Rockwell Diamonds’ FY 2014 results reflect operational turnaround

TORONTO (miningweekly.com) – Toronto- and Johannesburg-listed Rockwell Diamonds on Thursday after market close reported its full-year 2014 financial results, which pointed to its successful operational turnaround and refocus were starting to gain traction.

The Johannesburg-based company, which operates alluvial diamond mines in South Africa, reported that revenue for the period rose 39% year-on-year to C$45.1-million, underpinned by a 52% increase in diamond sales at C$41.1-million.

Beneficiation revenue through the beneficiation profit-share agreement with Diacore (previously Steinmetz Diamond Group) amounted to C$4.1-million, a 23% decrease on the fiscal 2013 revenue of C$5.3-million.

Rockwell president and CEO James Campbell in a statement said that these improvements were consistent with the company’s performance during each quarter over the past two years.

Rockwell reported an operating margin before amortisation and depreciation of C$6-million, compared with C$1.1-million in the prior year.

Campbell noted that economies of scale as a result of operating exclusively in the Middle Orange River (MOR) region of South Africa also emerged, as production costs for the year increased 25% to C$39.2-million, against the 52% improvement in the value of diamond sales.

Output for the year rose 27% to 27 776 ct, compared with 2013 output of 21 871 ct.

“We believe that the implementation of our earthmoving vehicle (EMV) upgrade programme should unlock further benefits as we improve the fleet overall utilisation to match our production capacity and renew the equipment to lower our maintenance expenses, while improving availabilities.

“Equally pleasing is the positive cash flow from normal operations of C$3.7-million [prior to working capital movements],” Campbell said.

From an operational perspective, Campbell said that the results also show that Rockwell’s MOR focus had gained traction.

During the 2014 financial year, the company opened two new mines, the Saxendrift Hill Complex (SHC) and Niewejaarskraal mine, both funded internally from cash reserves, which more than doubled the company’s MOR production capacity to 340 000 m3/m.

“Having met our short-term target to have three producing mines in the MOR, our production profile is now more flexible and sustainable. We are pleased too, that diamond quality and the frequency of larger stones has improved as anticipated,” he said.

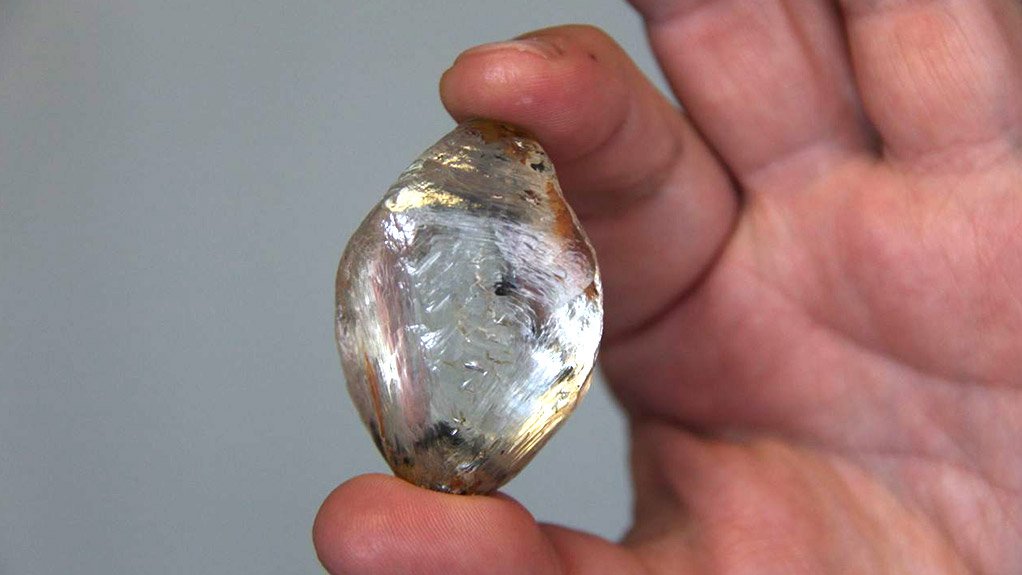

This included the recovery of 12 stones between 50 ct and 100 ct and five precious gems larger than 100 ct, the largest of which was a 287 ct stone, the biggest stone recovered in recorded history in the region.

The second phase of the Niewejaarskraal mine was commissioned on schedule in the fourth quarter and its diamond production performance was improving.

At Saxendrift, the plant continued to operate consistently. Once the EMV renewal plan is implemented, the plant utilisation is expected to improve further.

Campbell underscored that Rockwell remained “firmly focused” on its medium-term target to process 500 000 m3/m of quality gravels.

Rockwell is conducting contiguous exploration of existing resources at the Saxendrift Extension property to increase the current mine life, which would further leverage the company’s invested mining infrastructure at Saxendrift.

It had also implemented a focused exploration and trial mining programme at the SHC to increase the resource potential and develop contiguous areas.

Mining at Niewejaarskraal, where the processing rate approached the monthly nameplate capacity of 100 000 m3 at the end of the financial year, was aimed at upgrading the inferred resource to the indicated level.

At the same time, the company is working to review its options to bring the Wouterspan property to fruition, “with a preference for an internally funded and phased approach”, Campbell said.

Rockwell said that it had 2 752 ct of diamonds carried forward, which included 1 181 ct on royalty mining contracts. The current 'beneficiation pipeline' also held more than 6 000 ct, which would provide additional future revenue potential.

Returns from royalty mining contracts delivered net royalties of C$1.2-million from five Tirisano contracts and the Zwemkuil contract, which ceased in the third quarter.

Rockwell reported a narrower net loss of C$10.4-million for the year, compared with a loss of C$13.8-million in 2013, after noncash charges of C$10.1-million for foreign exchange and depreciation.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation