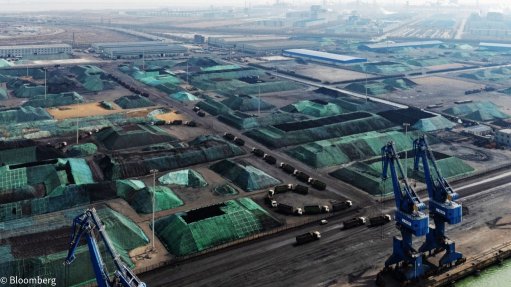

Rebound in China expected to boost commodity prices

CAPE TOWN (miningweekly.com) - After a poor run over the past two years, commodity prices are likely to increase over the next year or so, propelled by demand in China, the Investing in African Mining Indaba has heard.

“We’re not back to the bull market conditions when prices went up four or five times, but we should see a resumption in the increase in commodity prices over the next year,” Macquarie Securities senior consultant Jim Lennon told the Mining Indaba, in Cape Town, where thousands of global mining professionals gathered on Monday.

Lennon said China had slammed on the brakes in 2009 and 2010 after over-stimulating the economy, but a rapid rebound in Chinese demand was emerging. “We believe China is back on track.”

The Asian giant makes up 50% of global demand in almost every commodity.

While China’s gross domestic product growth had slowed to between 7% and 8% from highs of 12%, Lennon expected growth in commodities to be strong in volume terms.

He said the global commodities market had a mixed performance over the past year.

Iron-ore was the star performer, driven largely by demand in China, while copper had also done well, despite falling off its peaks of earlier years. Tin and lead did fairly well.

Lennon said an unprecedented increase in steel demand, driven almost exclusively by China, was largely unexpected by the market.

Virtually all other commodities had gone down in price to levels below the highest cost producer, he noted. Aluminium and zinc had performed particularly poorly, while nickel had also not done well.

Apart from positive trends in China, growth in commodities in the rest of the world was slowly creeping up.

“We see some growth, but it is running 15% to 25% lower than the boom of 2007,” said Lennon.

While Africa showed great promise for the future, he believed it would fall short of China’s boom.

“Are Africa and India the new China? No,” said Lennon.

A lack of infrastructure, a low savings rate, red tape and energy shortages in Africa and India limited their chances of reaching China’s tremendous growth surge.

But Lennon pointed out there were plenty of entrepreneurs in Africa and great promise.

Africa was expected to be the major urbaniser between 2015 and 2030. “We will see growth in China falling dramatically, while Africa will rise.”

On challenges facing companies, he explained that big companies had had to dramatically pull back on projects and instill capital discipline, with many having had massive overruns.

“More and more we will see supply forecasts being revised downwards. What we see is the need for more and more investment to hold production, rather than increased supply to the market.”

Lennon said cost pressures were expected to remain high.

The capital costs of copper mines had increased six-fold, while operating costs had risen four-fold over the past few years. This had been driven by higher energy costs, construction costs, mines having to be built in remote locations with plenty of challenges and the cost of environmental compliance.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation