the fact that it is relatively unexplored. Opportunities within South Africa will always attract international attention given the size of its resource base, and the country has a number of projects that are being looked at. Certain commodities within South Africa are more mature and well established, such as gold; therefore major opportunities exist in places such as the DRC, which is regarded as a relatively young market as well as the copper belt in Zambia.”

“The capital expenditure involved in the development of mining projects elsewhere in Africa, is dove-tailed with the costs of the infrastructure surrounding the development. South Africa may need to upgrade some of its infrastructure, but where else in the world will you find an 800 km heavy-haul railway line that is as efficient as the Sishen/Saldanha line? Therefore, while there is room for infrastructure improvements locally, the infra-structural ground work has already been implemented,” says von Klemperer.

Standard Bank Offers the Expertise

As a result of its African and international footprint, Standard Bank can offer clients and potential clients a wealth of financial and country-specific information. They have highly skilled and experienced technical teams with expertise in geology and mine engineering available to assess the risk of a project, its technical merits and feasibility in terms of costings. Standard Bank is involved in the most significant mining projects currently in development across Africa. They offer the following services:

Corporate finance advisory solutions

Acquisition and project finance

Working capital facilities

Bridging finance

Inventory financing

Structured trade and commodity finance

Commodity price risk management solutions

Foreign exchange and interest rate hedging

Global transactional banking services

Empowerment financing

Transactional banking

Trade finance

Von Klemperer adds that: “Standard Bank has a dedicated division within the bank that understands the specific risks associated with mining projects. Whether it is in an advisory capacity, an acquisition of a project, the evaluation around a project, the ability to raise equity for a project, the ability to raise debt on the bond or debt capital market side – on the debt side, we do acquisition and project debt and we have teams that specifically focus on this. We have a presence in 18 of the 54 countries on the continent and can provide a full gamut of financial services. We also have the capability to move physical commodities and provide price hedging, price protection, foreign exchange protection and the ability to convert local currencies to dollars or pounds etc where needed. It is not for nothing that we have won the top investment bank award on the continent on a regular basis – we have earned our stripes!”

Mining Deals Done By Standard Bank

Standard Bank is involved in the following mining deals providing financial assistance for projects, acquisitions or in an advisory role:

• First Quantum – Zambia – Project Finance

Standard Bank acted as joint lead arranger for First Quantum Minerals on their recent $1- billion corporate financing.

• De Beers Marine Namibia – De Beers – Namibia – Acquisition Finance

Standard Bank was the sole lender and arranger to De Beers Marine Namibia on the $70-million term facility to purchase the Peace in Africa exploration vessel.

• Tonkolili Iron Ore Mine – African Minerals – Sierra Leone – Short-Term Bridging Project Finance

Standard Bank funded $600-million for the mine development. It is a 15-million ton per year operation. The project has had a significant impact on the GDP of Sierra Leone. In addition to the funding of the mine, the bank also funded the rolling stock.

• Rights Issue – Lonmin – South Africa – Corporate Finance Advisory

Standard Bank acted as joint book runner and joint underwriter of $817-million rights issue, 2012.

• Metorex Sale – Jinchuan Group – China – Corporate Finance Advisory

Standard Bank was the lead financial advisor and investment bank on the $9.1-billion sale – the largest Sino-Africa mining transaction in 2011. This was also the first project financing done by Standard Bank in the DRC. The bank continues to support this DRC project.

Standard Bank is also involved in the Mozambique natural gas pipeline project as well as the oil terminal development project in the Cameroon.

Transactional Service Offerings

With mining projects generally located in outlaying or inaccessible areas, Standard Bank understands the related banking and financial transactional difficulties. Through their branch network in over 18 African countries, automated telling machines and online banking platforms, they offer operational support, insight and an operational suite of solutions for doing business in Africa, which includes: cash management, international trade services, custodial and securities services and transactional channels including ‘Business Online’.

The Competitive Advantage

Standard Bank commercial banking head Craig Polkinghorne says that the mining sector is supported by a vast amount of suppliers to the mining industry. “They are a crucial element in the supply chain, and are one of the main benefactors of our advanced technologies and services. Today, we are more focused on the unique banking and financial needs of our current and future client base and providing suitable banking solutions to them, rather than merely offering a banking product.

“Traditionally, in our commercial banking operations, we have measured our client base according to our own metrics; we are now researching the needs of companies and individuals. For example, if a client is looking to expand into Africa, we will try and craft solutions that cover all the related issues. If the client is faced with online complexities such as a just-in-time online ordering system, we need to know how we can assist. Because the needs of a young entrepreneurial company are completely different to those of a larger, older generation company, we believe that embracing this approach of using exterior metrics will enable us to be better placed to offer the appropriate assistance, tailor-made to the customer’s needs. This is particularly relevant to the supply chain in the mining sector.”

Standard Bank believes that its exposure to African markets in particular, affords it a good sense of the continent as a whole. Looking at resource sectors such as mining as an opportunity, Standard Bank has a lot of expertise to offer.

Polkinghorne continues: “Allied to that fact, we see infrastructural development as crucial to unlocking potential, whether that is infrastructure directly related to a mining opportunity, or whether it is secondary infrastructure development in terms of railway lines, ports etc – our exposure to local knowledge, which includes government views and policies, and alignment between the local players and their international partners on big mining spend, enables us to identify which opportunities are likely to succeed – this wealth of information and data gives us a very powerful advantage in the mining sector as a financier and a banking partner.”

“As a bank, we can service and provide capability and expertise to the top end of the mining industry, but at the same time, as a universal bank that operates across Africa, we can service the smaller mining players – including miners - as well as the suppliers and the supply chain into the mining sector in its entirety and that includes small- and medium-sized companies and individuals.”

Von Klemperer concludes: “The mining sector is crucial to the South African economy, for example without coal, there is no power, without power . . . many services, businesses, educational establishments and medical facilities falter. That is why Standard Bank believes in supporting the financing of and investment into this sector, locally and globally. Our knowledge base and banking bouquets offer commercial and mining businesses the support they can count on.”

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation