Salares Norte gold project, Chile – update

Photo by Gold Fields

Name of the Project

Salares Norte gold project.

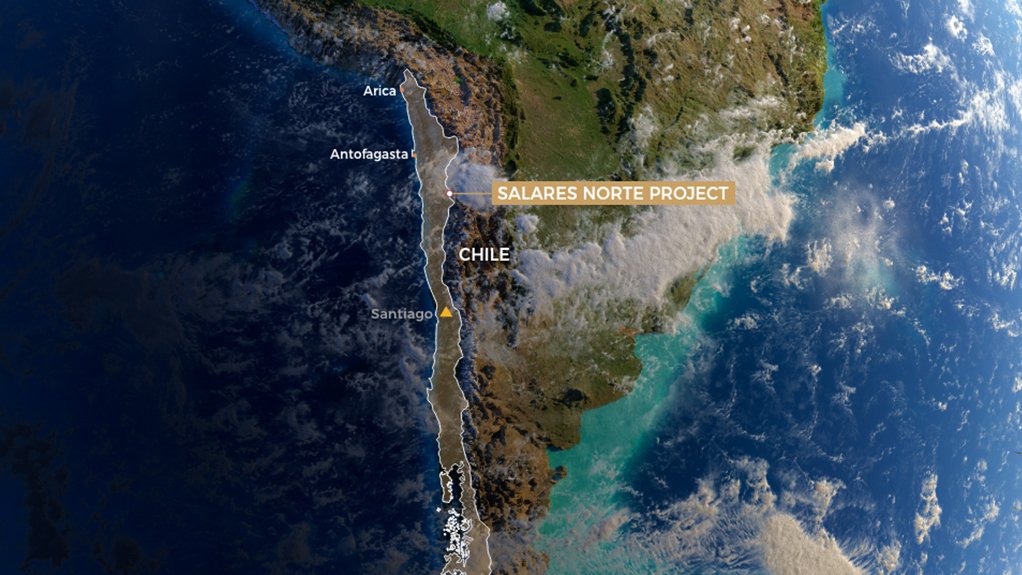

Location

Atacama region, northern Chile.

Project Owner/s

Minera Gold Fields Salares Norte Ltda (MGFSNL), in which Gold Fields indirectly holds a 100% interest.

Project Description

Salares Norte has a maiden reserve of 21.1-million tonnes grading 5.1 g/t gold and 57.9 g/t silver. The definitive feasibility study (DFS) for the project, which includes Brecha Principal and Agua Amarga, has been completed and peer reviewed.

The DFS envisages an openpit mining operation using conventional mining equipment. It estimates an initial 11.5-year mine life, with production, on average, of 450 000 oz/y for the first seven years. At peak production, the project is expected to produce 550 000 oz/y of gold.

Mining and blasting services will be undertaken by contractors.

There will also be a significant stockpiling strategy.

An estimated 308-million tonnes of waste mining is expected over the mine life.

The company will introduce tailings filtration before it is dry-stacked at the tailings facility, which is 1 km away from the processing plant. The tailings will be transported hydraulically for filtration, and from there on trucks to the storage facility.

The plant will start with two filters, with a third to be added at a later stage.

The DFS also includes plans for an on-site diesel-generated 14 MW power station.

The company plans to introduce renewables in stages as the project progresses, with an ultimate target of 20% of power consisting of renewables.

Potential Job Creation

It is estimated that about 2 700 jobs will be created during the construction of the mine. About 900 workers are expected to be employed once the mine is operational.

Net Present Value/Internal Rate of Return

The project has an estimated net present value, at a 7.5% discount rate, of $654-million and an internal rate of return of 25%, with a payback of 2.2 years.

Capital Expenditure

The project is estimated at $1.02-billion.

Planned Start/End Date

The project started construction in January 2021 and is scheduled for completion in late 2022, with the first gold production in early 2023.

Latest Developments

Gold Fields interim CEO Martin Preece has reported in the company’s half-year results for the six months ended June 2023 that it is expecting first production from the project during the fourth quarter of this year, ramping up in 2024.

The project’s capital expenditure remains on track to meet revised guidance of $1.02-billion.

Key Contracts, Suppliers and Consultants

Fluor (engineering, procurement and construction management).

Contact Details for Project Information

Gold Fields, email Investors@goldfields.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation